Good morning.

The Fast Five → Trump to announce 25% steel tariffs, execs trying to navigate Trump’s tariffs on earnings calls, inflation proving sticky as Powell heads to the Hill, CFPB to close office, and Trump says Nippon Steel will invest in U.S. Steel, not buy it…

🚀. A new coin is emerging in the crypto bull market.

Investing now could be like buying Bitcoin in 2013.

Before it took off.

Or scooping up Ethereum in 2017.. before it soared.

Click here to get more details on this coin.

-from Weiss Research

Calendar: (all times ET) - Full Calendar

Today:

None scheduled

Tomorrow:

Fed Chair Powell testifies to Congress, 10:00A

Your 5-minute briefing for Monday, February 10:

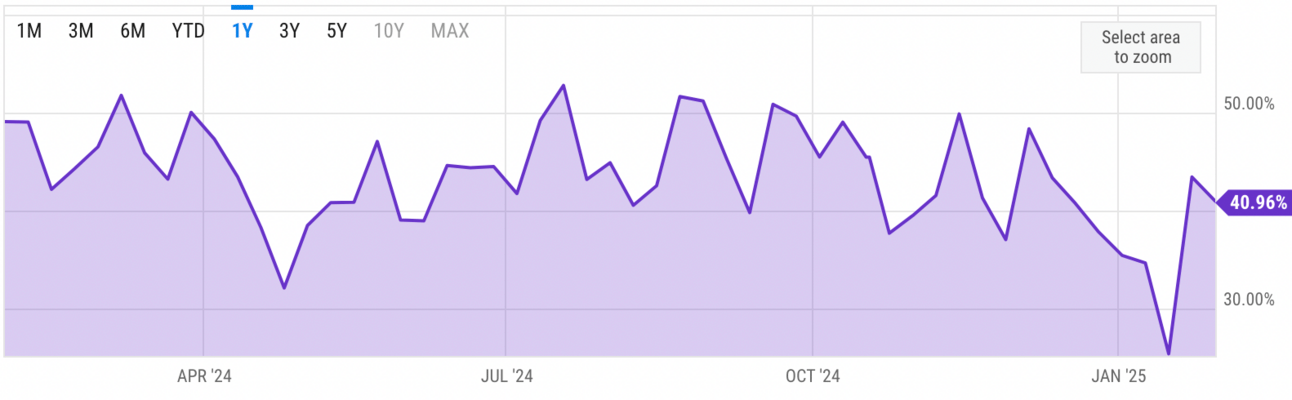

US Investor % Bullish Sentiment:

↓ 40.96% for Week of January 30 2025

Previous week: 43.43%. Updates every Friday.

📈 He called the top and bottom of Bitcoin nearly to the day… Here’s what he says is next »

- from Weiss Research

Market Wrap:

Stocks fell as Trump signaled new reciprocal tariffs

Dow -444 pts, S&P 500 -0.95%, Nasdaq -1.36%

Consumer sentiment dipped, inflation expectations hit 4.3%

Jobs report: wages up, unemployment fell to 4%

Amazon -4% on weak guidance, Alphabet extended losses

EARNINGS

Here’s what we’re watching this week:

Today:

McDonald's (MCD) - earnings of $2.86 per share (-3.1% YoY), on $6.5B revenue (+1% YoY)

HEADLINES

Wall Street closes lower on trade war escalation, weak data (more)

US hiring slowed in January, but economy remains resilient (more)

Fed officials see healthy jobs market, no rate-cut rush (more)

Inflation data to test market as tariff talk swirls (more)

Inflation is proving sticky as Fed Chair Powell heads to the Hill (more)

Trump says US might have less debt than thought (more)

CFPB to close office after Vought tells staff to halt all supervision (more)

US House Speaker to pursue 'one big bill' on Trump's tax agenda (more)

US Treasury taps former regulator Hood to lead bank watchdog (more)

Trump says Nippon Steel will invest in US Steel, not buy it (more)

Asian funds searching for shelter with Trump-driven volatility (more)

US pauses tariffs on small packages from China, a win for Shein and Temu (more)

Meta prepares for layoffs announcement today (more)

Apple’s new iPhone SE will kick off pivotal year for product line (more)

Activist Elliott said to build stake in struggling oil major BP (more)

IN PARTNERSHIP WITH MODE MOBILE

This tech company grew 32,481%...

No, it's not Nvidia... It's Mode Mobile, 2023’s fastest-growing software company according to Deloitte.

Just as Uber turned vehicles into income-generating assets, Mode is turning smartphones into an easy passive income source, already helping 45M+ users earn $325M+ through simple, everyday use.

They’ve just been granted their stock ticker by the Nasdaq, and you can still invest in their pre-IPO offering at just $0.26/share.

*Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur.

*The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period.

*Please read the offering circular and related risks at invest.modemobile.com.

DEALFLOW

M+A | Investments

Bank of America to buy $9 bln jumbo mortgage portfolio From TD (more)

Bain to acquire Mitsubishi Tanabe Pharma in $3.3B deal (more)

Pernod Ricard considers sale of Mumm champagne, sources say (more)

C&S Wholesale Grocers nears deal to buy Winn-Dixie stores (more)

Turn/River agrees to buy SolarWinds years after cyber-attack (more)

VC

Check here tomorrow

CRYPTO

BULLISH BITES

🇨🇳 Chinese companies detail use of AI amid DeepSeek frenzy.

💰 Billionaire proposes $1 Million reward for Bolivia’s Evo Morales.

🙄 Taylor Swift and the evolution of the NFL WAG.

🏓 Dope Pickleball's High Roller pickleball paddle steals the show in Michelob's new Super Bowl commercial.

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.