Good morning.

The Fast Five → Traders need a new playbook for these rate cuts, Middle Eastern funds are plowing billions into hottest AI start-ups, TSMC, Samsung weigh major new chip factories in UAE, Qualcomm wants to buy Intel, and Harris to unveil economic policy plans this week…

💰 Unveiled: NVIDIA’s "Secret Royalty" Program » *

A message from Porter Stansberry

Calendar: (all times ET) - Full calendar here

Today:

S&P flash US services PMI, 9:45 am

S&P flash US manufacturing PMI, 9:45 amTomorrow: Consumer confidence, 10:00 am

Your 5-minute briefing for Monday, September 23:

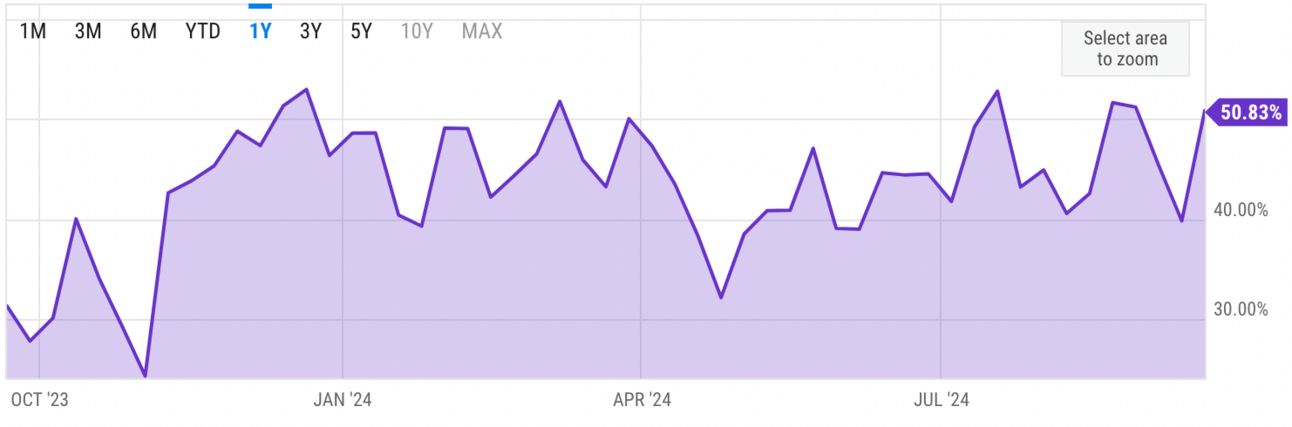

US Investor % Bullish Sentiment:

↑ 50.83% for Week of September 19 2024

Last week: 39.80%. Updates every Friday.

Market Wrap:

Dow futures flat after last week's rate cut hit record close.

Stocks rallied post Fed’s 50 bps rate cut.

Dow closed above 42,000; S&P hit new highs.

Lazard market strategist: Fed signals action to prevent labor market weakness.

Today: service/manufacturing data & Fed speeches.

EARNINGS

Here are the earnings we’re watching this week.

Monday: [none watched]

Tuesday: KB Home (KBH)

Wednesday: Jefferies (JEF)

Micron Technology (MU) - earnings of $1.13 per share (vs a per-share loss of $1.07 in the year-ago period). Revenue of $7.6B expected (+90% YoY)

Costco Wholesale (COST) - earnings of $5.08 per share (+4.5% YoY) on $79.9B revenue (+1.3%)

Friday: [none watched]

See full earnings calendar here.

HEADLINES

Harris to unveil economic policy plans this week (more)

Fed about to get validation for its jumbo rate cut (more)

The 10-yr Treasury yield is the most important interest rate (more)

Gold breaks $2,600 barrier as Fed cut bets prolong historic run (more)

Oil edges up following rate cut move, geopolitical concerns (more)

Asia stocks hold steady as more rate cuts loom (more)

TSMC, Samsung weigh major new chip factories in UAE (more)

Nvidia teams up with AI firm G42 to create climate tech lab (more)

Apple’s new iPhone 16 reflects a slowing pace of innovation (more)

FedEx flags major shift in consumer behavior that’s hurting profits (more)

SpaceX plans to launch five uncrewed Starships to Mars in two years (more)

J&J unit files for bankruptcy to advance $10 billion talc settlement (more)

X is capitulating to Brazil’s Supreme Court (more)

Stellantis Chair targeted in 75 mln euro seizure over alleged tax fraud (more)

TOGETHER WITH BEHIND THE MARKETS

Earn “AI Royalties”

With This Strategic Investment

Did you know that there's an investment that will give you the opportunity to collect "royalties" every time Nvidia makes a chip?

Ex-Wall Street CEO Dylan Jovine calls this "the easiest windfall from the AI revolution."

Elon Musk says that without this company, "civilization will crumble."

JP Morgan Chase warns of a "global depression" without this investment.

Even ChatGPT founder Sam Altman says AI depends on this company's work...

- sponsored message -

DEALFLOW

M+A | Investments

Chipmaker Qualcomm to explore takeover of Intel (more)

Apollo eyes $5 billion investment in Intel (more)

Blackstone to sell Motel 6 brand to Oyo in $525M deal (more)

Clean-energy firm Masdar nears deal to buy Brookfield’s Saeta Yield (more)

VaLogic Bio, compliance and SaaS services, acquired Facility Logix, a firm specializing in project management for life sciences facilities (more)

Lumivero, qualitative data analysis software NVivo, acquired ATLAS.ti, a QDA solution for qualitative, quantitative, and mixed-method research (more)

Hummingbird, financial crime risk management solutions, acquires LogicLoop, a company specializing in no-code data integration and automation (more)

Interplay Learning, a provider of immersive skilled trades training, secured funding from Goldman Sachs Alternatives (more)

Hippocratic AI, a company building a safety-focused LLM for healthcare, received an investment from NVentures (more)

VC

11x, an AI startup transforming the modern workforce with autonomous digital workers, raised $24M in Series A funding (more)

Functional Finance, a FinOps platform for managing general agents, insurance companies, and wholesalers, raised $20M in Series A funding (more)

Ferrum Health, a software platform for deploying AI into health systems, raised $16M in Series A funding (more)

HavocAI, a company specializing in autonomous uncrewed surface vessel technology, raised $11M in Seed funding (more)

Momos, an AI-powered customer platform for multi-location brands globally, raised $10M in Series A funding (more)

Tidal Metals, a deep-tech company, closed an $8.5M Seed funding round (more)

Schematic, a company improving pricing and packaging for B2B SaaS companies, raised $4.8M in funding (more)

Statt, a big data and AI company for the public policy, regulatory, and strategic communications sectors, raised $2.8M in Seed funding (more)

CRYPTO

BULLISH BITES

🚨 Breaking: Collect “royalties” every time Nvidia makes a chip? *

🤯 3 Mile Island? Microsoft AI needs so much power it's tapping site of nuclear meltdown.

🗣 Bot Convo’s: The joys of talking to ChatGPT.

📖 Memoir: In ‘Money Trap,’ an ex-SoftBank executive revisits the madness.

🧦 Revolution: Cashmere sock shoes are the newest style flex for your feet.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.