Good morning.

The Fast Five → CPI report today expected to show little progress against inflation, Google unveils custom Arm-based chips, small-business sentiment slides to 11-year low, gold hits another record awaiting inflation print, and Boeing hit with new whistleblower allegations…

Calendar: (all times ET)

Today: | Consumer Price Index (CPI), 8:30am |

THU 4/11: | Producer Price Index (PPI), 8:30am |

FRI 4/12: | Consumer Sentiment, 10:00am |

Your 5-minute briefing for Wednesday, April 10:

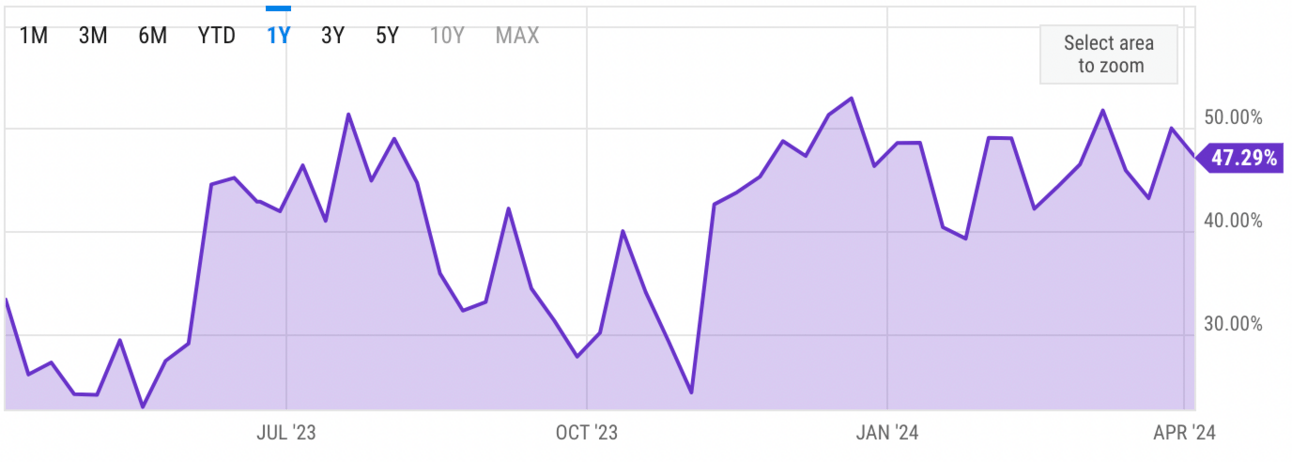

US Investor % Bullish Sentiment:

47.29% for Wk of Apr 04 2024 (Last week: 50.00%)

Market Recap:

slightly pithier- but only a tiny bit where it makes sense.

Dow up 0.09%, S&P 500 0.08%, Nasdaq 100 0.1%.

Markets hold steady ahead of March CPI report.

CPI expected to rise 0.3% month-over-month, 3.4% YoY.

Fed funds futures show 42% chance of unchanged rates in June.

Inflation data to influence market moves; hot print may trigger pullback.

Investors also eye Fed minutes and Q1 earnings, starting with Delta Air Lines.

EARNINGS

What we’re watching this week:

Today:

Delta (DAL) - earnings of $.35 per share (+40% YoY) on $12.6B revenue (+6.0% YoY)

JP Morgan Chase (JPM) - earnings of $3.88 per share (-5.4% YoY) on $38.8B revenue (-1.4% YoY)

Full earnings calendar here

HEADLINES

CPI report today expected to show little progress against inflation (more)

House Dems bring bill to nix IMF fees that cost countries billions (more)

Wall St rises on easing bond yields, inflation numbers on tap (more)

10-year Treasury yield falls as investors await inflation data (more)

Gold hits another record as investors await US inflation print (more)

Shocks in G20 emerging economies hit rich-world growth (more)

Global venture funding drops 30% as China helps drag market down (more)

Hong Kong, long an economic crossroads, now faces one (more)

Boeing hit with new whistleblower allegations, adding to safety concerns (more)

Boeing’s quarterly airplane deliveries drop to lowest since 2021 (more)

Intel unveils latest AI chip as Nvidia competition heats up (more)

Tesla investors brace for potential back-to-back sales decline (more)

Google’s Gemini 1.5 Pro can now hear (more)

Costco selling as much as $200M in gold bars a month now (more)

Blackstone plans to borrow $1B against its own investments to free up cash (more)

NYSE exec says ‘handful’ of AI startups are exploring IPOs (more)

PRESENTED BY WISERADVISOR

Compare top advisors in your area, Free.

