Good morning.

The Fast Five → Powell to volatile stock market: You’re on your own, China’s grip over the strategic minerals, tariff panic spurs fastest retail sales growth in years, Trump chip export restrictions deal blow to Nvidia, and China pivots from US to Canada for more oil…

🚀 DOGE could send 6 AI stocks through the roof *

Calendar: (all times ET) - Full Calendar

Today:

Initial jobless claims, 8:30A

Tomorrow:

none scheduled, Good Friday holiday

Your 5-minute briefing for Thursday, April 17:

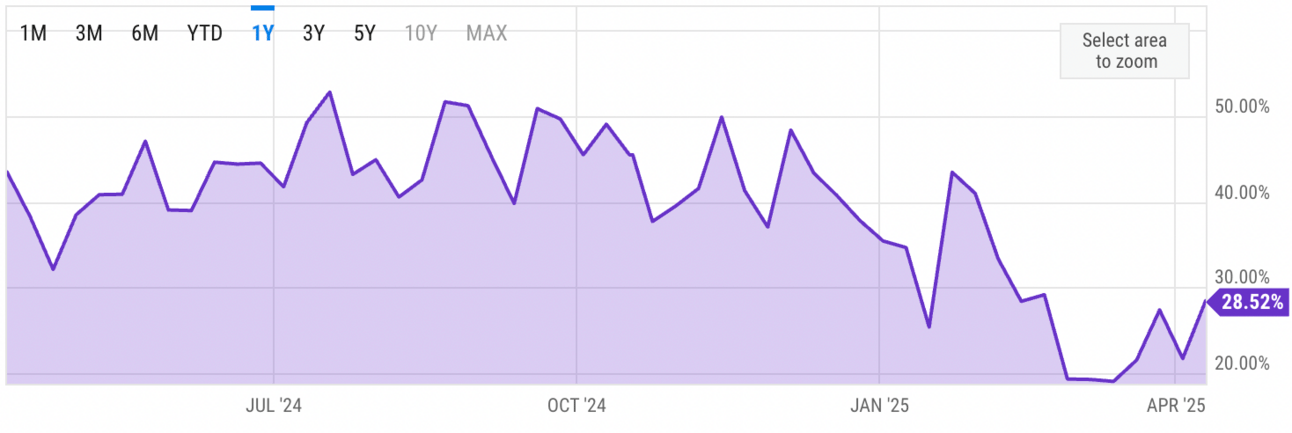

US Investor % Bullish Sentiment:

↑ 28.52% for Week of April 10 2025

Previous week: 21.76%. Updates every Friday.

Market Wrap:

Futures edge up: Dow +62 pts (+0.15%), S&P +0.2%, Nasdaq +0.3%.

Wednesday: Dow -1.7%, S&P -2.2%, Nasdaq -3.1%, nearing bear territory.

Nvidia -6.9% on $5.5B China charge; chip stocks slide on tariff fears.

Powell: tariffs may fuel inflation, complicate Fed goals.

Month-to-date: S&P -6%, Nasdaq -5.7%, Dow -5.6%.

EARNINGS

Here’s what we’re watching this week:

Today: American Express $AXP ( ▲ 1.03% ), Charles Schwab $SCHW ( ▲ 0.17% ), Netflix $NFLX ( ▲ 2.17% )

UnitedHealth $UNH ( ▲ 0.02% ) - expected earnings of $7.29 per share

Stay Alert for the Dept of Government Efficiency's Next Move …

Thousands of government jobs could be replaced …

By a new form of AI.

Recently perfected by Musk and his team at xAI.

This one move could save American taxpayers billions of dollars.

But even more important to you as an investor …

It could light a fire under the AI market.

And I believe six specific stocks could soar as a result.

Michael Robinson

Director of Tech Investing

Weiss Ratings

HEADLINES

Stocks sink, bonds climb as ‘Fed Put’ hopes dashed (more)

Trade war ripples through the business world, hits stocks again (more)

Trump says tariffs will boost US manufacturers, but many uncertain (more)

Tariff panic spurs fastest retail sales growth in two years (more)

US looks to box In China by recruiting other trading partners (more)

China pivots from US to Canada for more oil as trade war worsens (more)

Dollar slides towards Easter weekend (more)

Oil heads for weekly rise as US adds sanctions on Iran (more)

Trump chip export restrictions deal blow to Nvidia and AMD (more)

Temu Slashes Google, Meta Ad Spending as Tariffs Bite (more)

DEALFLOW

M+A | Investments

OpenAI in talks to pay about $3 bln to acquire AI coding startup Windsurf

Lyft, Inc., a ride hailing marketplace, acquired Freenow, a multi-mobility app with a taxi offering at its core

GeneDx, a company specializing in delivering improved health outcomes through genomic insights, acquired Fabric Genomics

Featured.com, a platform connecting subject-matter experts with journalists, acquired Help A Reporter Out (HARO), a tool for journalists

Infinite Reality (iR), a company improving digital media and ecommerce through immersive technologies, acquired Touchcast

CleanArc Data Centers, a developer and operator of data center campuses, received an investment from Townsend Group

VC

Auradine, Inc., a provider of energy-efficient solutions for blockchain and AI infrastructure, raised an additional $153M in Series C funding

Glycomine, a biotech company focused on developing new therapies for orphan diseases, raised $115M in Series C funding

Hammerspace, a data platform for AI, raised $100M in funding

Attovia Therapeutics, a clinical-stage biopharma company, raised $90M in Series C funding

Chapter, a medicare navigation platform, raised $75M in Series D funding

Luma Financial Technologies, a Cincinnati, OH-based structured products and insurance solutions provider, raised $63M in Series C funding

Caban, a provider of alternative energy solutions for critical infrastructure, raised $50M in funding

Loti AI, a leader in likeness protection technology, closed a $16.2M Series A funding

Scout AI, a defense-specific Vision-Language-Action (VLA) company, raised $15M in Seed funding

Blue Onion, a subledger used by retail and ecommerce brands, raised $10M in Series A funding

Bauplan, a Python-first serverless data platform, raised $7.5M in Seed funding

Arcana Labs, an AI-powered content production platform and studio, raised $5.5M in funding

Atomic, an AI-powered supply-demand management software, raised $3M in Seed funding

lashExperts, a platform built for B2B marketing and sales teams, raised $2M in Seed funding

Finch Legal, a pre-litigation operations platform built for personal injury law firms, raised a Seed funding round of undisclosed amount

CRYPTO

BULLISH BITES

🤖 Why DOGE is the only thing that can save AI *

📊 An AI startup says its new tool will help investors make smarter deals, faster.

⚔️ Jimmy Fallon to lead cutthroat marketing agency in new competition series ‘On Brand.

🤑 Lego black market fetches big prices and fuels brazen thefts.

💵 Beige is the color of money.

DAILY SHARES

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.