Good morning.

The Fast Five → Wall Street goes on a wild ride: ‘No one was expecting this’, Bessent says no recession risk for US economy, flood of AI bonds adds to pressure on markets, a swath of bank customer data was hacked, Trump’s net worth drops $1.1 billion…

📌 New warning from the analyst Barron’s called “prescient”: AI’s PHASE II IS COMING — Millions of Americans are about to be blindsided by the second, far more sinister phase of the artificial intelligence revolution… act now before it’s too late for your financial well-being. Go here to stream this new exposé now » (ad)

Calendar: (*Shutdown may affect key data. All times ET) - Full Calendar »

Today:

None watched

Tomorrow:

Producer Price Index, 8:30A

Your 5-minute briefing for Monday, Nov 24:

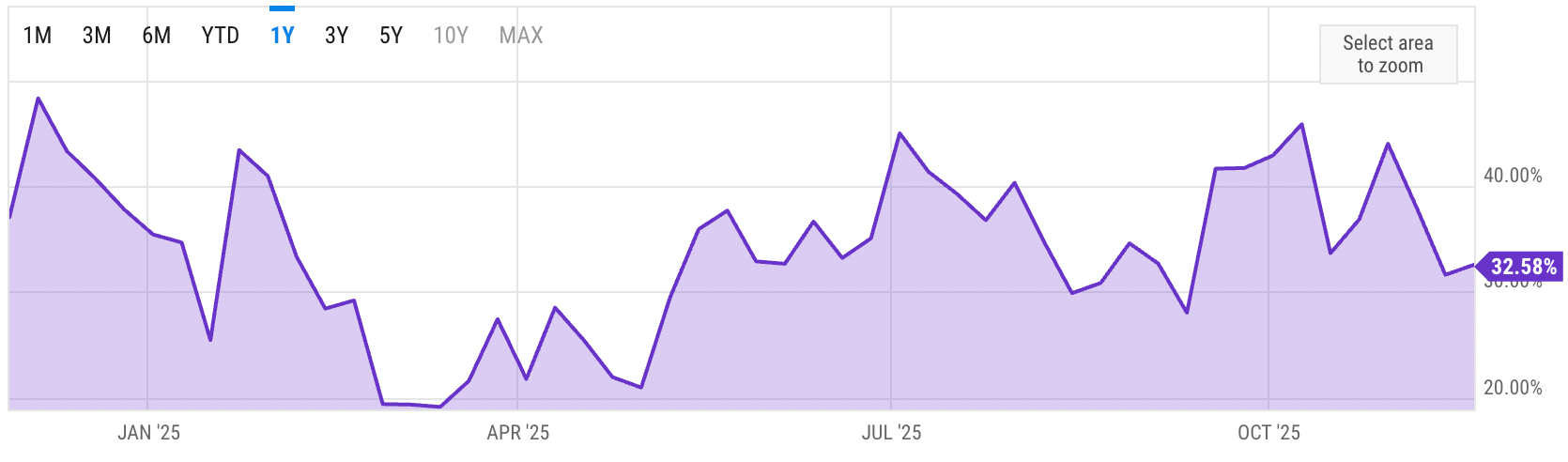

US Investor % Bullish Sentiment:

↑32.58% for Week of NOV 13 2025

Previous week: 31.62%

Market Wrap:

Futures rebound: Dow +200, S&P +0.6%, Nasdaq +0.8%.

Market trying to recover after AI-driven November slide.

S&P -3.5% MTD; Nasdaq -6.1%; Dow -2.8%.

NY Fed’s Williams kept a December cut on the table Friday.

Thin holiday trading could fuel volatility this week.

Key data Tuesday: retail sales + PPI.

EARNINGS

Here’s what we’re watching on this short, holiday week:

TUE: *Abercrombie & Fitch $ANF ( ▲ 0.53% ), *Alibaba $BABA ( ▲ 0.12% ), *Kohl's $KSS ( ▼ 2.49% ), Petco $WOOF ( ▼ 0.39% )

*Best Buy $BBY ( ▼ 2.75% ) - $1.31 EPS (+4% YoY) on $9.59B revenue (+1.5% YoY)

Dell Technologies - $2.48 EPS (+15.3% YoY) on $27.3B revenue (+12.9% YoY)

From the financial renegade who has predicted almost every major economic event since the late ‘90s comes an urgent new warning:

America Is About To Be Displaced —

An unstoppable new force is about to destroy millions of Americans financially (Goldman Sachs estimates 12,400 daily), while generating millions of dollars for others… Which side will you be on?

- a message from Porter & Company -

HEADLINES

Stocks rise as traders push up bets of December Fed cut (more)

Some hope after last week’s US market rout (more)

Bessent: Health care announcement coming this week (more)

Economists say Sept. jobs report complicates Fed rate cut path (more)

Flood of AI bonds adds to pressure on markets (more)

Investors eye holiday season turbulence amid AI and rate cut doubts (more)

Trump’s net worth drops $1.1 billion (more)

Dollar steady, Thanksgiving looms as yen test (more)

Gold steady as market weighs chance of another US rate cut (more)

Oil falls as Ukraine peace talks edge toward a solution (more)

AI investors want more making it and less faking it (more)

Google must double AI serving capacity every 6 months to meet demand (more)

Investors clamor for a peek behind the private markets curtain (more)

A swath of bank customer data was hacked, FBI is investigating (more)

BHP walks away from last stab at Anglo American takeover (more)

DEALFLOW

M+A | Investments

Daily Mail owner strikes $650 million deal to buy the Telegraph

Restaurant chain California Pizza Kitchen to be acquired by investor group

bQuest received an investment from First Rate Ventures

VC

Point One Navigation, a company specializing in location technology, raised $35M in Series C funding

Redrob, a platform for AI-driven B2B lead generation, raised $10M in Series A funding

Pibit.AI, an insurtech company, raised $7M in Series A funding

Twenty, a cyber warfare technologies company, closed a Series A funding round

Tailor, a headless ERP platform for retail and ecommerce brands, closed Series A add’l funding bringing total to $37M

HelloTrade, a blockchain-powered trading platform provider, closed a $4.6M seed funding round

Relixir, an AI search inbound engine provider, raised $2M in Seed funding

QSimulate, a quantum simulation technology company, raised an additional amount in Seed funding

Join Derek Jeter and Adam Levine

They’re both investors in AMASS Brands. And you can join them. Why invest? Their rapid growth spans everything from organic wine to protein seltzers. So with consumers prioritizing health in the $900B beverage market, it’s no surprise AMASS earned $80M+ already, including 1,000% year-over-year growth. They even reserved the Nasdaq ticker $AMSS. Become an AMASS shareholder and secure limited-time bonus stock by Dec. 4.

This is a paid advertisement for AMASS’s Regulation CF offering. Please read the offering circular at https://invest.amassbrands.com

CRYPTO

BULLISH BITES

📊 Nvidia didn’t save the market. What’s next for the AI trade?

💰 The fate of Google’s ad tech monopoly is now in a judge’s hands.

✌️ Poll: Americans with six-figure incomes are in 'survival mode.’

🧖🏻♂️ The hottest AI wearables and gadgets you can buy right now.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.