Good morning.

The Fast Five → AT&T discloses leak of 73 million accounts to dark web, Xiaomi releases electric 'dream car' to take on Tesla, consumer sentiment climbs to 2 ½-year high, China factory activity expands for first time in 6 months, Tupperware warns close to going out of business after 77 years…

Calendar: (all times ET)

TUE 4/2: | Job openings, 10am |

WED 4/3: | Fed Chair Powell, 10am |

THU 4/4: | Jobless claims, 8:30am |

FRI 4/5: | Unemployment rate, 8:30am |

Your 5-minute briefing for Monday, April 1:

US Investor % Bullish Sentiment:

50.00% for Wk of Mar 28 2024 (Last week: 43.20%)

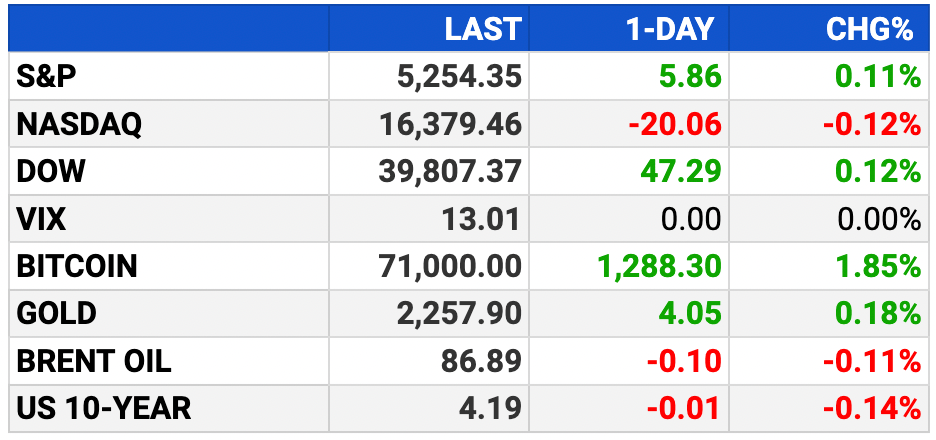

Market Recap:

Stock futures inch up as Q2 starts: Dow by 0.2%, S&P 500 and Nasdaq-100 by 0.3% and 0.5%.

Feb inflation matches expectations at 2.8%.

Q1 winners: S&P 500 up 10.2%, Dow up 5.6%, Nasdaq up 9.1%.

March sees S&P and Dow up 3.1%, Nasdaq up 1.8%.

AI stocks, Nvidia fuel market; Fed eyes rate cut in June.

Strong Q1 gains historically predict further rally, strategist says.

Upcoming data: Feb construction spending, March ISM manufacturing, and March jobs report on Friday.

EARNINGS

What we’re watching this week:

Tuesday: Cal-Maine Foods (CALM)

Dave & Buster’s Entertainment (PLAY) - anticipating revenue of $602.6M (+6.9% YoY). Earnings expected to rise 37.5% to $1.10 per share.

Wednesday: Levi Strauss (LEVI)

Lamb Weston (LW) - earnings of $1.46 per share for fiscal Q3. Revenue expected to rise 31% to $1.7 billion.

Full earnings calendar here

HEADLINES

Biden says Arab states ready to recognize Israel in future deal (more)

Key Fed inflation gauge rose 2.8% annually in February, as expected (more)

Consumer sentiment climbs to 2½ yr high as inflation eases (more)

Oil steadies after quarterly surge with Chinese demand in focus (more)

US oil suppliers muscling into OPEC+ markets around the world (more)

China factory activity expands for first time in six months (more)

Billions flood active ETFs in hunt for cheap developing stocks (more)

Walmart, Chipotle are splitting the wealth of a record stock market in a way they haven't in decades (more)

Kia recalling 430,000 Tellurides over rollaway risk (more)

New pollution rules aim to lift sales of electric trucks (more)

Generative AI ‘FOMO’ is driving tech heavyweights to invest billions of dollars in startups (more)

Tupperware warns it could go out of business over liquidity problems (more)

TOGETHER WITH PROMPTS DAILY

Have you heard of Prompts Daily newsletter? I recently came across it and absolutely love it.

