Good morning.

The Fast Five → Trump signs executive order for national AI regulation, Disney licenses characters to OpenAI—takes $1 bln stake, Rivian unveils AI chip for Robotaxi, OpenAI fires back at Google with GPT-5.2, and Time Magazine names 'architects of AI' person of the year…

📌 Trump is Fast-Tracking These Three Companies: The Trump administration is planning to invest directly in a small sector of the stock market… And they just revealed the names of three potential targets. Go here to see the details because legendary investor Louis Navellier believes shares are about to skyrocket. (ad)

Calendar: (*Shutdown may affect key data. All times ET) - Full Calendar »

Today:

None watched

Monday:

None watched

Your 5-minute briefing for Friday, Dec 12:

US Investor % Bullish Sentiment:

↑ 44.29% for Week of DEC 04 2025

Previous week: 32.03%

Market Wrap:

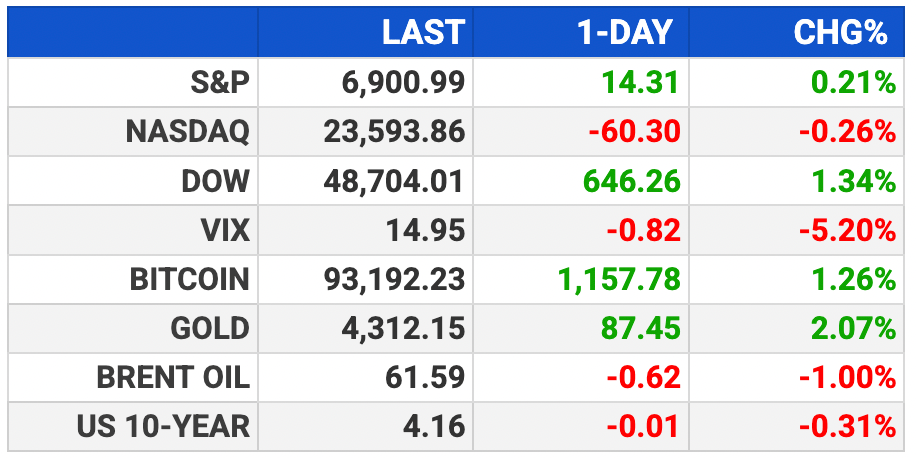

Dow +1.3% and S&P hit record highs; Nasdaq slips.

Oracle -11% sparks renewed AI return concerns.

Nvidia and Broadcom fall as money rotates.

Fed cut takes rates to 3.5%–3.75%, no hikes ahead.

Russell 2000 hits record as small caps benefit.

Rotation favors cyclicals over AI leaders.

EARNINGS

None watched today. See full calendar here »

Investors Can’t Afford to Miss This

To carry out Trump's Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the "reserve accounts" sitting on trillions of dollars' worth of untapped natural resources.

I've spent months digging into this – and I've identified three companies that have already been granted "emergency status" and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector.

- a message from InvestorPlace Digest -

HEADLINES

US stocks fall as Oracle revives worries about lofty AI spending (more)

Bessent accelerates regulation overhaul to jumpstart growth (more)

US trade deficit unexpectedly shrinks to smallest since 2020 (more)

Jobless claims jump by most since 2020 after holiday drop (more)

Housing will ‘be a problem,’ Fed chair warns after rate cut (more)

Dollar staggers to third straight weekly drop (more)

Gold clings to 7-wk high as investors gauge Fed move; silver near peak (more)

Senator calls for Nvidia CEO to testify on Trump China chip sales approval (more)

The battle for Warner Bros is a prelude to the real streaming war (more)

Broadcom shares slide after investors seek bigger AI payoff (more)

Broadcom reveals its mystery $10B customer is Anthropic (more)

First Brands loan hits 30 cents with fresh rescue seen as critical (more)

Rivian unveils AI chip for automated driving, ditches Nvidia (more)

OpenAI fires back at Google with GPT-5.2 after ‘code red’ memo (more)

Time magazine names 'architects of AI' person of the year (more)

President Trump Could Soon Unlock Trillions in New Wealth

If you think America is broke, think again. These "reserve accounts" are worth trillions. And according to President Trump's executive order #14196…

"It is the policy of the United States to maximize the stewardship of [these accounts] for the sole benefit of American citizens."

- a message from InvestorPlace Digest -

DEALFLOW

M+A | Investments

Oracle agreed to acquire the AI unit of Lionbridge for approximately $2.1B

Sinclair Broadcast Group increased bid to take over EW Scripps Company

VC

Blue River Therapeutics, a biotech using AI for target discovery in immunology, raised $55M in Series B funding

CortexAI, an AI infrastructure company, raised $42M in Series B funding

QuantCap Financial, a fintech focused on AI capital markets analytics, raised $30M in Series A funding

Planetary Labs AI, an AI Earth observation optimization startup, secured $25M in funding

Flowtech Robotics, an autonomous inspection robotics startup, secured $18M in Series A funding

olvix Energy, a clean energy tech startup with grid optimization software, raised $14M in Seed funding

HealthMesh, a digital health platform for remote clinician workflows, raised $11M in Seed funding

EduFlex, an edtech platform with adaptive learning AI, raised $8M in Seed funding

CRYPTO

Bitcoin rebounds to $93k from post-Fed lows, altcoins remain under pressure (more)

Michael Saylor slams MSCI plan to bar crypto-heavy firms from indexes (more)

Crypto CEOs join CFTC's Innovation Council to steer market developments (more)

A16z Crypto eyes Asia expansion with first office in South Korea (more)

BULLISH BITES

😳 Why Oracle is worrying investors about the AI boom.

💵 Why single-income households are ‘a bygone era.’

✈️ JetBlue unveils first-ever airport lounge, BlueHouse. Here’s what’s inside —

🍤 The enduring power of the shrimp tower.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.