Good morning.

The Fast Five → Trump floats 25% tariffs on US auto, drug, chips, DOGE effort has saved $50 Billion so far, judge denies bid to halt Musk access to US agencies, Intel pops 16% for best day in 5 years, and Lutnick confirmed as Commerce Secretary…

“Elon's #1 AI Stock" SET TO SOAR

Forget ChatGPT!

Because Elon's AI promises to be 100x more powerful.

After all, ChatGPT just works online...

While Elon's AI works in the real world.

Calendar: (all times ET) - Full Calendar

Today:

Minutes of Fed’s January FOMC meeting, 2:00P

Tomorrow:

Initial jobless claims, 8:30A

Your 5-minute briefing for Wednesday, February 19:

US Investor % Bullish Sentiment:

↓ 28.42% for Week of February 13 2025

Previous week: 33.33%. Updates every Friday.

📈 Bloomberg: Elon’s new AI startup is more powerful than its competitors »

- from Behind The Markets

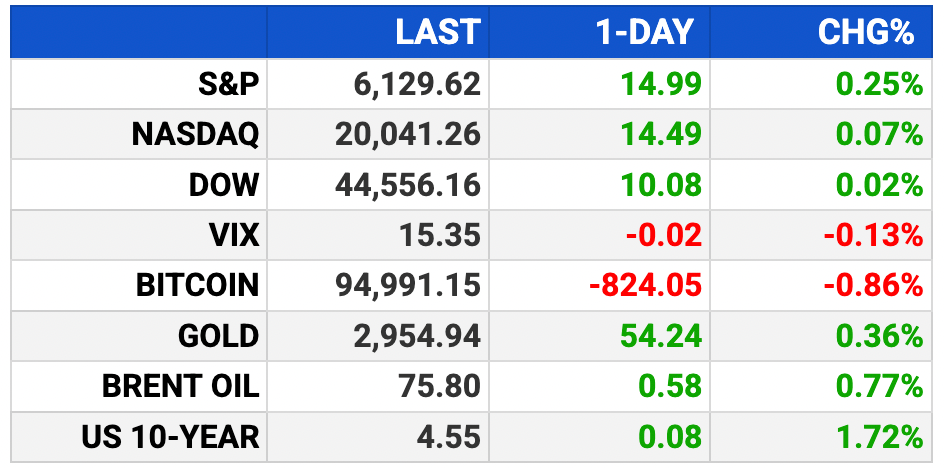

Market Wrap:

Stock futures were flat after a winning session.

Dow futures added 14 points, S&P and Nasdaq gained under 0.1%.

Arista fell 4%, Bumble plunged 18%, Toll Brothers dropped 5%.

S&P 500 hit a record, closing up 0.24% at 6,129.58.

Market remains resilient despite trade and inflation concerns.

EARNINGS

Here’s what we’re watching this week:

Today:

Klaviyo (KVYO) - earnings of $.06 per share (-33.3% YoY), on $257.2M revenue (+27.6% YoY)

Thursday: Rivian (RIVN)

Walmart (WMT) - earnings of $.65 per share (+8.3% YoY) on $178.8B revenue (+4.0% YoY)

Booking Holdings (BKNG) - earnings of $36.01 (+11.1% YoY) on $5.2B revenue (+8.3% YoY)

HEADLINES

Lutnick confirmed as Commerce Secretary (more)

S&P ekes out all-time closing high as Fed minutes eyed (more)

Dollar firms on Ukraine tensions (more)

Homebuilders raise alarm over tariffs as sentiment falls to 5-mo low (more)

US consumers rush to buy as Trump tariffs fuel stockpiling (more)

Foreign holdings of US Treasuries fall in December (more)

BlackRock paused corporate meetings in wake of new rules on ESG (more)

Judge denies bid to halt Musk access to US agencies for now (more)

Intel pops 16% for best day since March 2020 on potential breakup (more)

HSBC expects revamp to cost $1.8 billion over two years (more)

Ackman dangles $900M in new bid to revamp Howard Hughes (more)

TOGETHER WITH AI CAPITAL NEWS

The AI Stock Poised to Soar Under Trump’s $500B Plan

Nvidia was a standout opportunity back in February 2019, delivering a massive 490% return.

Now, there's another under-the-radar AI stock, 2,500x smaller than Nvidia, with significant potential. And with Trump’s recent $500 billion AI push, the timing couldn’t be better.

DEALFLOW

M+A | Investments

X is in talks to raise money at a $44 billion valuation (more)

‘Pokémon Go’ maker nears $3.5B deal to sell games unit (more)

HP to acquire parts of Humane, AI pin startup from ex-Apple managers, for $116M (more)

Quokka Care, a healthcare tech solutions for the remote patient monitoring space, received a strategic Growth investment from Ray Guzman (more)

VC

Bambusa Therapeutics, a biotech company, raised a Series A financing of approximately $90M (more)

Hightouch, a data and AI platform for marketing and personalization, raised $80M in Series C funding (more)

Endovascular Engineering, Inc., a medical technology company for Pulmonary Embolism, raised $42M in Series B funding (more)

Subsense, a neurotechnology company developing a non-surgical Brain-Computer Interface, raised $17M in Seed funding (more)

Perceive Pharma, a pharmaceutical company advancing therapeutics in ophthalmology, raised $15M in Series A funding (more)

Vema Hydrogen, a company developing stimulated geologic hydrogen (SGH), raised $13M (more)

DiligentIQ, a platform for conducting private equity due diligence, raised $12M in Series A funding (more)

MirrorTab, a provider of advanced web application protection, raised $8.5M in Seed funding (more)

Brother's Bond Bourbon, a whiskey brand, raised $7.5M in funding (more)

Keebler Health, an AI-native risk adjustment platform for healthcare providers, raised $6M in Seed funding (more)

SRA Watchtower, a financial tech platform, raised $4M in funding (more)

Maestro, an enterprise-grade infrastructure designed for Bitcoin DeFi, raised $3M in Seed (more)

FullEnrich, a data enrichment aggregator, has raised $2M in seed funding (more)

CRYPTO

BULLISH BITES

🪐 The people in Elon Musk’s DOGE universe.

🤖 Humane is shutting down the AI Pin and selling its remnants to HP.

🤔 AI can fix bugs—but can’t find them, exposing limits to software engineering.

🥯 This isn’t your normal Saturday morning hangover bagel.

DAILY SHARES

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.