Editor note: Hello - for the next few weeks you may catch a stray briefing in your promotions or spam folder - this is because we’ve switched to a new domain and told to expect a little turbulence.

How you can help: Kindly mark any stray briefing as "not spam", drag it to your primary folder, or reply to this email. We’ll be smooth sailing again by the end of the month. Thank you! -MB

Good morning.

The Fast Five → Markets are uneasy as a recession looks more likely, Trump says Musk would head a gov’t efficiency commission if elected, family offices are the new force on Wall St., top airlines' loyalty programs are under investigation, and China creates its largest brokerage to take on Wall Street…

⚠️ When the largest bank in the US says a crisis is coming - you need to listen »

From Behind The Markets

Calendar: (all times ET) - Full calendar here

Today: US unemployment report, 8:30 AM

Monday: Wholesale inventories, 10:00 AM

Your 5-minute briefing for Friday, September 6:

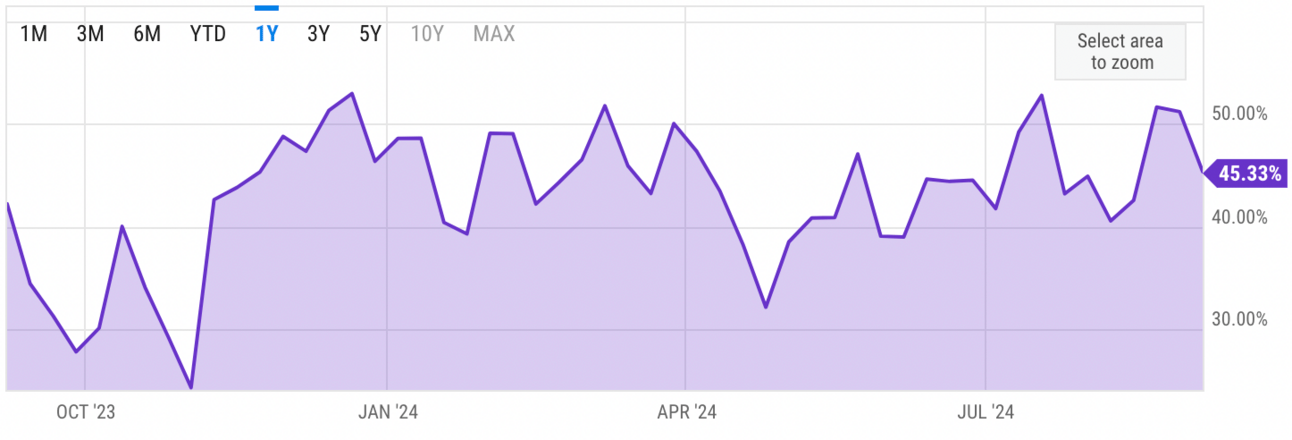

US Investor % Bullish Sentiment:

↓ 45.33% for Week of September 05 2024

Last week: 51.16%. Updates every Friday.

Market Wrap:

S&P and Dow closed lower Thursday on weak labor data.

Broadcom slips 7% after weak Q4 revenue forecast.

August private payrolls grew just 99,000, below expectations.

Today: Focus on nonfarm payrolls report, key for Fed's rate decision.

Economists expect 161,000 payrolls and 4.2% unemployment.

Markets optimistic for Fed rate cut by September meeting.

Major indexes down this week: S&P -2.6%, Nasdaq -3.3%, Dow -1.9%.

"September's volatility raises questions about recovery's sustainability." - LPL Financial

EARNINGS

HEADLINES

Markets are uneasy as a recession looks more likely (more)

Yellen says labor market healthy despite slower hiring pace (more)

Oil near $69 per barrel as OPEC+ delays production boost (more)

The Fed should cut rates by a half point this month says JPMorgan (more)

John Paulson sees Fed cutting rates to as low as 2.5% by end of 2025 (more)

Top airlines' loyalty programs under investigation for unfair practices (more)

Port union unanimously supports strike, escalating supply chain fears (more)

China creates its largest brokerage to take on Wall Street (more)

Falling rates offer scant shelter from property storm (more)

Ford truck, hybrid models lead to 13% increase in August sales (more)

Larry Ellison will control Paramount after deal (more)

Paramount's Redstone to reap $180M in severance, benefits (more)

A Message from Behind The Markets

“The most predictable crisis in history”

When the largest bank in the U.S. says a crisis is coming - you need to listen.

The Wall Street Journal warns, "America's bonds are getting harder to sell."

Bloomberg says, "Homebuyers are starting to revolt."

JP Morgan calls it, "The most predictable crisis in history."

- sponsored message -

DEALFLOW

M+A | Investments

Salesforce acquires data management firm Own for $1.9B in cash (more)

Intel is exploring sale of part of stake in Mobileye (more)

Vista and Blackstone in talks to acquire software maker Smartsheet (more)

Amtivo, a B2B provider of certifications and assurance services, received a growth investment from Audax Capital (more)

threatER, a cyber defense company eliminating cyber threats before they reach the network, received financing from CIBC Innovation Banking (more)

VC

Drip Capital, a fintech providing working capital to SMBs, picks up $113M (more)

Vesta Healthcare, a virtual care provider raised $65M in Series C funding with new debt financing (more)

Oyster, a provider of a solution to employ, pay, and care for distributed teams, raised $59M in Series D funding (more)

You.com, a provider of an AI-powered productivity engine, raised $50M in Series B funding (more)

Thatch, a personalized health benefits platform for businesses, raised $38M in Series A funding (more)

Mantel, a technology provider of a carbon capture system using molten borates, raised $30M in Series A funding (more)

E-PAL, a gaming and social companion platform, raised two funding rounds which brought total funding to $30M (more)

Venova Medical, a company developing technology for percutaneous arteriovenous fistulas for hemodialysis access, raised $30M in Series B funding (more)

Sedric AI, a provider of a compliance-dedicated AI platform for financial institutions, raised $18.5M in Series A funding (more)

Switch Bioworks, a biotech company developing low-cost and sustainable fertilizers, raised $17M in Seed funding (more)

ATLAS Space Operations, a provider of ground station services for satellite communications, raised $15M in Growth funding (more)

CytoTronics, semiconductor-based platforms for discovery in cell biology, raised $13.5M in Series Seed 2 funding (more)

The Demex Group, a risk analytics and intelligence company, raised $10.25M in funding (more)

Acuvity, a comprehensive AI security and governance platform for both employees and applications, raised $9M in Seed funding (more)

AltScore, a provider of AI-driven B2B credit infrastructure, raised $8.5M in Series A funding (more)

DubClub, a platform to consume, discuss, and buy premium sports content from creators, raised $7.5M in Series A funding (more)

Portex, a tool where shippers can handle everything related to freight management in one place, raised $6.25M in seed funding (more)

Abanza, a company specializing in advanced soft tissue repair solutions, raised $5M in Pre-Series A funding (more)

Create Wellness, a company specializing in creatine-based products, raised $5M in Series A funding (more)

Mesa Quantum, a quantum sensing company, raised $3.75M in Seed funding (more)

Ediphi, a hospitality technology provider, raised $1.5M in funding (more)

Angel Kids AI, an AI-powered browser providing children with a safe internet experience, raised $1.1M in Seed funding (more)

CRYPTO

BULLISH BITES

📊 Heavyweight: Why this jobs report could be the most pivotal one in years.

💰 Pursuits: Snoop Dogg, Robert Rodriguez look to fans to finance projects.

🚙 Say What? No joke, California will soon require your car to beep at you if you speed.

🎁 Only Fans: The ultimate gift for Fed fans.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.