Good morning.

The Fast Five → NYSE to launch exchange in Texas, inflation surges ahead rising to 3%, Google says US is facing a power capacity crisis, Robinhood revenue doubles fueled by crypto, and Musk lines up deep-pockets for OpenAI bid…

Calendar: (all times ET) - Full Calendar

Today:

Producer price index, 8:30A

Initial jobless claims, 8:30A

Tomorrow:

US retail sales, 8:30A

Your 5-minute briefing for Thursday, February 13:

US Investor % Bullish Sentiment:

↓ 33.33% for Week of February 06 2025

Previous week: 40.96%. Updates every Friday.

📈 Trump's New AI Move Could Trigger Massive Melt Up?

Get details before it's too late.

- from InvestorPlace

Market Wrap:

Futures slightly higher as traders digest earnings, await inflation data

Reddit fell 13% post-earnings, Dutch Bros surged 25% on strong sales

CPI came in hot, sending Dow -200 pts, S&P 500 -0.3%, Nasdaq flat

PPI and jobless claims data due today

Airbnb, Coinbase, Palo Alto Networks report next

EARNINGS

Here’s what we’re watching this week:

HEADLINES

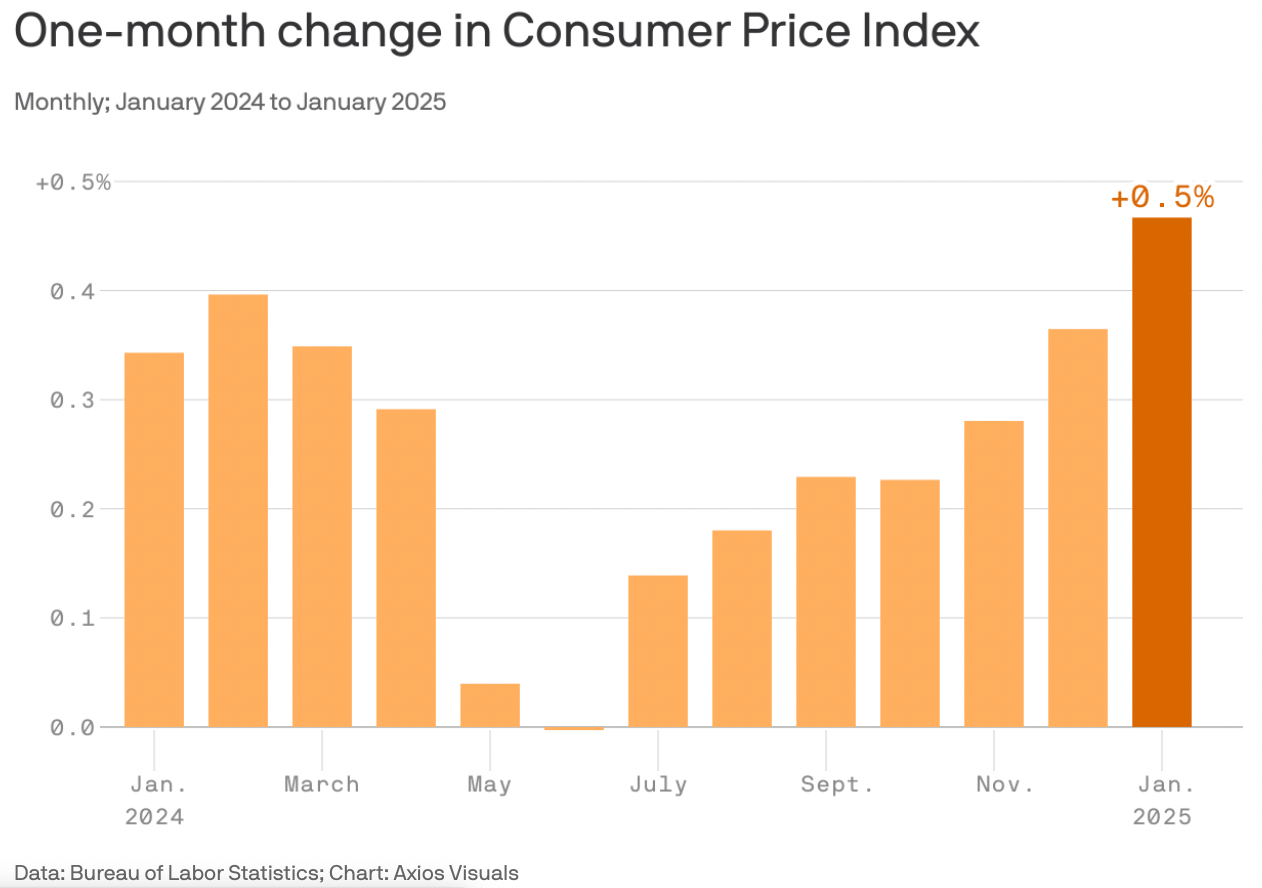

Here’s the inflation breakdown for January 2025 (more)

Consumer prices rise 0.5%, higher than expected as annual rate rises to 3% (more)

S&P 500 ends down as hot US inflation data hints at fewer rate cuts (more)

Dollar gains on yen as consumer prices rise more than expected (more)

Google says US is facing a power capacity crisis in AI race against China (more)

Ford CEO Jim Farley blasts Trump's tariff plans (more)

Musk lines up deep-pocketed loyalists for OpenAI bid (more)

Robinhood revenue doubles, fueled by surge in crypto trading (more)

Reddit shares plunge after Google algorithm change contributes to miss (more)

Apple brings its TV streaming service to rival Android platform (more)

Chevron to lay off up to 20% of global workforce (more)

JPMorgan reportedly starts first round of layoffs with more later this year (more)

The #1 Stock for Trump’s Second Term?

Legendary investor Louis Navellier's stock rating system gave a buy rating to ALL of the top 30 performing stocks in the S&P 500 index of Trump's first term…

ALL of them!

His system is now rating these stocks as a "BUY" for Trump's second term.

- a message from our partner -

DEALFLOW

M+A | Investments

United Group sells Serbia Broadband to e& PPF Telecom Group (more)

Validus Energy to buy natural gas producer 89 Energy III for $850M (more)

OpenGov, an AI-enabled software provider for local and state governments, acquired Ignatius, a dynamic low-code platform (more)

