Good morning.

The Fast Five → Wall Street braces for key inflation report, Disney and Mukesh Ambani create new India media giant, Tim Cook says Apple will ‘break new ground’ in GenAI this year, Google CEO tells employees Gemini AI blunder ‘unacceptable’, and Wendy’s says ‘dynamic’ pricing won’t tack surge pricing to your nuggets…

Calendar:

Today, 2/29: Personal Consumption Expenditures (PCE), 8:30a ET

Fri, 3/1: Consumer sentiment (final), 10:00a ET

Your 5-minute briefing for Thursday, February 29:

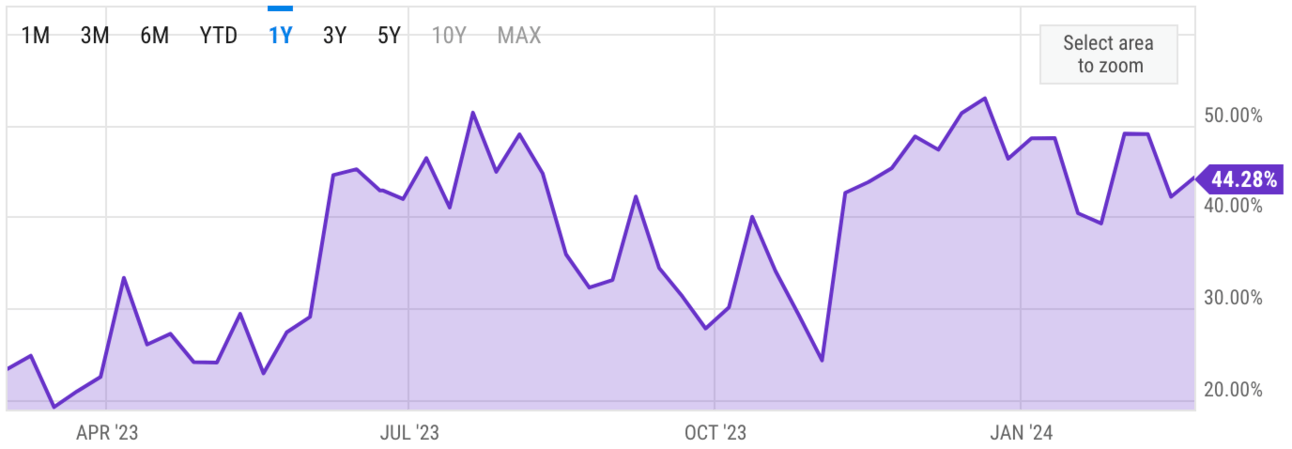

US Investor % Bullish Sentiment:

44.28% for Wk of Feb 22 2024

Market Recap:

Stock futures down as earnings weighed.

Dow futures slip 0.2%, S&P 500 and Nasdaq 100 edge down.

Salesforce, Snowflake, Okta in focus: mixed results.

Dow falls for third day; S&P, Nasdaq also decline.

Eyes on personal consumer expenditures reading.

February marks another positive month; Nasdaq leads.

Earnings continue: Best Buy, HPE, Bath & Body Works.

Key economic figures due: personal income, PMI, pending home sales.

EARNINGS

What we’re watching this week:

Today: Anheuser-Busch InBev (BUD)

Birkenstock (BIRK) - earnings per share of 10 cents on $312.4M in revenue

Full earnings calendar here

HEADLINES

Reliance to control JV and invest $1.4 billion for growth. Deal is expected to close as early as last quarter of 2024

Wall Street braces for key inflation report (more)

US economy on firmer footing heading into first quarter (more)

Fed officials emphasize data to guide pace of interest-rate cuts (more)

US lawmakers strike deal to avoid imminent government shutdown (more)

Housing inflation relief may be short-lived (more)

China bans high-speed futures trader as quant crackdown expands (more)

Teamsters, Anheuser-Busch reach deal to avert a strike (more)

Google CEO tells employees Gemini AI diversity blunder ‘completely unacceptable’ (more)

Google hit with $2.3B lawsuit by Axel Springer, others (more)

Apple to disclose AI plans later this year, CEO Tim Cook says (more)

Volkswagen, XPeng deal to develop two B-class battery EVs (more)

Snowflake CEO Frank Slootman stepping down—Wall St hates it (more)

Wendy’s says ‘dynamic’ pricing won’t tack surge pricing onto your nuggets (more)

Alibaba unveils big cloud price cuts as AI rivalry deepens (more)

TOGETHER WITH TRADINGVIEW

Where the world does markets.