Connect with the best financial advisor for your needs from WiserAdvisor - a no-cost, independent and unbiased matching service…

✅ Trusted by over 100,00+ consumers since 1998

✅ Free initial 1 on 1 consultation

✅ Get a personalized match with 2-3 vetted Advisors to compare

— and NO match fee!

It’s easy. Simply answer a few questions and WiserAdvisor will find and connect you with 2-3 financial advisors in your area now…

~ please support our sponsors ~

DEALFLOW

M+A | Investments

Merger arbitrage desks still waiting for broader M&A bounce (more)

Blackstone nears buyout of skin-care company L’Occitane (more)

Silver Lake lines up $8.5 Billion financing for Endeavor buyout (more)

Bain Capital exits Axis Bank, raises $429M in stake sale (more)

ProSiebenSat.1 prepares Verivox, Flaconi sale amid Mediaset pressure (more)

Multiverse, a tech company that delivers apprenticeship to create equitable access to economic opportunity, acquired Searchlight, a provider of a talent intelligence/skills assessment platform (more)

Restaurant365, provider of a restaurant enterprise management platform, acquired ExpandShare, provider of a proprietary learning management system built for restaurants (more)

Entrust, a company specializing in payments, identities, and data security, acquired Onfido, an identity verification company (more)

Trivest buys pet care assets from PET|VET M&A Sales & Advisory (more)

Stellex-backed Fenix Parts acquires Neal Auto Parts (more)

Beeper messaging app that irked Apple is acquired by WordPress.com owner (more)

PE-backed Waverly Advisors purchases McShane Partners (more)

Alpine-backed Cobalt buys four businesses (more)

Ascendant and CIP acquire portfolio of multifamily properties (more)

Buyers Edge Platform, a provider of digital procurement solutions for the foodservice industry, received a $425M equity investment (more)

Stonebranch, a provider of service orchestration and automation solutions, received a minority investment from EMH Partners (more)

VC

Cyera, a data security company, raised $300M in Series C funding, at $1.4B valuation (more)

Monad Labs, the NYC-based core developers behind layer 1 blockchain Monad, closed a $225M Series A funding (more)

Nova Farms, an integrated cannabis operator, received a $20M in Loan Facility from Chicago Atlantic (more)

Sprinto, provider of an automated risk and compliance platform, raised $20M in Series B funding (more)

Cariloop, provider of a caregiver support platform, raised $20M in Series C funding (more)

StrikeReady, a company working to advance the way modern security teams operate, announced $12M in funding (more)

Procurement Sciences AI, provider of a bidding-intelligence platform for government contractors, raised $10M in Series A funding (more)

Bite, a provider of intelligent kiosk solutions for restaurants, raised $9M in Series A funding (more)

Quintar, an extended reality company, raised $8.2M in Series A funding (more)

Kiki World, a community commerce company, raised $7M in funding (more)

Juicer, a company specializing in restaurant revenue management and pricing solutions, raised $5.3M in Seed funding (more)

Ostra Cybersecurity, a holistic and managed security as a service platform provider, raised over $4M in Series A funding (more)

Pete, an AI EdTech startup, raised $2M in Seed funding (more)

GoodGist, a company specializing in corporate skills development and knowledge management automation, raised $1M in funding (more)

Algotech has emerged again with the milestone of raising $500,000 in a single day during its ongoing presale. In less than four weeks of the current presale, Algotech has raised over $3.5 million (more)

CRYPTO

Powered by MILKROAD - Get smarter about crypto in 5 min.

BULLISH BITES

⚾️ Pursuits: Popular YouTube channel Dude Perfect scores more than $100M investment.

🏡 Boomtown: The US has a record number of cities where $1 million homes are ‘typical'.

🏞 Rivalry: TikTok’s competing with Instagram with TikTok Notes.

⌚️ Inside look: What's hot at Watches and Wonders 2024.

⏳ Don’t put it off: Just answer a few questions and be connected with 2-3 financial advisors in your area right now. WiserAdvisor has been matching investors since 1998 - there is no cost, and no obligation… try it »*

What did you think about today's briefing?

☀️ Get your briefings before everyone else, go PRO »

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

*from our sponsors

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.