Alarm.com, a platform for the connected property, acquired CHeKT, a cloud platform for remote video monitoring services (more)

Drata, a trust management platform, acquired SafeBase, a trust center solution provider for the enterprise (more)

SRA Watchtower, a risk management technology company, acquired Lumio Insight, a cloud-based data management and analytics provider (more)

Equals 5, an AdTech platform for pharmaceutical and healthcare marketing, received a strategic investment from Baleon Capital (more)

Sitemetric, a connected jobsite and workforce management platform, received a strategic investment from Gemspring Capital Mgmt (more)

Resolute Science, a preclinical-stage biotech company, received an investment from NuFund Venture Group (more)

VC

Olipop valued at $1.85 billion in $50M funding round (more)

Archer, an airspace technology company, raised $300M in funding (more)

QuEra Computing, a neutral-atom quantum computing company, raised $230M in funding (more)

IMB Partners, a private investment firm, closed its inaugural institutional fund, at $125.5M (more)

High Definition Vehicle Insurance, a tech-driven commercial auto insurance provider, raised $40M in growth capital (more)

Mast Reforestation, a post-wildfire reforestation company, raised $25M in Series B funding (more)

Pathify, a digital engagement hub for higher education, raised $25M in Growth Equity funding (more)

Andesite, a company developing a human-AI collaboration product empowering cyber defense teams, raised additional $23M in funding (more)

Lucidity, a multi-cloud storage management platform, raised $21M in Series A funding (more)

Suger, an API platform helping software companies transact on cloud marketplaces, raised $15M in Series A funding (more)

Lingopal.ai, a real-time speech-to-speech translation company, raised $14M in Serie A funding (more)

QuSecure, a company specializing in post-quantum cryptography, raised an addition Series A funding of an undisclosed amount (more)

Keragon, an AI-powered, HIPAA-compliant platform for healthcare, raised $7.5M in Seed funding (more)

CRYPTO

BULLISH BITES

📺 More people are watching YouTube on TV than any other type of device, a first. The Hollywood Reporter has more here.

💪 The secret behind Silicon Valley's macho makeover.

🏈 Tom Brady buys ownership stake in sports collectibles company.

🤑 And in case you’re wondering.. Asia’s 20 richest families of 2025.

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.