Good morning.

The Fast Five → Market faces most crucial inflation reading of 2024, Crypto is Trump’s new weapon, Apple store workers vote to authorize strike, Americans are racking up ‘phantom debt’, and OpenAI to announce Google search competitor today…

Calendar: (all times ET)

TUE, 5/14: | Producer price index (PPI), 8:30a |

WED, 5/15: | Consumer price index (CPI), 8:30a |

THU, 5/16: | Initial jobless claims, 8:30a |

Your 5-minute briefing for Monday, May 13:

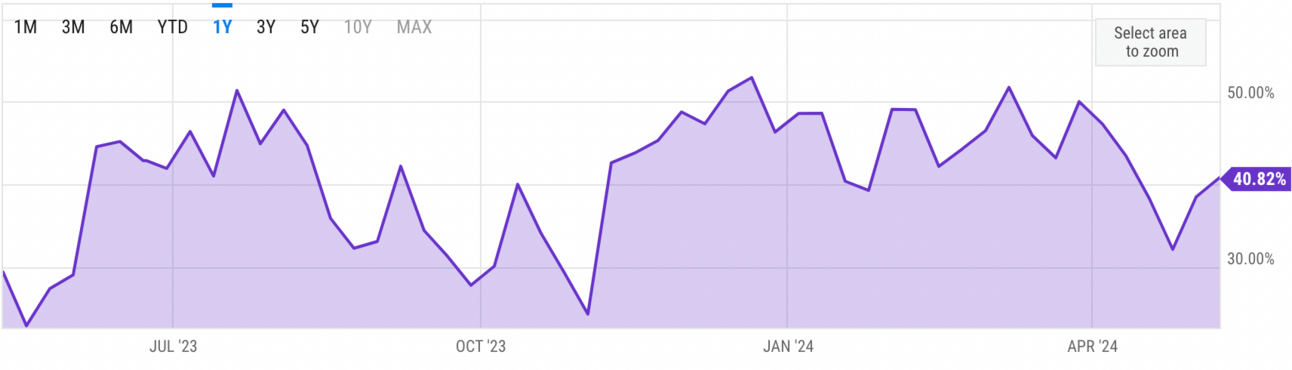

US Investor % Bullish Sentiment:

40.82% for Wk of May 09 2024 (Last week: 38.49%)

Market Recap:

Stock futures steady on Sunday, eyes on inflation data

S&P futures down 0.1%, Nasdaq 100 flat, Dow slips 0.09%

Dow enjoyed 8 consecutive wins last week, best of the year

Investors watch April's CPI report for Fed policy clues

Hopeful Fed keeps rate hikes at bay despite inflation

Strong Q1 earnings season bolsters market resilience

EARNINGS

What we’re watching this week:

Tuesday: Alibaba (BABA)

Home Depot (HD) - earnings of $3.82 EPS on $36.7B revenue (-1.6% YoY)

Wednesday: Monday.com (MNDY)

Cisco Systems (CSCO) - earnings of $.77 (-23% YoY) on $11.6B (-20.5% YoY)

Thursday: Deere (DE)

Walmart (WMT) - earnings of $.53 on $159.4B (+4.7% YoY)

Full earnings calendar here

HEADLINES

Market’s near-record rally faces most crucial inflation reading of 2024 (more)

The April CPI report may shock the market and the Fed (more)

$600B wall of debt looms over market’s riskiest stocks (more)

Currency market calm as inflation data holds focus this week (more)

China kicks off ultra-long debt sale in bid to boost economy (more)

Americans racking up ‘phantom debt’ Wall Street can’t track (more)

US judge halts rule capping credit card late fees at $8 (more)

OpenAI to announce Google search competitor today (more)

After layoffs, Tesla to spend $500M on charging network (more)

Big short trader warns Tesla vulnerable to 70% drop (more)

Rivian, Lucid, other EV startups scramble to shore up cash and reassure Wall Street (more)

Arm Holdings plans to launch AI chips in 2025 (more)

Shein steps up London IPO prep amid US hurdles to listing (more)

Financiers fret over 'leverage on leverage' in private credit (more)

Musk's Starlink satellites disrupted by major solar storm (more)

PRESENTED BY BULLSEYE TRADES

This tiny company has all but cemented itself in the future list of bitcoin mining giants.

An industry shakeup of environmental regulations could spell catastrophe for others, while this company begins to soar.

The underlying factors?

Cheap production and carbon neutral mining.

But that’s just the start of it.

Subscribe to Bullseye Trade to learn more.

DEALFLOW

M+A | Investments

Schumer urges FTC to hit the brakes on $53B Chevron-Hess merger (more)

Pfizer and AstraZeneca announce new investments of nearly $1B in France (more)

Cocoa supplier Natra in talks to buy chocolate duo Gubor, Nutkao (more)

PAI moves to delay exit from $10B Nestle Ice Cream JV (more)

Brightstar purchases AGS for $1.1B (more)

AI Squared, a company integrating information into web-based business applications, acquired Multiwoven, an open-source reverse ETL company (more)

Corpay (CPAY), a corporate payments company, acquires Paymerang, an accounts payables solutions company (more)

Mobix Labs, Inc. (MOBX), a semiconductor company, acquired RaGE Systems Inc., a company specializing in radio frequency joint design and manufacturing services (more)

Black Mountain Software, accounting and billing software for local government organizations, acquired Fiscalsoft, a market leader in accounting and payroll solutions for local governments (more)

Multitude Insights, an AI-powered solution enabling fast collaboration for law enforcement agencies, received an investment from NEC X, innovation accelerator and venture studio (more)

MPE-backed ATG buys BAF Industries (more)

K1 acquires Capital Karts (more)

One Rock-backed EnviroServe acquires CG Environmental (more)

VC

Attovia Therapeutics, a developer of a pipeline of biotherapeutics with an initial focus on immune-mediated diseases, raised $105M in Series B financing (more)

Glacis, a developer of a Firewall and Router Protocol for simplifying cross-chain operations, secured $2M in seed funding (more)

Offleash’d, a mobile app connecting pet parents via patented AI-powered matchmaking process, raised $700K in Seed funding (more)

CRYPTO

BULLISH BITES

💎 HODL: @RoaringKitty is back, apes.

📉 Hit hard: VC fund performance is down sharply — has it already hit its lowest point?

🎲 Blowback: Miss the latest All-In podcast with Sam Altman? The gold is in the comments.

💫 Heavenly: Spectacular displays of the aurora borealis in photos from around the globe.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.