Good morning.

The Fast Five → Nvidia unveils advancements beyond chips, McDonald’s consumer pullback worsens, Fed expected to keep rates steady but tee up for Sept. cut, Apple says AI models were trained on Google’s chips, and Andrew Left surrenders on securities fraud charges in L.A …

📈 From Behind The Markets: if you missed out on the first wave of big AI profits... Get in on the second wave of big winners here »

Calendar: (all times ET)

Today: | Consumer confidence, 10:00 AM |

WED, 7/31: | FOMC interest-rate decision, 2:00 PM |

THU, 8/1: | Initial jobless claims, 8:30 AM |

FRI, 8/2: | Employment report, 8:30 AM |

Your 5-minute briefing for Tuesday, July 30:

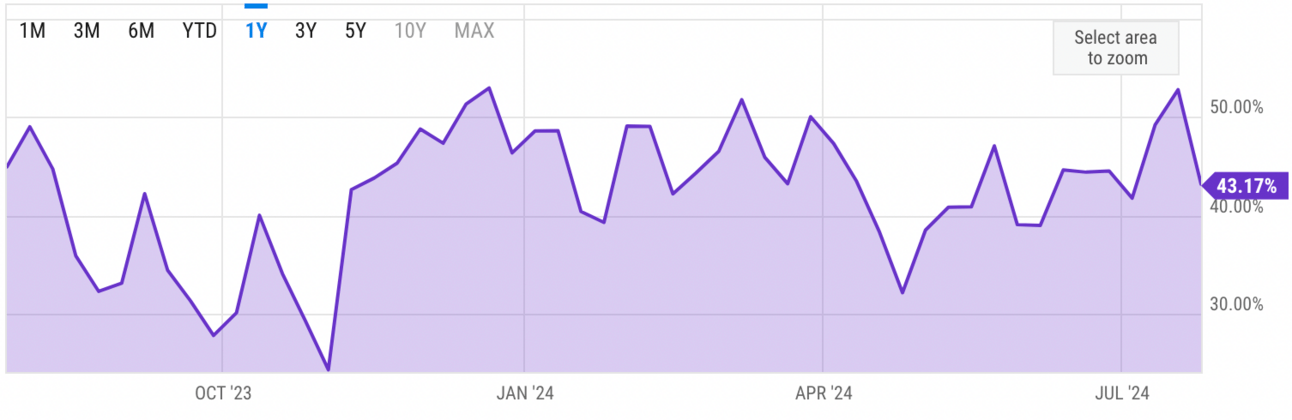

US Investor % Bullish Sentiment:

↓ 43.17% for Wk of July 25 2024 (Last week: 52.75%)

Chart updates every Friday.

Market Recap:

Stock futures flat; key earnings and Fed meeting ahead.

Merck, Pfizer, PayPal, P&G, JetBlue report earnings before the bell.

Microsoft, AMD, Starbucks report after the close.

40% of S&P 500 companies have reported; 79% beat earnings.

Fed's policy meeting starts Tuesday; possible rate cut signals.

100% chance of a September rate cut priced in.

EARNINGS

Here’s what we’re watching:

Today: Advanced Micro Devices (AMD), JetBlue Airways (JBLU), Live Nation (LYV), PayPal Holdings (PYPL), Restaurant Brands (QSR), SoFi Technologies (SOFI), Starbucks (SBUX)

Microsoft (MSFT) - earnings to be up 8.9% YoY, while revenue is forecast to rise 14.5% to $64.4B

Procter & Gamble (PG) - earnings of $1.37 per share, flat on a year-over-year basis, on $20.8B revenue (+1% YoY)

Thursday: Amazon (AMZN), DoorDash (DASH), DraftKings (DKNG), Hershey Foods (HSY), Intel (INTC), Moderna (MRNA), Roblox (RBLX), Roku (ROKU), Sirius XM (SIRI), Twilio (TWLO), Wayfair (W), Wendy's (WEN)

Apple (AAPL) - earnings of $1.34 per share (+13.6% YoY) on $84.4B revenue (+10.4% YoY)

Full earnings calendar here.

