Good morning.

The Fast Five → Traders expect big Fed-day move, Musk’s goes ‘absolutely hardcore’ with Tesla layoffs, consumer confidence slumps, US newspapers sue Microsoft and OpenAI over copyright, and pot stocks surge on report DEA reclassifying marijuana. Today’s briefing ahead, but first…

From our partner:

📈 Uncover trends in seconds, not hours: This AI-powered market sentiment tool monitors millions of conversations, giving you EARLY actionable insight on emerging stock trends.

Calendar: (all times ET)

Today: | Job openings, 10a |

THU 5/2: | Jobless claims, 8:30a |

FRI 5/3: | Unemployment report, 8:30a |

Your 5-minute briefing for Wednesday, May 1:

US Investor % Bullish Sentiment:

32.13% for Wk of Apr 25 2024 (Last week: 38.27%)

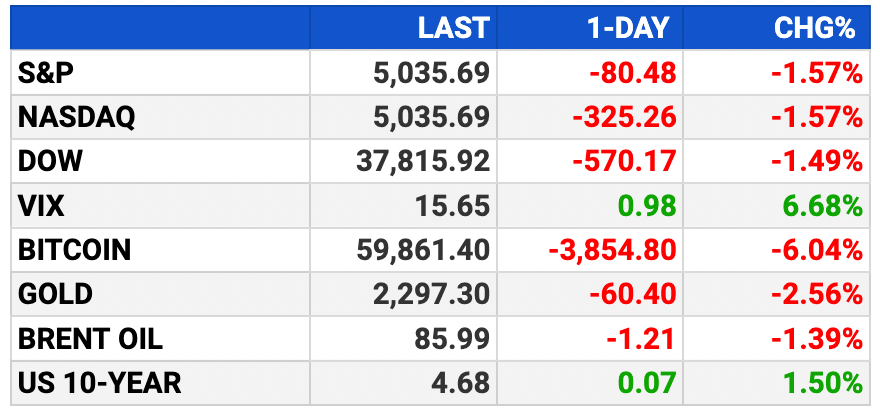

Market Recap:

S&P 500 futures slipped ahead of the Fed's rate decision.

Nasdaq 100 futures dropped 0.4%, Dow futures ticked 0.02% lower.

Amazon up 1% after strong earnings; AMD fell 6%, Super Micro 9%.

Dow, S&P both down over 1%; Nasdaq fell 2%

Bond yields rose post Q1 employment cost index exceeding expectations.

April ended with S&P, Nasdaq each posting over 4% losses.

Fed expected to hold rates steady; eyes on Powell's clues.

Upcoming earnings: Pfizer, Kraft Heinz, CVS, Qualcomm, DoorDash.

EARNINGS

What we’re watching this week:

Mastercard (MA) - earnings of $3.23 EPS (+15.4% YoY), on $6.3B revenue (+10.3% YoY)

Apple (AAPL) - earnings of $1.50 EPS (-1.3% YoY) in $90B revenue (-5.0% YoY)

Friday: Hershey Foods (HSY)

Full earnings calendar here

HEADLINES

Stocks sink to end worst month of 2024 as Fed decision looms (more)

US consumer confidence slumps to lowest level in nearly two years (more)

Americans’ pay gains rose faster than expected so far this year (more)

Treasury announces new Series I bond rate of 4.28% for the next six months (more)

Home-price gains accelerate in the US, climbing 6.4% in February (more)

FTC targets 'junk' patent listings on Ozempic and other drugs (more)

Big brands warn that low-income consumers are starting to crack (more)

Consumers are more cautious, Citi CEO says emphasizing bank overhaul (more)

Pot stocks surge on report DEA is moving to reclassify marijuana (more)

Trump Media shares rise again, jump 50% in the past week (more)

Walmart launches store-brand food line in bid for Gen Z dollars (more)

Walmart closes health centers, telehealth unit as costs rise (more)

US newspapers sue Microsoft and OpenAI over copyright infringement (more)

JPMorgan broadens roles for sales executives, memo says (more)

TOGETHER WITH SIGNM

Every investor needs an edge.

Sharpen your edge with Al-powered market insights and social media analysis.

SIGNM gives you access to actionable insights EARLY by knowing what others are thinking:

✔️ Easily monitor millions of opinions daily about the market

✔️ See what's trending, gaining or losing momentum

✔️ Bullish and bearish sentiment summary

✔️ Millions of social media posts analyzed daily

✔️ View over 1,000+ stocks profiled

✔️ And much more…

Harness AI’s power with SIGNM’s market insights.

~ please support our sponsors ~

DEALFLOW

M+A | Investments

UAE's e& seeks to buy $8.6B European carrier United Group (more)

Union announces talks with Carlyle on majority stake in Thyssenkrupp Marine Systems (more)

S&P Global weighs options for mobility unit (more)

ZF Friedrichshafen taps banks for sale or IPO of airbag unit (more)

Walmart’s Vizio acquisition to undergo full FTC antitrust probe (more)

Playa Bowls' owners explore sale of restaurant chain (more)

SES to buy Intelsat in $3.1B bid to rival Musk’s Starlink (more)

Carlyle picks JPMorgan, Morgan Stanley for IPO or sale of StandardAero (more)

SES, Intelsat revive deal talks to form satellite giant (more)

Godspeed-backed SAS acquires Willbrook Solutions (more)

WindRose purchases SubjectWell, a patient access marketplace that connects people with health conditions to care options (more)

Simply Good Foods buys capital-backed OWYN (more)

Norwest Equity Partners buys MDC Interior Solutions (more)

Your Behavioral Health acquires Insight Treatment Programs (more)

Ryan Reynolds reportedly invests in Mexican Soccer Team (more)

Kain Capital invests in Essen Health Care (more)

Borgman Capital invests in Buck Bone Organics (more)

TA Associates invests in Edmunds GovTech, a provider of ERP software services to local government (more)

Riverspan Partners makes inaugural investment in Barretts Minerals (more)

PsiQuantum, a provider of fault-tolerant quantum computing systems, is to receive $620M (USD) through a financial package from the Australian Commonwealth and Queensland Governments (more)

Blackrock Neurotech, a brain-computer-interface tech company, received a $200M investment from Tether (more)

VC

Corelight, an open network detection and response company, raised $150M in Series E funding (more)

Enlaza Therapeutics, a covalent biologic platform company, raised $100M in Series A funding (more)

Elisity, a company specializing in identity-based microsegmentation, raised $37M in Series B funding (more)

Inhabitr, an AI-powered commercial real estate furnishing platform, raised $27M in Series B funding (more)

Ory Corp, a provider of an access control, authorization and identity platform, raised $5M in Series A funding (more)

Plover Parametrics, a tech-enabled commercial insurance brokerage, raised over $5M in funding (more)

First time reading? Get tomorrow’s briefing here »

CRYPTO

BULLISH BITES

🤖 Results: A.I. start-ups face a rough financial reality check.

📈 Pursuits: Where to invest in real estate right now.

💰 Crash profits: How to protect your portfolio in down markets. *

🧠 Peek inside the brains of ‘Super-Agers’ - why some octogenarians have exceptional memories.

🏝 Hot tip: You’re looking in the wrong place for travel advice, says top restaurateur.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.