Good morning.

The Fast Five → Nvidia shares pass $1,000 on blowout earnings, House approves crypto FIT21 bill, White House signals Biden will sign crypto bill, existing-home sales unexpectedly fall, and OpenAI inks deal with News Corp. to improve ChatGPT…

Calendar: (all times ET)

Today: | Initial jobless claims, 8:30a |

FRI, 5/24: | Durable-goods orders, 8:30a |

Your 5-minute briefing for Thursday, May 23:

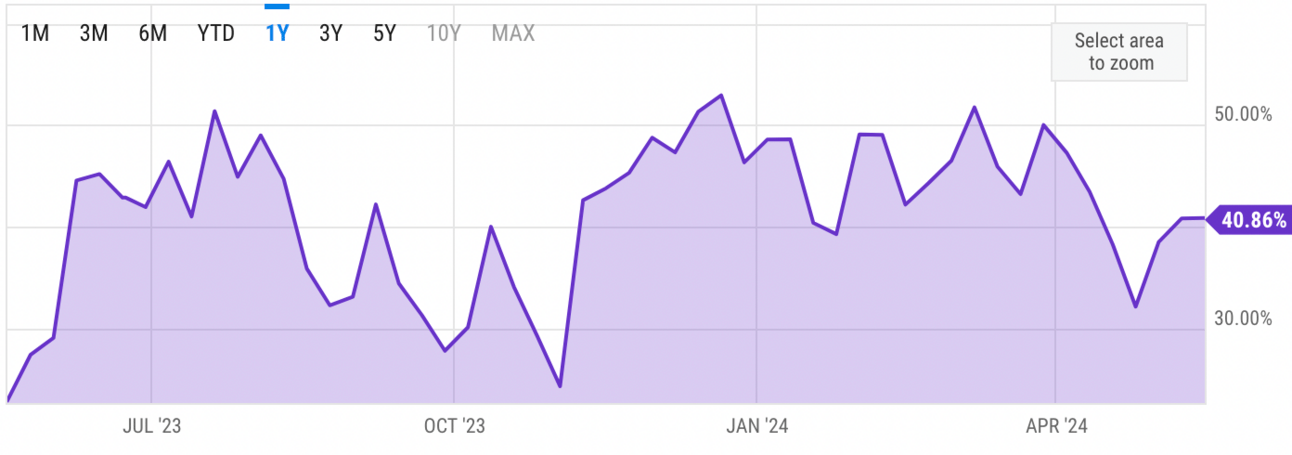

US Investor % Bullish Sentiment:

40.86% for Wk of May 16 2024 (Last week: 40.82%)

Market Recap:

Stocks fell Wed on Fed minutes hinting at persistent inflation.

Fed minutes suggest potential rate hikes.

Dow dropped 201.95 points (0.51%), its worst session in May.

S&P lost 0.27%, Nasdaq fell 0.18%

Target fell 8% on weak earnings, raising consumer spending concerns.

EARNINGS

Uncover the Potential of a Soaring Penny Stock

HEADLINES

House approves crypto FIT21 bill with wave of democratic support (more)

US securities regulator urges against crypto bill adoption (more)

Fed shifts talk to 'scenarios' as policy grows less certain (more)

Goldman Sachs CEO says he sees "zero" rate cuts this year (more)

Biden widens student loan relief to more than 10% of borrowers (more)

Existing-home sales unexpectedly fall, prices stay high (more)

Oil prices maintain losing streak on inflation confusion (more)

Goldman sees more dollar strength amid fight against inflation (more)

Most Americans falsely think the US is in recession (more)

Latin America’s steel tariffs won’t push China away (more)

Target, Walmart shoppers seek home goods, grocery delivery online (more)

US consumer watchdog will apply credit card rules to buy now, pay later companies (more)

Pfizer aims to save $1.5B by 2027 in first wave of new cost cuts (more)

OpenAI inks deal with News Corp. to improve ChatGPT (more)

Amazon to give Alexa an AI overhaul — and a monthly subscription price (more)

DEALFLOW

M+A | Investments

Anglo opens talks with BHP after rejecting $49B offer (more)

Firefly Aerospace backers explore $1.5B sale (more)

Disney said to sell stake in Tata’s $1 Billion India TV platform (more)

NFL owners delay private equity vote to allow more deal talks (more)

Lagardere says it is closing in on sale of Paris Match Magazine to LVMH (more)

Deutsche Bahn gathers bids for €15B logistics arm (more)

Cover Whale Insurance Solutions, a insurtech company, raised $27.5M in debt and equity from investment funds managed by Morgan Stanley Expansion Capital (more)

XponentL, a data and AI consultancy, raised a strategic investment from Databricks Ventures and Inoca Capital Partners (more)

Velotix, a AI-driven DSP, received an investment from Barclays Bank and Capri Ventures (more)

VC

Suno, a music creation platform, raised $125M in funding (more)

Coactive Systems, an AI powered platform to make image and video data useful, raised $30M in Series B funding at a $200M valuation (more)

Allez Health, provider of a continuous glucose monitoring biosensor platform, raised a $60M Series A+ financing (more)

Hydrolix, a streaming data lake platform, closed a $35M Series B funding (more)

SOCRadar, provider of enterprise-grade, threat intelligence and brand protection solutions, raised $25.2M in Series B funding (more)

PolarityTE, a biotech company developing regenerative tissue products, raised $22.5M in funding (more)

Aerodome, a drone-as-first-responder (DFR) tech company, raised $21.5M in Series A funding (more)

Expedera, a licensor of edge inference AI semiconductor IP, raised $20M in Series B funding (more)

Verse, a software enabling organizations to understand, plan, and manage clean energy, raised a $20.5M Series A funding (more)

Majority, a platform offering mobile banking and international services to migrants in the US, raised $20M in funding (more)

Patronus AI, an automated evaluation and security platform, raised $17M in Series A funding (more)

Max Retail, a marketplace for independent retailers and brands to sell excess inventory, raised $15M in Series A funding (more)

Bolster, a multi-channel phishing protection company, raised $14M in Series B funding (more)

Amino Health, a digital healthcare navigation company, raised $10M in funding (more)

Superlegal, an AI platform for legal contract review for SMB’s, raised $5M in Seed funding (more)

Skribe.ai, a legaltech platform, raised $3.5M in funding (more)

Volt, a messaging operations infrastructure platform, closed its $3M seed funding round (more)

InfinitForm, a company providing GenAI software, raised an undisclosed amount in Seed funding (more)

healthŌme, a genomics-based precision health management company, raised an undisclosed amount in Seed funding (more)

CRYPTO

BULLISH BITES

🫣 Oof: A $444 billion 'fat finger' trade crashed stocks.

🔑 Pursuits: Garry Tan has revealed his ‘secret sauce’ for getting into Y Combinator.

🚨 Investor alert: Central Banks preparing for US dollar collapse? *

⛔️ Flawed: Startup Humane is looking for a buyer after the AI Pin's underwhelming debut.

🥣 Health tech: This Japanese electric salt spoon makes low-sodium food taste better.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.