AI news, insights, tools and workflows. If you want to keep up with the business of AI, you need to be subscribed to the newsletter (it’s free).

Read by executives from industry-leading companies like Google, Hubspot, Meta, and more.

Want to receive daily intel on the latest in business/AI?

DEALFLOW

M+A | Investments

Nippon Steel emphasizes its 'deep roots' in US as it pursues US Steel deal (more)

Keysight bids £1.2 Billion for Spirent, overtaking Viavi (more)

Home Depot bulks up Pro-business with $18.25B deal for building products supplier SRS (more)

Southwest Airlines purchases SAFFiRE Renewables (more)

Stash explores options with advisers including possible sale (more)

Oakley Capital considers sale of Ocean Technologies Group (more)

Bending Spoons ends pursuit of video platform Vimeo (more)

Blackstone sells $1 Billion of California warehouses to Rexford (more)

Landing, provider of a membership for flexible apartment living, acquired Barsala, a tech-enabled flexible housing operator (more)

AIP-backed CES Power acquires ABird/Apex Power Solutions (more)

Trinity Hunt-backed Supreme Group buys Health+Commerce (more)

Alpine-backed Axcel Learning buys KMK Optometry (more)

Bain Capital Insurance invests in Emerald Bay Risk Solutions (more)

Solace Capital Partners Invests in Siprocal (more)

Flexpoint Ford makes majority investment in Accuserve (more)

VC

Celestial AI, a creator of an optical interconnect technology platform, raised $175M in Series C funding (more)

Coro, a cybersecurity platform purpose-built for SME's, secured $100M in Series D funding (more)

Lightshift Energy, a energy storage development company, raised $100M from Greenbacker Capital Management (more)

Pelago, a digital clinic partner to U.S. businesses and health plans for substance use management, raised $58M in Series C funding (more)

Hume AI, a startup and research lab building AI optimized for human well-being, raised $50M in Series B funding (more)

Blueground, a global operator of furnished, flexible rentals for 30+ day stays, raised $45M in Series D funding (more)

Zilliant, a leader in pricing lifecycle management, received a $35M investment from Madison Dearborn Partner (more)

NewRetirement, a digital-first financial planning platform for consumers and enterprise partners, closed its Series A round with $20M in funding (more)

Vizcom, a company deploying AI for industrial design, raised $20M in Series A funding (more)

Champ Titles, a provider of digital vehicle title, registration, and lien systems of record in the US, raised $18M in Series C funding (more)

TurbineOne, a company specializing in government Machine Learning, raised $15M in Series A funding (more)

MyShell, a decentralized AI consumer layer, raised $11M in Pre-Series A funding (more)

Oka, a carbon insurance company, raised $10M in funding (more)

Sprocket Security, a provider of an expert-driven offensive security platform, raised $8M in Series A funding (more)

Benjamin Capital Partners, a holding company for the cash-rewards app, raised $5.5M in Seed funding (more)

Ensis, a startup developing AI-powered proposal software, raised $4M in Seed funding (more)

SydeLabs, a security and risk management startup, raised $2.5M in Seed funding (more)

Soracom, a provider of advanced connectivity for the Internet of Things, received an investment from Suzuki Global Ventures (more)

CRYPTO

Powered by MILKROAD - Get smarter about crypto in 5 min.

BULLISH BITES

🚘 Stealth mode: Hyundai and Kia are quietly taking over America's driveways.

🇨🇳 Inside look: How Xi Jinping plans to overtake America.

🍦 Ben & Jerry’s or Haagen-Dazs? Investors are spoiled for choice as food giants put their ice-cream units up for sale.

💍 New beginning: With this ring, I unwed. "Divorce Rings" are having a moment.

👜 Not haute: The implosion in luxury ecommerce.

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here »

☀️ Get your briefings before everyone else, go PRO »

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

*from our sponsors

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.2