☕️ Good Morning.

The Fast Five → Biden says UAW should fight for 40% pay raise, OpenAI seeks $90 billion valuation in possible share sale, FTC + 17 states sue Amazon on antitrust charges, Target closes 9 stores in major cities due to violence/theft, and FCC announces plans to reinstate net neutrality…

Here’s your MarketBriefing for Wednesday:

BEFORE THE OPEN

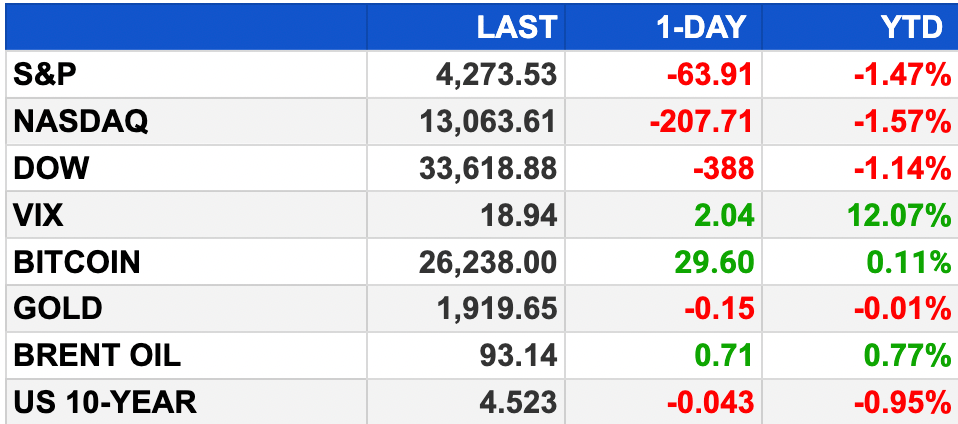

As of market close 9/26/2023.

MARKETS:

Flat stock futures with slight gains.

Dow futures up 0.1%, S&P 500 and Nasdaq 100 futures both up 0.1%.

Costco down 2.5% after mixed Q4 results.

Main trading session: Dow -1.14%, S&P 500 -1.47%, Nasdaq -1.57% on missed economic data.

September's seasonally weak, with S&P 500 -5.2%, Dow -3.2%, Nasdaq -7%.

Volatility expected into October; Earnings season mid-October could be a market catalyst.

Wednesday: Durable goods orders, Paychex earnings, Micron Technology's quarterly release.

EARNINGS

Here’s what we’re watching this week:

Today: Micron Technology (MU)

Thursday: Nike (NKE)

NEWS BRIEFING

Moody's warns government shutdown could hurt US credit rating (more)

FTC and 17 states sue Amazon on antitrust charges (more)

FCC announces plans to reinstate net neutrality (more)

US consumer confidence dives to four-month low; home sales tumble (more)

Elon Musk says auto union’s demands would bankrupt big three carmakers (more)

‘Unprecedented’ secrecy in Google trial as tech giants push to limit disclosures (more)

Asia stocks mixed as investors grapple with higher rates (more)

Alibaba’s logistics arm files for $1 billion-plus IPO (more)

Private equity is piling debt on itself like never before (more)

Citibank raises $5 billion in first bank-level bond since 2019 (more)

Amazon faces landmark monopoly lawsuit by FTC (more)

Target says it will close nine stores in major cities, citing violence and theft (more)

McKinsey agrees to pay $230 Million to settle more opioid suits (more)

Uber partners with California taxi operators to boost supply (more)

Peloton co-founder and Chief Product Officer Tom Cortese is leaving the company (more)

Telegram starts to look like a super app, echoing WeChat (more)

Evergrande’s billionaire Chairman Hui is under police surveillance (more)

Was this briefing forwarded to you? (Sign up here.)

DEALFLOW

Liberty Media proposes merger with radio broadcaster Sirius XM (more)

Paine Schwartz Partners, a private equity firm specializing in sustainable food chain investing, closed its $1.7B food and agribusiness-focused Fund VI (more)

UK's Pendragon gets $544 million takeover proposal from AutoNation (more)

Sierra Space, a pureplay commercial space company, raised $290M in Series B funding (more)

Anzu Partners, an investment firm delivering capital and strategic support to early-stage breakthrough technology companies, raised more than $200M at the close of its third venture capital fund (more)

Adela, a company specializing in blood testing for minimal residual disease monitoring and early cancer detection, raised $48M in funding (more)

P1 Ventures, a Seed VC firm, completed the first $25M close of its second fund (more)

Cartwheel, a provider of a platform helping schools tackle the student mental health crisis by delivering telehealth services, raised $20M in Series A funding (more)

Kolena, an AI and machine learning model testing company, raised $15M in Series A funding (more)

Collective Liquidity, a company providing financial tools for employees, extended its Series A to $12M (more)

QT Medical, a medtech company focused on cardiac care technology, raised $12M in Series B funding (more)

Erudit, an AI company that helps leaders improve culture and productivity, raised $10M in Series A funding (more)

Airmart, an e-commerce platform for community group buying in the US, raised $8.2M in funding (more)

Digma, a provider of a continuous feedback platform for developers to analyze code, raised $6M in funding (more)

Pontoro, a financial technology company creating a proprietary and structurally differentiated platform, raised $4.6M in Seed II funding (more)

Crediverso, a Spanish and English language consumer technology company providing financial and educational resources to underserved communities, raised an additional $3.5M in funding (more)

Meeno, a relationship mentoring company, raised in Seed funding (more)

AnchorWatch, an insurer that covers commercial entities holding Bitcoin, raised $3M in funding (more)

360ofme, a provider of an ethical data exchange platform, raised an undisclosed amount in Seed funding (more)

M & A:

Italy's Alfasigma to buy drugmaker Intercept for nearly $800M (more)

Varian, a Siemens Healthineers company, acquired Aspekt Solutions, a provider of medical physics, dosimetry, and strategy consultation services (more)

Titan Cloud, a Fuel Asset Optimization software platform, acquired Leighton O’Brien, a global fuel analytics software and field technologies provider (more)

KKR-Backed Apexanalytix Buys Darkbeam (more)

Arlington acquires Exostar from Thoma Bravo (more)

CRYPTO

BULLISH BITES

📉 The Fall of What Was India’s Most Valuable Startup

Once a $22 billion ed-tech giant, Byju’s is now dealing with lawsuits and questions over its financial management → WSJ

🥤 Coca-Cola's New AI-Generated Soda Flavor Falls Flat

CokeGPT is about as half-baked as all of the hype surrounding AI → Gizmodo

🎧 [AUDIO] The Next Elon Musk?

Sam Parr talks to Brett Adcock about how he nearly went bankrupt after his +$100m exit from Vettery (now Hired). How? Betting everything on the next big idea. And he’s doing it again today with Figure.ai, a robotics company bringing a general-purpose humanoid to life. → Listen

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Subscribe Now

Keep the curation going! Buy the team a coffee ☕️

Have any suggestions for MarketBriefing? We’d love to hear it.

Share your thoughts here -mb