Come see what you’re missing! Join 50 million traders and investors taking the future into their own hands.

Try TradingView today and experience the supercharged, super-charting platform and social network for traders and investors.

- please support our sponsors -

Tip: If email is clipped by Gmail click “read online” in the top right corner

DEALFLOW

M+A | Investments

Shell's US solar unit launches asset sale (more)

KKR considers selling stake in India’s $3B JB Pharma (more)

Fiserv, Amadeus vie to acquire Shift4 Payments (more)

BC Partners revives plans for $9.7B Springer Nature sale (more)

I Squared taps advisers to sell Energia for up to $3B (more)

Black Mountain Software, a provider of accounting software for local governments, announced the acquisition of Cascade Software Systems, a provider of integrated accounting solutions (more)

Veradigm acquires ScienceIO (more)

STSCP-backed PestCo buys PestShield (more)

Silver Oak-backed Summit acquires Deft (more)

Nordic Capital makes majority investment in ActiveViam (more)

Advent International invests in Skala (more)

VINCI Highways purchases 43.3% stake in Northwest Parkway (more)

GTCR, Avryo Healthcare invest in 7to7 Dental (more)

OpenGov, a cloud software company, received a majority investment from Cox Enterprises (more)

VC

Rhombus, a cloud-managed physical security company, raised $26M+ in funding (more)

Range Energy, a hardware company bringing trailers to the commercial trucking market, raised $23.5M in new funding (more)

Redi Health, a digital health startup, raised $14M in Series B funding (more)

Tracksuit, a brand tracker for growth brands, raised $13.5M in funding (more)

Coverdash, an SMB focused-insurance company, raised $13,5M in Series A funding (more)

Roshal Health, a company providing hospital-grade, on-demand ultrasound/echocardiogram services, raised $10M in funding (more)

Collov AI, a provider of an AI design tool for furniture, raised $10M in Series A funding (more)

tvScientific, a performance advertising platform for CTV, raised $9.4M in convertible note funding (more)

Flexnode, a data infrastructure startup, raised $9M in seed funding (more)

Slice, a provider of a global equity platform utilizing AI for continuous compliance, raised $7M in Seed funding (more)

Gradial, a content management system, announced $5.4M seed funding led by Madrona (more)

HuLoop Automation, an AI-powered intelligent automation company, raised $5M in Seed funding (more)

FamilyWell, a tech-enabled health company, raised $4.3M in Seed funding (more)

Codified, a generative AI-powered data governance startup, raised $4M in Seed funding (more)

Campfire, a provider of accounting software for startups and midsize companies, raised $3.5M in Seed funding (more)

Looq AI, a survey technology platform company dedicated to advancing critical infrastructure digitization and analysis, raised $2.6M in seed funding (more)

Lionize, provider of an AI-driven influencer search tool and influencer marketing platform, raised $2M in funding (more)

BlueBean, a provider of a procure to pay solution, raised $1.3M in funding (more)

AiDash, an enterprise SaaS company making infrastructure industries sustainable with satellites and AI, received an investment from Duke Investments (more)

Catch+Release, a content licensing marketplace, received an investment from Roller Labs Ventures, the corporate venture capital fund of Canadian Tire Corporation (more)

CRYPTO

Bitcoin rockets to $64,000 as it closes in on previous all-time high (more)

Online trading platform Webull is set to go public via a $7.3B SPAC deal (more)

Coinbase users see $0 balance after crypto-trading app suffers glitch (more)

Sam Bankman-Fried asks for lenient sentence, points to FTX fund recovery (more)

BULLISH BITES

💼 Biz opp: The best (and worst) states for business owners in 2024.

🏚 Nostalgia: Average cost of an American home in the decade you were born, from 1940s.

🔌 Unplugged: What a bunch of A-list celebs taught me about how to use my phone.

😉 In the know: How to access Delta Sky Club lounges amid tightening policies.

🚨 Take control of your future: D16 Countries Join BRICS in Dollar Exodus — Prepare Now (GoldenCrest)*

*from our sponsors

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.