Good morning.

The Fast Five → Modi joins hands with Xi and Putin, stock market’s fate comes down to next 14 sessions, BRICS leaders schedule virtual meeting to discuss Trump tariffs, Trump weighs declaring national housing emergency, Nestlé ousts CEO over office affair -taps Nespresso boss…

📌 Is This Stock the 'Next Nvidia'? Billionaire Warren Buffett has been loading up on millions of shares of this single stock. Is he preparing for the next, biggest, and possibly final phase of the AI boom? Click here to see why he's buying this... and then learn the name and ticker symbol of this stock (complimentary). (ad)

Calendar: (all times ET) - Full Calendar

Today:

ISM Manufacturing, 10:00A

Tomorrow:

Job Openings, 10:00A

Your 5-minute briefing for Tuesday, Sept 2:

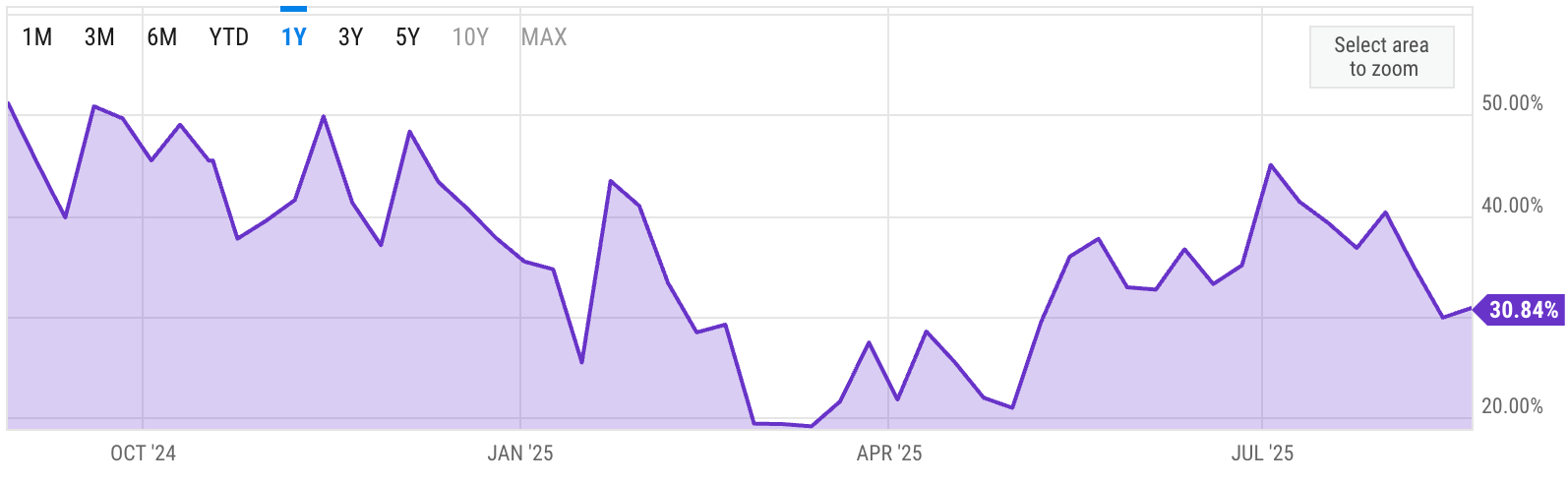

US Investor % Bullish Sentiment:

↑ 30.84% for Week of AUG 21 2025

Previous week: 29.88%

Market Wrap:

S&P -0.64%, Nasdaq -1.15%, Dow -0.2%

Core PCE +2.9% YoY in July, highest since Feb

Fed cut odds hinge on jobs vs inflation risk

Nvidia -3% on Alibaba chip report; Alibaba +13%

Caterpillar, Gap warn of tariff profit hits

August: Dow +3%, S&P +2%, Nasdaq +1.6%

September historically weakest month for stocks

EARNINGS

Here’s what we’re watching this week:

WED: American Eagle $AEO ( ▲ 1.24% ), *Campbell Soup $CPB ( ▼ 0.48% ), *Macy's $M ( ▲ 1.82% )

*Dollar Tree $DLTR ( ▲ 0.7% ) - $0.41 eps, down 38.8% YoY

Salesforce $CRM ( ▼ 0.07% ) - $2.78 eps (+8.6% YoY) on $10.1B revenue (+8.6% YoY)

THU: Lululemon $LULU ( ▲ 2.42% )

Broadcom $AVGO ( ▼ 0.4% ) - $1.66 eps (+33.9% YoY) for fiscal Q3 on $15.8B revenue (+20.6% YoY)

Shocked One of My Clients with This—

I was speaking with one of my hedge fund clients the other day...

