Good morning.

The Fast Five → Fed holds rates steady, Trump to announce a ‘major trade deal’ with the UK, US scraps Biden-era export curbs on AI chips, CrowdStrike announces 5% job cuts due to AI, and Disney announces its first Middle East theme park in Abu Dhabi…

Trump’s Final Reset

Inside the plot to “reset” America’s financial system…and why you need to move your money now.

Calendar: (all times ET) - Full Calendar

Today:

Initial jobless claims, 8:30A

US productivity, 8:30A

Wholesale inventories, 10:00A

Tomorrow

none watched

Your 5-minute briefing for Thursday, May 8:

US Investor % Bullish Sentiment:

↓ 20.94% for Week of MAY 1 2025

Previous week: 21.94%. Updates every Friday.

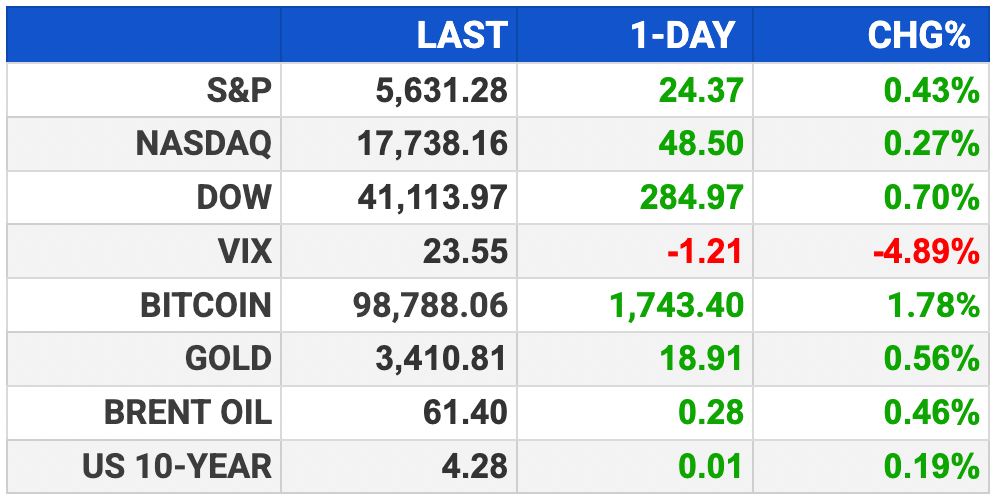

Market Wrap:

Futures edge lower post-Fed: S&P -0.1%, Dow -55 pts, Nasdaq flat

Wed: S&P +0.43%, Dow +0.7%, Nasdaq +0.27%, Nvidia +3% on chip news

Fed holds at 4.25%–4.5%, flags inflation and jobs risk

Powell rules out early cut, says inflation still too high

AppLovin +13% on earnings & gaming sale; Arm -11% on weak outlook

EARNINGS

Here’s what we’re watching this week:

Today: DraftKings $DKNG ( ▼ 0.8% ), MARA $MARA ( ▲ 0.13% ), Paramount Global $PARA ( ▼ 2.1% ), Peloton $PTON ( ▼ 0.23% ), Tapestry $TPR ( ▲ 3.15% )

Coinbase $COIN ( ▲ 3.26% ) - Analyst overweight (or "Buy") rating on COIN and a 12-mo target price of $310

⬇️ Claim Your Complimentary Report from GoldCo

4 Reasons The Dollar Could Collapse

If you’ve noticed that your dollars don’t seem to go as far as they used to, you’re not alone. Millions of Americans are in the same boat.

The recent inflation rate, the highest in over 40 years, was a wake up call that made many people realize that the financial stability they had taken for granted for decades no longer exists.

The US government has been tempted to use its reserve currency status to its financial advantage. This has resulted in massive devaluation of the dollar.

A way to help protect your dollars is to diversify your money with assets that don’t depend upon the strength and health of the dollar for their value. Precious metals like gold and silver, for instance, are in demand around the world 24/7 and aren’t dependent upon the value of the dollar.

To find out reasons why experts are predicting the collapse of the dollar, request your free digital copy of the 4 Reasons the Dollar Could Crash eBook.

*Offer valid on qualified orders of Goldco premium products only. Receive up to 10% in free silver based on purchase amount; cannot be combined with other offers. Additional terms apply—see your customer agreement or contact your representative for details.

HEADLINES

Late chip rally lifts stocks after Fed rate decision (more)

Analysts react to Federal Reserve holding rates steady (more)

Moody's warns of risk posed by rising retail exposure to private credit (more)

US scraps Biden-era rule aimed to limit exports of AI chips (more)

Cargo at the Port of LA is down 35% in the wake of tariffs (more)

Alphabet sinks 7% after Apple’s Cue says AI will replace search engines (more)

Arm shares drop on weak forecast (more)

Toyota sees 21% full-year profit decline as tariffs take a bite (more)

CrowdStrike announces 5% job cuts, says AI is ‘reshaping every industry’ (more)

China’s factories start to imagine world without American buyers (more)

Disney announces its first Middle East theme park in Abu Dhabi (more)

DEALFLOW

M+A | Investments

Grab looks to acquire Indonesia's GoTo in Q2

Veolia to acquire remaining stake in Water Technologies and Solutions for $1.75B

Neocol, a consulting firm helping organizations streamline their operations, received an investment from Shamrock Capital

VC

OX Security, an application security platform, raised $60M in Series B funding

PAQ Therapeutics, a biotech company developing KRAS degraders, raised $39M in Series B financing

Inductive Bio, a tech company advancing AI models for small molecule drug discovery, raised $25M in Series A funding

WisdomAI, a company offering business insight agents, raised $23M in funding

Carta Healthcare, an AI-powered clinical data abstraction solutions, raised $18.25M in Series B1 funding

Jericho Security, an AI-powered cybersecurity training and conversational phishing defense platform, raised $15M in Series A funding

FirmPilot, an AI marketing engine for law firms, raised further funding, bringing its total to $11.7M

Uviquity, a tech startup advancing new photonic disinfection technologies, raised $6.6M in Seed funding

CRYPTO

BULLISH BITES

🚨 Could Trump have a third term in office? *

🤖 Amazon just unveiled a new warehouse robot with a sense of touch.

💊 OpenAI and the FDA are discussing AI for drug evaluations.

💼 A comprehensive list of 2025 tech layoffs.

✝ How to stream the papal conclave.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.