HEADLINES

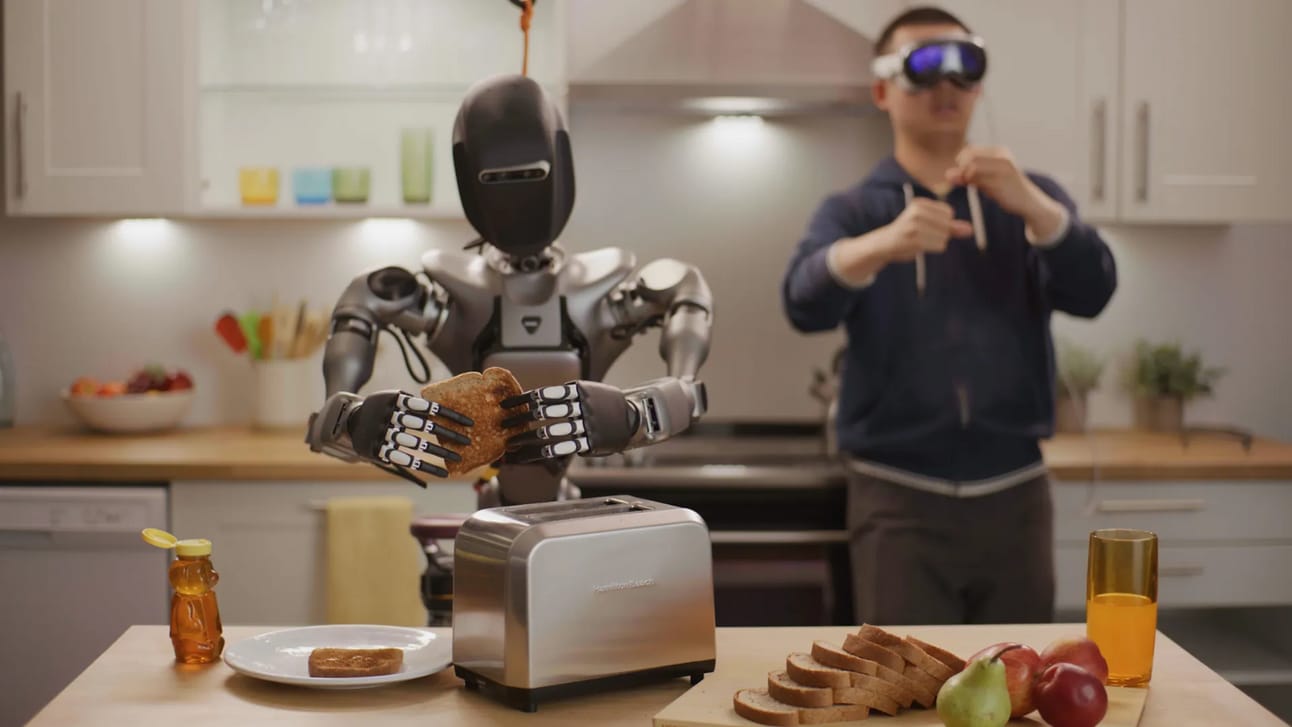

Nvidia unveiled several new real-world examples of generative AI at work Monday afternoon during SIGGRAPH, a major computer graphics technologies conference.

Fed expected to keep interest rates steady but to tee up September cut (more)

Stock turbulence throws spotlight on Big Tech's valuations (more)

Broader rotation tries to stick this time (more)

Dollar rebounds as markets await FOMC directions (more)

US buys 4.65M barrels for emergency oil stockpile (more)

IPO market to slow after Lineage, with quiet summer ahead (more)

Traders fret as 32-hr Central Bank spree hangs over market (more)

Delta hires David Boies to seek damages from CrowdStrike, Microsoft after outage (more)

Apple AI models were trained on Google’s custom chips (more)

Ford, GM, Stellantis face a daunting second half of 2024 (more)

Temu and Shein’s soaring popularity has Wall Street eyeing China’s influence on tech earnings (more)

Short seller Andrew Left surrenders on securities fraud charges in L.A., due in court (more)

A Massive $1 Trillion AI

Superproject is Underway

AI is growing exponentially. That means thousands of existing facilities are now obsolete.

