Good morning.

The Fast Five → Powell may steal the spotlight this week, Nvidia replaces Intel on Dow Jones Industrial Average, Boeing CEO issues ultimatum to workers, tech giants spend $200+ bln this year chasing AI, and Buffet sells more Apple…

🚨 Fed's Rate Cut to Trigger Unexpected Market Shift?

From Stansberry Research

Calendar: (all times ET) - Full calendar here

Today:

Factory orders, 10:00 am

Tomorrow:

Trade deficit, 8:30 am

Your 5-minute briefing for Monday, November 4:

US Investor % Bullish Sentiment:

↑ 39.49% for Week of October 31 2024

Last week: 37.70%. Updates every Friday.

Market Wrap:

Stock futures dipped Sunday night ahead of the US election.

Nov. began strong: Nasdaq +0.8%, S&P +0.4%, Dow +0.7%.

CFRA’s Stovall: Strong election years often boost Nov/Dec gains.

Fed rate decision this week; 96% chance of a cut, per CME’s FedWatch.

Earnings season rolls on: Super Micro, Moderna, CVS report.

70% of S&P 500 firms have beaten estimates, says FactSet.

EARNINGS

Here’s what we’re watching this week.

Today: Hims & Hers (HIMS)

Palantir (PLTR) - earnings of $.09 per share (+28.6% YoY). Revenue is forecast to arrive at $701.1M (+25.6% YoY)

Arm (ARM) - earnings of $.24 per share (-33% YoY) on revenue of $799M (-0.9% YoY)

DraftKings (DKNG) - expect loss of $.42 per share on $1.1 bln (+39.2% YoY)

See full calendar here.

