Good morning.

The Fast Five → Dollar surges, Bitcoin hits record and 'Trump trade' soars, Republicans win control of Senate ahead of tax fight, Tesla jumps overnight as Musk seen benefiting, Trump Media shares gain 40% overnight, and Nvidia passes Apple as world’s most valuable company…

💰 Protect your wealth against global volatility: Download this free Wealth Protection Kit (3 Guides) and get answers to your most common questions.

Courtesy of All American Assets

Calendar: (all times ET) - Full calendar here

Today:

none watched

Tomorrow:

Initial jobless claims, 8:30a

Fed interest rate decision, 2:00p

Powell press conference, 2:30p

Your 5-minute briefing for Wednesday, November 6:

US Investor % Bullish Sentiment:

↑ 39.49% for Week of October 31 2024

Last week: 37.70%. Updates every Friday.

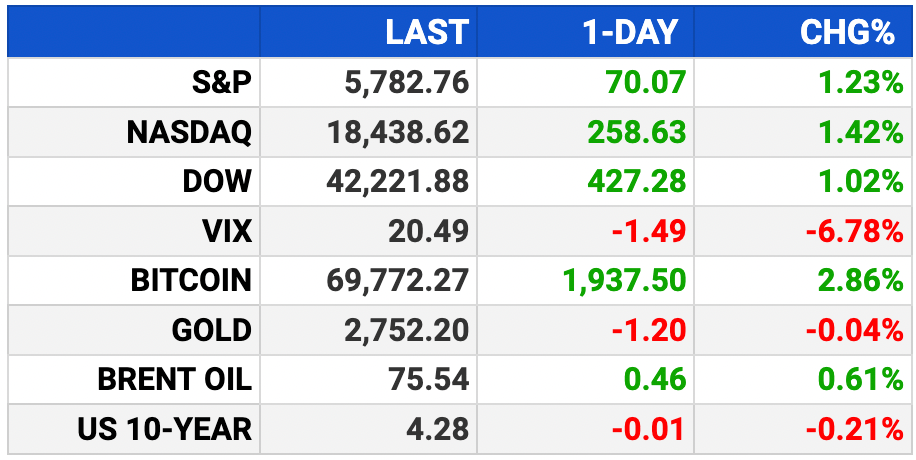

Market Wrap:

Dow futures jump 900 points on Trump win; S&P up 1.9%, Nasdaq 1.7%

Bitcoin hits record; Russell 2000 +5%; Trump Media surges 40%

10-year Treasury yield at 4.43% on potential tax cuts

Goldman: S&P may pop 3% on Trump-GOP sweep

S&P YTD gains over 21%, boosted 1.2% Tuesday

EARNINGS

Here’s what we’re watching this week.

Arm (ARM) - earnings of $.24 per share (-33% YoY) on revenue of $799M (-0.9% YoY)

DraftKings (DKNG) - expect loss of $.42 per share on $1.1 bln (+39.2% YoY)

See full calendar here.

HEADLINES

Republicans win control of Senate ahead of critical tax fight (more)

Trump Media shares gain 40% in overnight trading (more)

Bank stocks advance overnight as traders bet on less regulation with Trump (more)

US service sector activity accelerates to more than 2-yr high (more)

Traders trim bets on Fed rate cuts in 2025 (more)

Asia stocks mixed as US election results trickle in (more)

Boeing strike ends as workers accept new contract (more)

Nvidia passes Apple as world’s most valuable company (more)

Apple facing first-ever EU fine over App Store rules (more)

Super Micro shares plunge with still no clear answers to investors (more)

Meta's AI feasts on user data (more)

Fintech lender Dave accused of misleading needy borrowers (more)

IN PARTNERSHIP WITH UPMARKET

Your Access to Select Private Investments

Join a network of 500+ accredited investors accessing private companies like OpenAI, SpaceX, Neuralink, and ByteDance.

All investments have the risk of loss. UpMarket is not associated with or endorsed by the above-listed companies. Only available to eligible accredited investors. View important disclosures at www.upmarket.co

DEALFLOW

M+A | Investments

Printful and Printify ink a merger deal (more)

Emerson offers to buy rest of AspenTech in $15B deal (more)

French IT firm Atos agrees to sell Worldgrid unit to Alten (more)

StarFish Medical, a medical device development company, acquired Omnica Corporation, a medical device design and engineering company (more)

Chemonics International, a sustainable development company, acquired Luvent Consulting, a company specializing in sustainable development solutions (more)

Vertafore, a company providing end-to-end connectivity solutions, acquired Surefyre, a submission and underwriting workbench platform purpose-built to empower MGAs and wholesalers (more)

Almaviva acquired Iteris, a company providing smart mobility infrastructure management solutions (more)

Wave Therapeutics, a developer of AI-enabled, soft robotics cushioning technology, received an investment from Nurse Capital (more)

The Nursing Beat, a digital media platform that produces a daily digital newsletter designed for nurses, received an investment from Nurse Capital (more)

VC

Inquis Medical, a medical technology company specializing in advanced thrombectomy systems, raised $40M in Series B funding (more)

Ellipsis Labs, a verifiable finance company, raised $21M in funding (more)

CrossBridge Bio, a biotech company pioneering dual-payload antibody-drug conjugates as targeted cancer therapies, raised $10M in funding (more)

Endeavor, an enterprise AI platform for manufacturing companies, raised $7M in seed funding (more)

Troveo, a platform helping content owners monetize from AI, raised $4.5M in Seed funding (more)

CRYPTO

BULLISH BITES

💰 Savings Protection: Why Americans are turning to gold in 2024 *

📊 Election Betting: Kalshi and Polymarket apps top Apple app store charts.

🚘 Bumper Cars: San Francisco has a new type of traffic obstacle these days - Waymo traffic jams.

🏠 Pursuits: Americans who bought homes in 2024 were older and richer than ever.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.