He was shocked to hear this. And I think you will be too.

While virtually no one knows about this yet (even industry insiders)...

My team and I have discovered something strange going on in the US stock market right now.

It involves a disturbingly broken regulator in Washington, D.C. And if it isn't fixed ASAP, I believe it could quickly spiral into a 2008-style meltdown within a matter of weeks.

My concern is: what's coming is about to wipe out thousands - or perhaps even millions - of innocent people.

I don't want you to be one of them...

To your financial safety,

Rob Spivey

Director of Research, Altimetry

HEADLINES

Nasdaq futures waver as Wall St enters Sept with trade, Fed drama in focus (more)

BRICS leaders schedule virtual meeting to discuss Trump tariffs (more)

Trump weighs declaring national housing emergency, Bessent says (more)

US still working on trade deals despite court ruling (more)

Tame US job growth expected in approach to Fed meeting (more)

US consumer spending strong; core inflation warmer on services (more)

Dollar hits lowest since end-July ahead of US jobs data (more)

Gold trades near record highs on US rate cut bets; silver at 14-yr high (more)

Oil rises on weaker dollar and Russian supply disruptions (more)

BYD's shares slide after steep fall in quarterly profit (more)

Emerging stocks rally as Alibaba surges on AI revenue boost (more)

Nestlé ousts CEO over office affair and taps Nespresso boss (more)

‘Robinhood, FanDuel use gray area to link sports betting and stocks (more)

Spirit Airlines bankruptcy tees up painful cuts in survival bid (more)

TOGETHER WITH PACASO

Keep This Stock Ticker on Your Watchlist

They’re a private company, but Pacaso just reserved the Nasdaq ticker “$PCSO.”

No surprise the same firms that backed Uber, eBay, and Venmo already invested in Pacaso. What is unique is Pacaso is giving the same opportunity to everyday investors. And 10,000+ people have already joined them.

Created a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of luxury home transactions across 2,000+ owners. That’s good for more than $110M in gross profit since inception, including 41% YoY growth last year alone.

And you can join them today for just $2.90/share. But don’t wait too long. Invest in Pacaso before the opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

DEALFLOW

M+A | Investments

CapVest to acquire majority stake in Stada, abandoning IPO plans

Colt buys majority stake in $1 billion gunpowder ingredient maker

Wood Group accepts Sidara's takeover bid after year-long pursuit

VC

Vulcan Elements, a maker of rare-earth magnets, raised $65M in Series A funding

Copper, an appliances company, raised $28M in funding

Sensorium Therapeutics, a neuroscience therapeutics company, raised $25M in Series A funding

FriendliAI, an AI inference platform company, closed a $20M seed extension

Terraton, a biochar platform provider, raised $11.5M in Seed funding

Obita, headquartered in Hong Kong, raised over $10M in Angel financing

RenewCO2, a startup turning carbon dioxide into chemicals and fuels, raised $5M in seed funding

FallCall Solutions, an innovator in SaaS-based life-safety technology, closed a $1.5M Seed round

InnerActiv, a risk intelligence cybersecurity company, raised an undisclosed amount

CRYPTO

BULLISH BITES

📈 Could this be Warren Buffett’s #1 AI stock? (Forensic analysis) *

🤝 Trump’s plan to pack the Fed with loyalists.

👋 Zuckerberg’s AI hires disrupt Meta with swift exits and threats to leave.

💼 Soft skills matter now more than ever, according to new research.

👠 ‘The Wizard of Oz’ is getting an AI glow-up. Cue the pitchforks.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.