Good morning.

The Fast Five → Biden vs. Trump all over again, tech giants drag down market after torrid rally, Biden to form price-gouging ‘strike force’, Bezos dethrones Musk as world’s richest, and Dodge kicks off the electric muscle era…

Calendar:

Today: Fed Chair Jerome Powell testifies to Congress, 10:00a ET

Job openings, 10a ET

Fri, 3/8: US nonfarm payrolls, unemployment rate, 8:30a ET

Your 5-minute briefing for Wednesday, March 6:

US Investor % Bullish Sentiment:

46.50% for Wk of Feb 29 2024 (Last week: 44.28%)

Market Recap:

Nasdaq 100 up 0.2%; S&P 500 adds 0.05%, Dow inches 0.05% higher

CrowdStrike soars 25%; Nordstrom tumbles 10% on sales warning

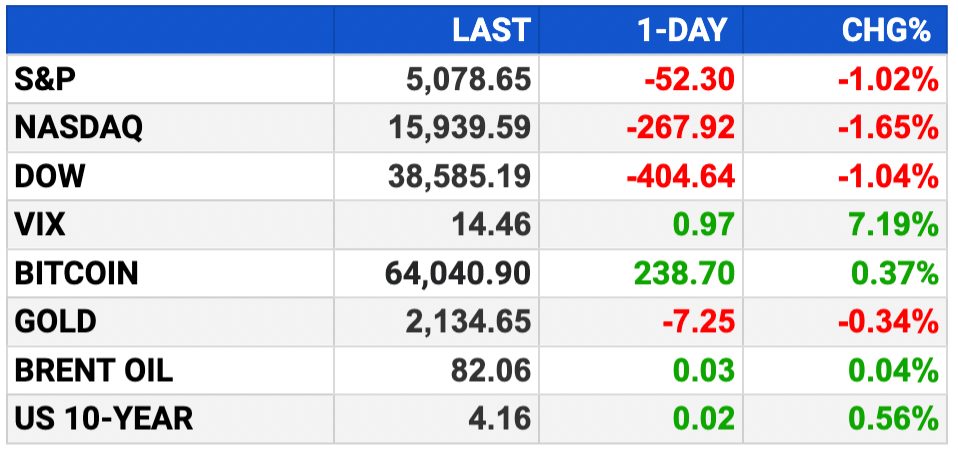

Major averages see second day of losses: Dow down 1.04%, S&P 500 dips 1.02%, Nasdaq slips 1.65%

Tech suffers worst day since Jan. 2; Apple falls 3% on China iPhone sales report

Fed Chair Powell testifies today, Senate Thursday

Investors seek clarity on interest rate cuts

EARNINGS

What we’re watching this week:

Today: Abercrombie & Fitch (ANF), Campbell Soup (CPB)

Thursday: DocuSign (DOCU), Gap (GPS), Kroger (KR)

Broadcom (AVGO) - earnings of $10.29 per share (-0.4% YoY) on $11.7B revenue (+31.5% YoY)

Costco (COST) - earnings of $3.62 per share (+9.7% YoY) on $59.2B revenue (+9.2% YoY)

Full earnings calendar here

HEADLINES

Biden to form ‘strike force’ to go after price-gouging (more)

New CFPB rule caps banks’ credit card late fees at $8 (more)

Lawmakers seek to force ByteDance to divest TikTok or face US ban (more)

Russia considering putting a nuclear power plant on the moon with China (more)

Tech giants drag down US stocks after torrid rally (more)

Bitcoin faces ‘sell-the-news’ moment after new record high (more)

Banks with heavy commercial property exposure see bonds get hit (more)

Emerging markets slip amid Fed caution, China growth concerns (more)

Leading U.S. banks leave ESG project finance group (more)

Apple iPhone sales plunge 24% in China as Huawei smartphone business resurges (more)

Apple stock gloom deepens as pressure to show AI progress mounts (more)

Elon Musk loses world’s richest person title to Jeff Bezos (more)

Target launches new paid membership program (more)

A MESSAGE FROM INVESTOR’S BUSINESS DAILY

The most powerful stock research platform just got better—

IBD’s MarketSmith is now MarketSurge 🎉

A new name. A fresh look. IBD’s MarketSurge era begins with a bang: more powerful data infrastructure and exciting new features like…

✅ The Ants Indicator

Identifies unusually strong price and volume action over a 3-week period, automatically.

✅ Forward Earnings

Four quarters of forward EPS and sales estimates for every stock - a handy tool for gauging a stock’s growth potential.

🔥 For a limited time, Market Briefing readers get 6-Weeks of MarketSurge for only $49.95 — an exclusive offer you won’t find anywhere else. Give it a test-drive today! (cancel anytime)

- please support our sponsors -

Tip: If email is clipped by Gmail click “read online” in the top right corner

DEALFLOW

M+A | Investments

Fintech raises $30M from investors including Rockefeller Capital, Bain (more)

Investors raise bid for Macy’s by 14% after earlier rebuff (more)

Cycode, a company specializing in application security posture management, acquires Bearer, provider of an AI-powered SAST, API discovery/data leak protection solution (more)

Charlesbank acquires EverDriven from Palladium (more)

Godspeed-backed SHA buys Smith Consulting Architects (more)

PE-backed Mercer acquires $2.5B RIA MDK Private Wealth Management (more)

Lee Equity Partners invests in PCS (more)

Daraja Capital invests in Serac Ventures (more)

TA invests in AGA Benefit Solutions (more)

VC

Silas Capital, an equity and venture capital firm, closed its Fund II, at $150M (more)

RapidSOS, an intelligent safety company, raised $75M in additional funding (more)

Overjet, a dental-AI company, raised $53.2M in Series C funding (more)

DTEX Systems, an insider risk management company, raised $50M in Series E funding (more)

Argyle, a provider of direct-source income and employment data, raised $30M in funding (more)

Openprise, a RevOps data automation company, raised $25M in Series B funding (more)

Metaplane, a provider of a data observability platform for data teams, raised $13.8M in Series A funding (more)

Rios Intelligent Machines, an AI-powered robotics company focused on the manufacturing industry, raised $13M in Series B funding (more)

HData, a company using AI and automation to help the US energy industry file regulatory data, raised $10M in Series A funding (more)

Phase Genomics, a genomics technology development company, raised $1.5M in funding (more)

mPATH Health, a digital health company dedicated to improving cancer screening, raised $1.1M in funding (more)

Stevenson Search Partners, a global life sciences executive search firm, received a long-term investment from SixSibs Capital (more)

CRYPTO

BULLISH BITES

🚀 Meteoric: Bitcoin's stunning climb to new records, explained in charts.

🍪 “Me hate less”: Cookie Monster complaint about "shrinkflation" sparks response from White House.

✨ Magic manifesto: Disney’s activist investor publishes plan to ‘Restore the Magic’.

📈 Video reveals: The next great crypto bull market has begun ...*

🔥 Exclusively for MB readers: For a limited time our readers can try 6-Weeks of IBD’s new MarketSurge for only $49.95 — an offer you won’t find anywhere else. Don’t wait—give it a test-drive!*

*from our sponsor

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.