New billion-dollar mega complexes are rising in their place.

They’re six times more powerful.

And Nvidia, the hottest company in the world, is playing a vital role in their production.

But they’re not alone …

Nvidia needs a critical group of Silent Partners to help get the job done.

- sponsored message -

DEALFLOW

M+A | Investments

Baupost opts out of IPO for Bill Ackman’s Pershing Square Fund (more)

Hewlett Packard set for EU nod for $14B Juniper deal (more)

Vital Energy, Northern Oil and Gas buy Point Energy shale assets for $1.1B (more)

Sixth Street inks $5.1B take-private purchase of insurer Enstar (more)

ACA Group, a compliance solutions provider to the financial services industry, acquired Encore Compliance, an AI compliance software company (more)

Agilent Technologies Inc. acquired Sigsense Technologies, a startup using AI and monitoring to optimize lab operations (more)

Deepnote, an AI-powered data workspace, acquired Hyperquery, a competitor in the data science and analytics space (more)

MiQ, a global programmatic media partner, acquires Pathlabs, a Media Partner providing end-to-end digital media execution services to independent agencies (more)

1970 Group, a specialized risk financing provider to the insurance industry, credit support, and risk management, received a growth investment from Bain Capital Insurance (more)

Chekable, a developer of an AI solution for patent professionals, received an investment from NEC X (more)

Clearly, a Kyiv, Ukraine-based psychological startup, secured non-dilutive funding from Google for Startups Ukraine Support Fund (more)

OnSight Technology, advanced solar monitoring and inspection, received a strategic investment from Convective Capital (more)

SePRO Corporation, a specialty environmental restoration company focused on water quality, received an investment from Stanley Capital Partners and Goldman Sachs Alternatives (more)

VC

Altana, a provider of a value chain management system, raised $200M in Series C funding (more)

Astranis, a geostationary satellite maker, raised $200M in Series D funding (more)

Spear Bio Inc., a biotech company enabling the measurement of protein molecules, closed a $45M Series A financing (more)

Oats Overnight, a high-protein oatmeal brand, raised $35M in Series B funding (more)

unspun, a 3D weaving technology company, raised $32M in Series B funding (more)

ReviR Therapeutics, an AI-enabled biotech company developing small molecule RNA modulators for neurogenetic diseases, closed a $30M Series A financing (more)

Trio Mobil, a provider of AI and IoT solutions for workplace safety and efficiency, raised $26.5M in growth financing (more)

Rillet, an automation-first ERP specifically built for high-growth companies, raised $13.5M in funding (more)

ZeroTier, a network security startup, raised $13.5M in Series A funding (more)

Mezo, Thesis's permissionless Bitcoin Economic Layer, raised $7.5m in strategic funding (more)

Wed Society, a wedding industry franchise, closed its Series A funding round, at a $5.75M valuation (more)

Axle Automation, Inc., a provider of AI-powered solutions for compliance teams, closed its $2.5M seed funding round (more)

Helpt, a technical and customer service solution provider, raised $850K in seed funding (more)

| Sponsored |

| Maximize 2024: Uncover "9 Stocks Poised for Growth |

| As we step into 2024, seize strategic opportunities in the market. Discover "9 Stocks Set to Soar," handpicked for their potential. Act Now: Before diving into our report, consider the opportunities 2024 holds. The time is ripe.Go HERE to Get Their Names And Ticker Symbols |

| By clicking the link you are subscribing to the Summa Money Newsletter and may receive up to 2 additional free bonus subscriptions. Unsubscribing is easy |

| Privacy Policy/Disclosures |

CRYPTO

BULLISH BITES

🧐 VP as VC: The Wall Street Journal digs into JD Vance's career as a VC.

🚨 Next in AI: He called Nvidia at $8. Here’s his next pick… *

🚀 Stock watch: The tiny firm behind "Quantum AI Disruption *

🏎 Defying odds: Lamborghini’s winning formula is defying an auto industry slump.

📈 Hedging a bet: Former hedge fund manager publicly issues a new prediction *

What did you think about today's briefing?

Have a comment or suggestion?

💌Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.