A MESSAGE FROM THE OXFORD CLUB

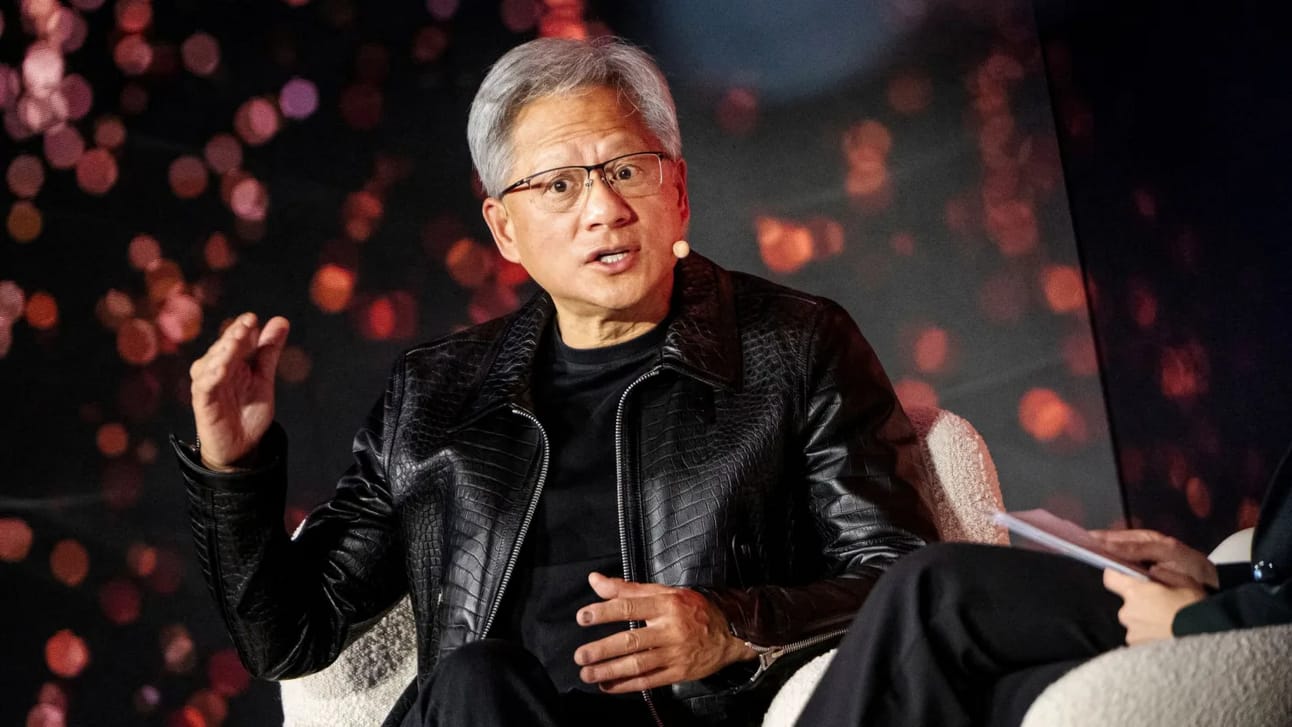

Man Who Called Nvidia at $1.10 Says Buy This Now...

This company signed a major deal with Apple

Nvidia has invested more in this one company than any othe

And its tech is found in products from Samsung and Google

HEADLINES

Traders prepare for a long, volatile election night (more)

Fed will go ahead with rate cuts after this week’s election (more)

Dollar dips as US election outcome remains uncertain (more)

OPEC+ agrees to delay December output hike for one month (more)

IRS unveils Roth IRA income limits for 2025 (more)

China gears up for big week as markets await US elections (more)

Boeing CEO issues ultimatum to machinists (more)

Concerns grow in Washington over Intel (more)

Companies brace for Tues - mentions of election surge on earnings calls (more)

Tech giants set to spend $200 billion this year chasing AI (more)

Berkshire's cash pile reaches record $325.2B, as Buffet sells more Apple (more)

LVMH’s empty megastore in China signals deepening luxury crash (more)

DEALFLOW

M+A | Investments

Blackstone in advanced talks to buy property owner (more)

Shore Capital, Silver Lake in talks over $8.6B pet care deal (more)

Stonepeak nears $3.1B deal for aircraft lessor ATSG (more)

Arcos, a provider of workforce management solutions for infrastructure industries, acquired Clearion, a SaaS and mobile software company for vegetation management (more)

Ōura, the smart ring delivering personalized health data, insights, and daily guidance, acquired Sparta Science, enterprise software transforming health and performance data into actionable intelligence (more)

1910 Genetics, a biotech company with a multimodal AI platform, received an investment from Accenture Ventures (more)

Tectonic Engineering, an engineering firm focused on the transportation, telecom, energy, and water infrastructure end markets, received an investment from Good Spring Capital (more)

VC

Insider, an AI-native omnichannel experience and customer engagement platform, raised $500M in Series E funding (more)

Redoxblox, a company providing low-cost thermochemical energy storage systems, raised $40.7M in Series A funding (more)

Spot AI, a company specializing in AI camera systems, raised $31M in equity funding (more)

Decart, an AI research lab, raised $21M in funding (more)

Marqii, a digital operations platform for hospitality businesses, raised $10M in funding (more)

Delos Insurance Solutions, an insurtech company, raised further $9M in funding (more)

JUUNO, a design company, raised $6.6M in internal funding (more)

Trinity Guardion, a company specializing in hospital bed hygiene solutions, raised $6M in funding (more)

Ataraxis AI, an AI precision medicine company, raised $4M in Seed funding (more)

Persana AI, a company providing an agent-driven approach to prospecting, raised $2.3M in funding (more)

Opus Guard, a SaaS provider specializing in retention management solutions, raised an undisclosed amount in funding (more)

CRYPTO

BULLISH BITES

🚨 Wall St Legend: What the Fed isn’t telling you about this rate cut *

💰 Big Bet: Meet the secretive French “whale” wagering on a Trump victory.

📊 Chart: Here’s where the jobs are for October.

🦄 Next Level: Wesley Chan on what he looks for as he shops for potential unicorns.

🎄 Holiday turnaround: How Disney turns over its parks between its two most important holidays.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.