Good morning.

Note: Market Briefing will be paused January 1, 2025 ✨

The Fast Five → S&P 500’s 2024 rally shocked forecasters, bank bull run seen thundering onward, India’s white-hot IPO market, crypto industry groups sue IRS, and bond investors risk ending 2024 in the red…

Time to Sell NVDA? 50-Yr Wall Street Legend Weighs In

Wall Street investors are selling their shares at a record pace. Even AI superfan Cathie Woods is offloading her shares. With the stock already up 63% in 2024 alone – is it too late to get in?

One legendary stockpicker – with 50 years' experience on Wall Street – just gave his answer, here.

Calendar: (all times ET) - Full calendar

Today:

Pending home sales, 10:00A

Tomorrow:

no notable reports

Your 5-minute briefing for Monday, December 30:

US Investor % Bullish Sentiment:

↓ 40.71% for Week of December 19 2024 *

Previous week: 43.33%. Updates every Friday. *Delayed update due to holiday

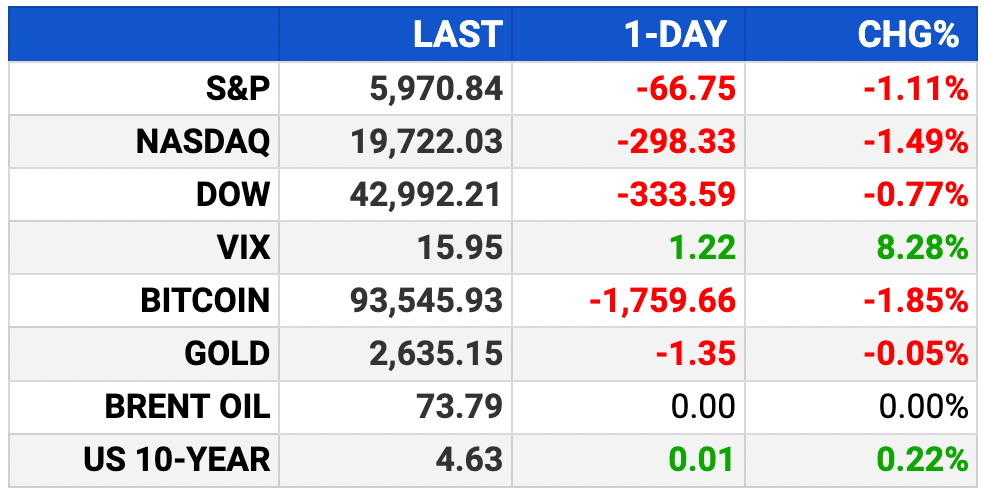

Market Wrap:

Futures edged down Sunday night; Dow -45 pts, S&P -0.06%, Nasdaq flat.

Major indexes near 2024 highs: S&P +25%, Nasdaq +31%, Dow +14%.

Nasdaq set for longest quarterly streak since mid-2021.

Santa Claus Rally hopes linger; S&P avgs +1.3% late Dec./early Jan. since 1950.

Light week ahead; Chicago PMI, pending home sales out Monday.

EARNINGS

No noteworthy earnings scheduled for release this week. See full calendar »

HEADLINES

US economy surprised again in 2024 despite Fed, election drama (more)

Gold’s 27% advance stands out in mixed year for metals markets (more)

Most Gulf markets gain on rising oil (more)

Bond investors enter final week of 2024 at risk of ending in red (more)

Drama-prone fintechs face mixed regulatory environment in 2025 (more)

Asian stocks poised for weak open after US losses (more)

India upbeat IPO market had almost as many public offerings in 2024 as the US and China combined (more)

Trump asks Supreme Court to pause law that could ban TikTok (more)

Crypto industry groups sue IRS over broker reporting rule (more)

OpenAI outlines new for-profit structure to stay ahead in costly AI race (more)

Nvidia supplier Ibiden weighs faster expansion to meet AI demand (more)

Elon Musk’s political influence wears down global resistance to Starlink (more)

TOGETHER WITH CompareCredit

2 Cards Charging 0% Interest Until 2026

Paying down your credit card balance can be tough with the majority of your payment going to interest. Avoid interest charges for up to 18 months with these cards.

- Shortened briefing during holiday -

Dealflow, Crypto, and Bullish sections

will resume on January 2, 2025. Happy New Year!

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.