Good morning.

The Fast Five → Bitcoin plummets as investors brace for more volatility, BofA: it’s time to add crypto to portfolio, Cyber Monday online sales hit $9.1 billion, OpenAI just made another circular deal, Burry says Tesla is 'ridiculously overvalued'…

📌 If your retirement strategy involves "picking the right stocks," you're one crash away from disaster… A hedge fund legend who made $95 million in profits during a crash has a different way. He's using 18-digit codes to "skim" the market without buying stocks.And his followers have seen an 84%-win rate. Go here to see how he does it » (ad)

Calendar: (*Shutdown may affect key data. All times ET) - Full Calendar »

Today:

None watched

Tomorrow:

Non-Farm Employment Change, 8:15A

ISM Services PMI, 10:00A

Your 5-minute briefing for Tuesday, Dec 2:

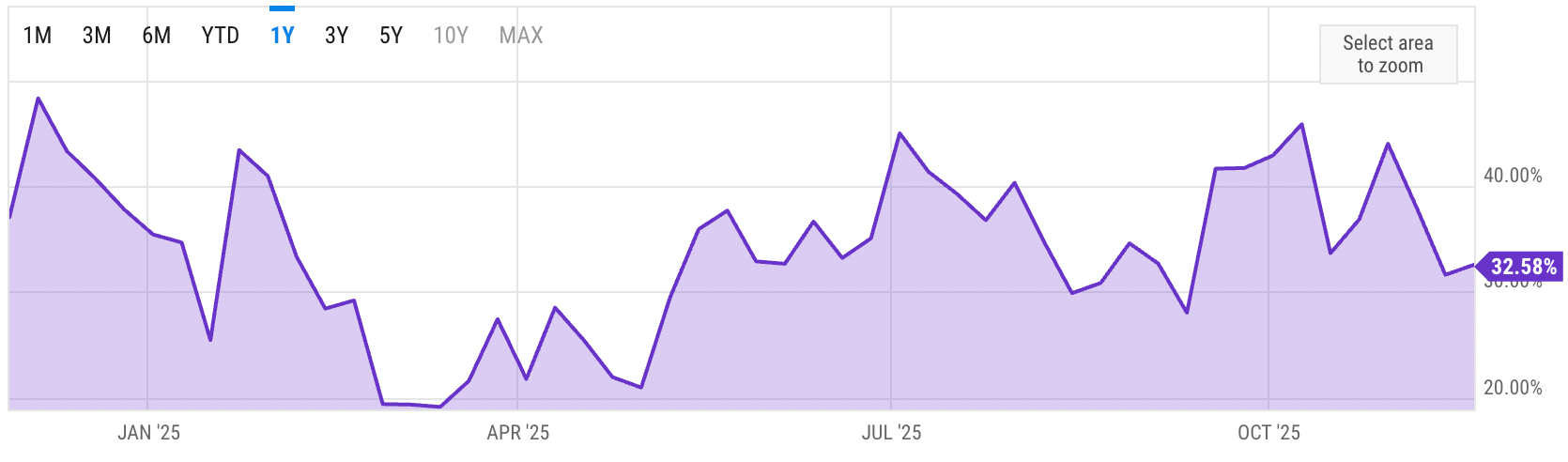

US Investor % Bullish Sentiment:

↑32.58% for Week of NOV 20 2025

Previous week: 31.62%

Market Wrap:

Futures flat after a weak start to December.

Monday snapped 5-day win streaks as risk-off tone returned.

Crypto hit hard: bitcoin -6%, Coinbase/HOOD down; gold +, yields +.

Tech slipped: Alphabet -1.7%, Palantir and Broadcom lower.

Fed cut odds for Dec. 10 now ~88%, sharply higher vs mid-Nov.

Nationwide: tailwinds intact; risks are AI buildout + valuations.

December seasonality strong historically for the S&P.

EARNINGS

Here’s what we’re watching this week:

Today: American Eagle $AEO ( ▲ 1.24% ), CrowdStrike $CRWD ( ▼ 7.95% )

WED: *Dollar Tree $DLTR ( ▲ 0.7% ), Five Below $FIVE ( ▲ 1.91% ), *Macy's $M ( ▲ 1.82% )

Salesforce $CRM ( ▼ 0.07% ) - EPS of $2.86 on $10.27B revenue

THU: *Kroger $KR ( ▼ 1.88% ), Ulta Beauty $ULTA ( ▼ 1.43% )

*Dollar General $DG ( ▼ 0.76% ) - EPS of $.93 on $10.6B revenue

The Hidden Winners Behind Gold’s Recent Surge

Gold blasted past $4,300 recently. It's up almost 50% in the past year. But why settle for 50% like most coin buyers… when past gold cycles have thrown off gains of 2,300%, 7,746%, even 9,850%?

Weiss Ratings' gold expert Sean Broderick reveals what he believes is a more profitable way to play this surge. No futures, no options, no vault required.

- a message from Weiss Ratings -

HEADLINES

Wall Street ends lower as yields climb; crypto stocks drop (more)

US Cyber Monday online sales hit $9.1 billion (more)

Treasuries lead global bond selloff amid corporate supply surge (more)

US manufacturing stuck in doldrums as tariff headwinds persist (more)

Dollar on the defensive as PMI data boosts case for rate cut (more)

Oil climbs over $1 a barrel on OPEC action, Ukraine attack (more)

Bitcoin plummets as analyst warns to brace for 'more volatility' (more)

Nvidia takes $2 bln stake in Synopsys as AI deal spree accelerates (more)

Goldman Sachs bets on active ETFs (more)

Costco joins companies suing for refunds if Trump’s tariffs fall (more)

OpenAI just made another circular deal (more)

Netflix offers mostly cash for Warner Bros. in new bid round (more)

NYC getting three casinos in major gambling expansion (more)

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

DEALFLOW

M+A | Investments

Goldman Sachs agreed to acquire Innovator Capital Management

Unilever is selling the snack brand Graze to Katjes International

SAI360 acquired Plural Policy

Mamava acquired TalkBox

PayRange acquired KioSoft Technologies

VC

Omni Fiber, a provider of fiber optic Internet services in the Midwest, raised $210M in funding

Protego Biopharma, Inc., a clinical-stage biotechnology company, closed a $130M Series B financing

Nevis, an AI platform for wealth management, raised $35M in Series A funding

Tutor Intelligence, an AI-powered fleet of warehouse robot workers, raised $34M in Series A funding

Mixx Technologies, an optical connectivity company for AI infrastructure, raised $33M in Series funding

Circular Genomics, a developer of circular RNA-based precision medicine tools, raised $15M in Series A funding

Raindrop, a monitoring platform for AI agents, raised $15M in Seed funding

Jeeva AI, an AI platform that enahnces productivity for sales teams, raised $9M in funding

Numerata, an AI-powered software development tools, raised an undisclosed amount in Seed funding

CRYPTO

BULLISH BITES

📊 Prediction markets offer unmatched accuracy, Polymarket CEO tells 60 Minutes.

🦸🏻♂️ Traders are flooding markets with risky bets. Robinhood’s CEO is their cult hero.

😬 AI, private credit: Blue Owl is the sum of all investor fears.

💼 A timeline of key moments in the history of work in America.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.