Good morning.

The Fast Five → Nvidia passes Apple becoming second-most valuable public US company, S&P 500 hits 25th record this year, unwinding of popular currency trade rocks markets, SEC hedge fund fee disclosure rule struck down, and Boeing CEO to testify in Senate hearing…

Calendar: (all times ET)

Today: | Initial jobless claims, 8:30a |

FRI, 6/7: | Unemployment rate, 8:30a |

Your 5-minute briefing for Thursday, June 6:

US Investor % Bullish Sentiment:

↓ 39.04% for Wk of May 30 2024 (Last week: 47.04%).

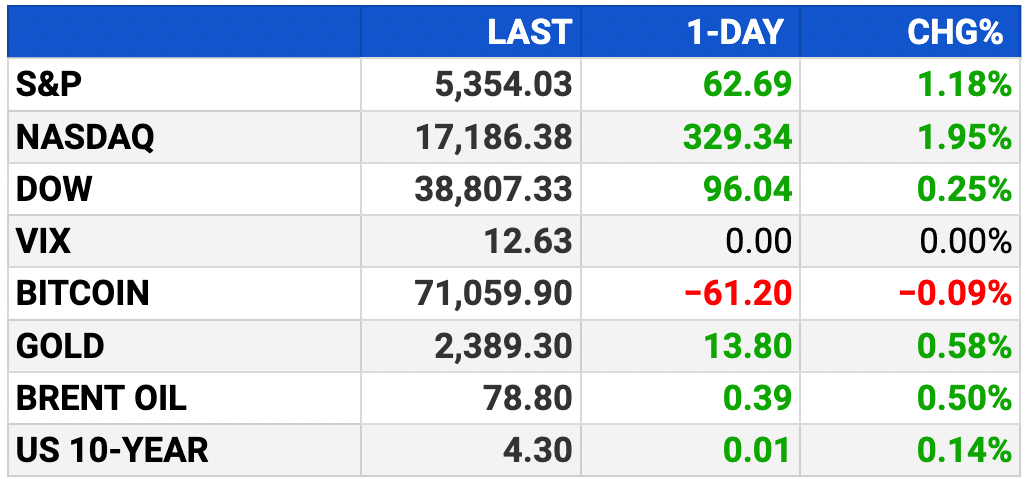

Market Recap:

Stock futures flat after S&P hits record high on Nvidia rally.

S&P and Nasdaq futures up 0.1%, Dow up 10 points.

Lululemon +10% on strong Q1 results; Five Below -15%.

S&P +1.18%, Nasdaq +1.96%, Dow +0.25%.

Nvidia +5%, hits $3T market value, tops Apple.

Focus on Friday’s payroll report; ADP shows hiring slowdown.

Today: Jobless claims data due

EARNINGS

What we’re watching this week:

Ciena (CIEN) - earnings of $0.15 per share (-79.7% YoY) on $894.9M revenue (-20.8% YoY)

Full earnings calendar here.

HEADLINES

S&P 500 hits 25th record this year as tech soars (more)

US hiring has slowed to the weakest pace since start of year (more)

Rate-cut bets supercharge longest bond winning streak this year (more)

Boeing CEO to testify in Senate hearing June 18 (more)

SEC hedge fund fee disclosure rule struck down by court (more)

FTC prepares to sue largest US alcohol distributor, alleging ‘secret kickbacks’ (more)

Asia stocks rally as rate cut bets gather momentum (more)

Goldilocks market is ignoring slowdown signs (more)

Electric air taxi maker Archer Aviation gets key FAA sign-off (more)

Alphabet taps Eli Lilly’s Anat Ashkenazi as new CFO (more)

Walmart rolls out new training programs for skilled trades as it tries to fill high-demand roles (more)

EBay to drop AMEX over fees, says customers have other options (more)

SeatGeek adds Citigroup, Wells Fargo to IPO (more)

Chanel’s record dividend brings owners’ windfall to $12B(more)

‘Everything is not going to be OK’ in private equity, Apollo’s Co-President says (more)

A MESSAGE FROM BEHIND THE MARKETS

NEW VIDEO: $13 Billion Unlocked for New "UFO Weapon"

Air Force Magazine calls it "transformational."

The Wall Street Journal calls it one of the Pentagon's "highest priorities."

National Defense Magazine reports "Eye-popping budget" for it.

This small company won the first contract to build them!

All the best,

Simmy Adelman, Publisher

Behind the Markets

DEALFLOW

M+A | Investments

Hanesbrands to sell Champion brand to Authentic Brands in $1.2B deal (more)

Dollar Tree exploring a sale of its Family Dollar brand (more)

Data provider Preqin explores £1 billion sale (more)

DELFI Diagnostics, developer of blood-based tests, received an equity investment from the Merck Global Health Innovation Fund (more)

Solarity, automated clinical data processing solutions for healthcare providers, received a strategic growth investment from TA Associates (more)

Fispoke, a WealthTech company, received an investment from First Rate Ventures (more)

Dubin Research & Consulting, a trial consulting and litigation advisory firm assisting global law firms, received a strategic growth investment from Trivest Partners (more)

SOFIE Biosciences, a radiopharmacy and contract dev and manufacturing org, received a strategic growth investment from Trilantic North America (more)

PostPilot, a direct-mail marketing company, received a strategic investment from Summit Partners, with participation from Klaviyo founders Andrew Bialecki and Ed Hallen (more)

VC

Vilya, a biotech company creating medicines that precisely target disease biology, expanded its Series A funding to $71M (more)

restor3d, a company specializing in 3D printed, personalized orthopedic implants, raised $70M in funding (more)

Twelve Labs, a video understanding company, raised $50M in Series A funding (more)

Nium, a global leader in real-time cross-border payments, raised $50M in Series E funding round (more)

Eko Health, a company applying AI for early detection of heart and lung diseases, raised $41M in Series D funding (more)

Advanced Medicine Partners, developer of innovative advanced medicines, received an additional $32M in financing (more)

LiveKit, a platform for building and scaling voice applications, raised $22M in Series A funding (more)

Tobiko Data, a data infrastructure startup, raised $21.8M in funding (more)

Vantage Discovery, a search and content discovery platform for ecommerce, raised $16M in Series A funding (more)

Understory, an insurance platform protecting climate-vulnerable industries from severe weather risk, raised $15M in Series A funding (more)

SiTration, a materials recovery company, raised $11.8M in Seed funding (more)

HyperSpectral, a spectral intelligence company, raised $8.5M in Series A funding (more)

Testsigma, an AI-powered, low-code test automation platform, raised $8.2M in funding (more)

Inventive, a startup building embedded AI for SaaS products, raised $6.5M in Seed funding (more)

Liminal, a company specializing in horizontal gen AI data security, raised additional $5M in funding (more)

Hoop, an AI-powered task management platform, raised $5M in Seed funding (more)

Wevr, a creative development and production studio, $3.5M in funding (more)

Field Materials, a provider of AI software to control and verify construction material and equipment spending, raised additional $3.5M (more)

Envisagenics, a biotech company focused on discovery and development of novel RNA splicing therapeutics, raised a Series B fundraising round (more)

CRYPTO

BULLISH BITES

🩴 Dynasty: How Birkenstock became an improbable luxury empire.

📚 Recommend: The private lives beneath Wall Street glitz are revealed in a new book.

🤝 Game Changer: The importance of the OpenAI-Apple partnership will be announced at Apple's developer conference next week.

🌁 Pursuits: Ultra-wealthy are putting money behind bets on San Francisco’s comeback.

🛏 Retail Therapy: An inflatable bed for your Tesla.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.