Good morning.

The Fast Five → Stocks get post-Fed rally, Fed's jumbo cut signals recalibration, Nike replaces CEO with company veteran, Apple Intelligence is now live in public beta, and Buffett’s remaining $34B BofA stake is now pure profit…

🚀 Breakthrough: Billions are flowing into weird Appalachian technology » *

A message from Porter Stansberry

Calendar: (all times ET) - Full calendar here

Today: [none scheduled]

Monday:

S&P flash US services PMI, 9:45 am

S&P flash US manufacturing PMI, 9:45 am

Your 5-minute briefing for Friday, September 20:

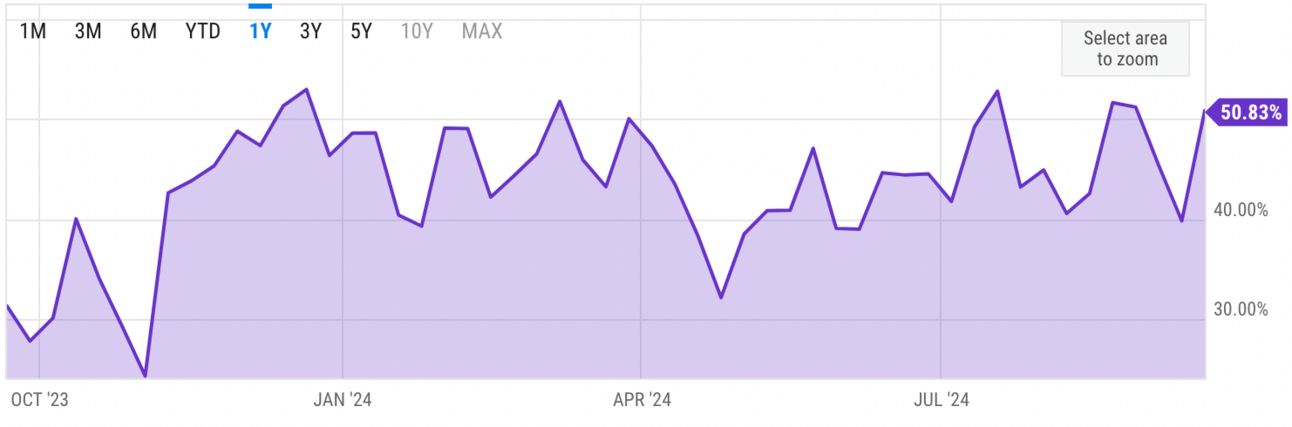

US Investor % Bullish Sentiment:

↑ 50.83% for Week of September 19 2024

Last week: 39.80%. Updates every Friday.

Market Wrap:

Dow futures flat after record close, boosted by Fed cut.

FedEx dropped 11% on earnings cut; Nike up 7% after CEO change.

S&P above 5,700; Dow hit 42,000, both record highs.

Jobless claims beat expectations at 219K, supporting Fed cut.

Major averages on track: S&P up 1.6%, Dow 1.5%, Nasdaq 1.9%.

EARNINGS

No earnings watched today. See full earnings calendar here.

HEADLINES

Global stock rally also extends (more)

Fed's jumbo cut signals recalibration for America (more)

Fed’s dovish capitulation spurs new winners across ETF world (more)

Wall St’s $5.1 trillion triple-witching is next market test (more)

10-year Treasury yield jumps as investors bet there’s no recession ahead (more)

Mortgage rates fall further, stoking housing optimism (more)

Oil set for weekly gain, focus on Middle East (more)

Market bull Tom Lee hesitant to jump into this post-Fed rally (more)

Largest east coast port starts prepping for first union strike since 1977 (more)

Apple Intelligence is now live in public beta (more)

Amazon introduces Amelia, an AI assistant for third-party sellers (more)

Trump faces a $2 billion decision over his social media empire (more)

Buffett’s remaining $34B Bank of America stake is now pure profit (more)

TOGETHER WITH CompareCredit

2 Cards Charging 0% Interest Until 2026

Paying down your credit card balance can be tough with the majority of your payment going to interest. Avoid interest charges for up to 18 months with these cards.

DEALFLOW

M+A | Investments

Uniper, ConocoPhillips agree to 10-year natural gas supply deal (more)

KKR, Axel Springer reach deal to break up the media giant (more)

Platinum Equity in talks to buy packaging maker Trivium (more)

Datamaran gets $33M investment from Morgan Stanley Funds (more)

Gruve, a startup specializing in AI-driven solutions, acquired NetServ, a provider of cloud services, AI, and network automation (more)

Easy Metrics, a labor analytics platform, acquired TZA, a labor management system (more)

CSI, an end-to-end financial software and technology, acquired Velocity Solutions, a company providing financial institutions customer retention solutions (more)

Planview, a platform for portfolio mgmt and digital product development, acquired Plutora, value stream mgmt and software delivery solutions (more)

CropX, a company specializing in digital agronomic solutions, acquired EnGeniousAg, advanced nitrogen sensing applications for agriculture (more)

Flourish Research, a multi-site clinical trial organization focused on therapeutic areas, received a majority investment from Genstar Capital (more)

Amperage Infrastructure Corporation, a broadband infrastructure investment company, received an investment from S2G Ventures (more)

VC

Twelve, a company that converts captured carbon dioxide into essential products made from fossil fuels, raised $645M in funding (more)

Mercor, an HR Tech startup, closed a $30M Series A funding round, at a $250M valuation (more)

AtoB, a modern payment solutions company for the transportation industry, raised $130M in funding (more)

Virtuous, responsive fundraising software for nonprofits, raised $100M in funding (more)

Picus Security, a security validation company, raised $45M in funding (more)

Datamaran, a software analytics platform that identifies and monitors external risks, raised $33M in Series C financing (more)

LiquidStack, a company specializing in liquid cooling for data centers, raised $20M in Series B funding (more)

Rebelstork, a baby gear returns recommerce marketplace, raised $18M in Series A funding (more)

Fathom, an AI-powered meeting intelligence platform, raised $17M in Series A funding (more)

Hemi Labs, a developer of Web3 infrastructure, raised $15M in funding (more)

True Markets, a cryptocurrency platform, raised $9M in Seed funding (more)

Safire Technology Group, a Li-ion battery technologies company, raised $8M in Pre-Series A funding (more)

Harbor, an infant care technology company, raised $7M in Seed funding (more)

Cercle, an AI women’s healthcare data company, raised $6M in Seed funding (more)

Vana, a decentralized network for user owned data, raised $5M in strategic funding (more)

Opnova, a company specializing in IT, security, and compliance operations optimization, raised $3.75M in funding (more)

Canopie, a prevention-focused maternal health company, raised $3.7M in Seed funding (more)

CRYPTO

BULLISH BITES

📈 Breakout: This technology could swing the election *

🥵 Drying Up: China's venture capital collapse.

🎬 Futurism: Lionsgate's new deal is a test of Hollywood's relationship with AI.

🚲 Hustlers: A small band of New Yorkers are gaming Citi Bikes and making up to $6,000 a month.

🧢 The Buzz: The fashion accessory taking over the NFL.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.