Good morning.

The Fast Five → Rally shakes off Powell, port workers strike on east and gulf coasts, gold has best quarter in four years, Softbank to invest $500M in OpenAI, and Nvidia rival files for IPO …

📊 Exclusive: How this One Stock Could Make You Money in ANY Market »

A message from BTM

Calendar: (all times ET) - Full calendar here

Today: Job openings, 10:00 am

Tomorrow: no notable

Your 5-minute briefing for Tuesday, October 1:

US Investor % Bullish Sentiment:

↓ 49.62% for Week of September 26 2024

Last week: 50.83%. Updates every Friday.

Market Wrap:

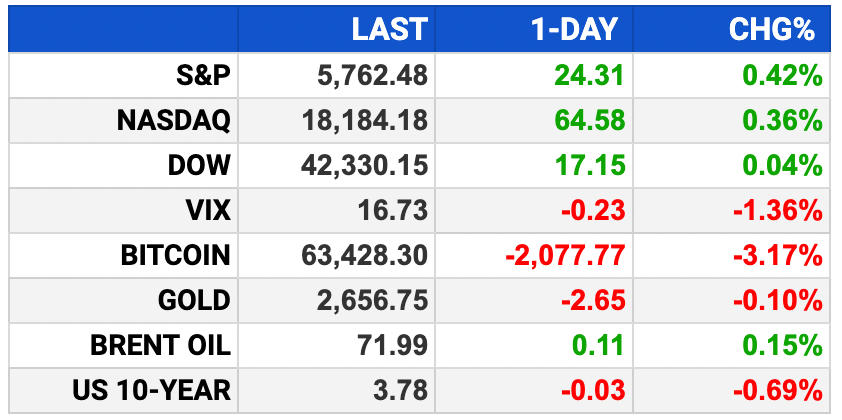

S&P closed at a record, up 0.42% to 5,762.48.

Dow +0.04%, Nasdaq +0.38%; all hit record highs.

Fed Chair Powell hinted at more rate cuts, no set path.

Investors optimistic, but October brings volatility risk.

Key labor data to provide more economic insight this week.

EARNINGS

Here’s what we’re watching this week:

Today: McCormick (MKC)

Lamb Weston (LW) - earnings of $.71 per share (-56.4% YoY) on $1.6 billion revenue

Nike (NKE) - earnings of $.52 per share (-44.7% YoY) on $11.7 billion revenue (-9.3% YoY)

Wednesday: Levi Strauss (LEVI)

See full earnings calendar here.

HEADLINES

Record run steers gold to best quarter in four years (more)

Dollar’s losing streak keeps traders wary as Fed cuts rates (more)

Oil steadies as mideast tensions vie with Libyan supply outlook (more)

Second oil company CEO conspired with OPEC to keep prices high (more)

FTC clears Chevron-Hess deal, bans John Hess from board (more)

Global investors call time on their exodus from China (more)

Boeing strike enters third week (more)

Nvidia stock slips on China trade fears (more)

Nvidia rival Cerebras Systems files for IPO (more)

SoftBank to invest $500M in OpenAI (more)

Ford to give free EV home charging stations to EV buyers (more)

Nuclear power's AI renaissance (more)

A MESSAGE FROM BTM

Can just one ticker lead to a successful retirement?

The legendary Ex-Wall Street CEO who predicted the 2008 financial crisis is finally revealing his unique strategy:

He calls it "The Last Retirement Stock You'll Ever Need"

In this exclusive report, he'll explain how you could help secure your retirement - in any kind of market - using just ONE stock.

Simmy Adelman, Publisher

Behind the Markets

- sponsored message -

DEALFLOW

M+A | Investments

DirecTV to acquire Dish in merger of satellite TV rivals (more)

Marsh McLennan to acquire McGriff Insurance in $7.8B deal (more)

Mizuho acquires minority stake in private credit investor Golub (more)

PepsiCo in talks to buy Siete Foods for over $1 billion (more)

Pfizer to sell about $3.25B stake in Sensodyne-maker Haleon (more)

Equativ, an ad tech company, announced the strategic acquisition of Kamino Retail, an on-site retail media platform designed for retailers (more)

Davenforth, a managed IT, voice, and networking platform, acquired TeleCloud, a cloud communication and connectivity provider, and Third Generation, cloud communication services (more)

Valerio Therapeutics, a clinical-stage biotech company, acquired Emglev Therapeutics, an antibody-based therapeutics company (more)

Creative Planning, an independent wealth management firm, received an investment from TPG Capital (more)

C2N Diagnostic, a company developing Alzheimer’s disease-specific fluid biomarker tests, received a $15M investment from GHR Foundation (more)

VC

Aktis Oncology, a clinical-stage biotech company, closed a $175M Series B financing (more)

HungryPanda, an overseas Asian food delivery platform, closed a $55M refinancing and fundraise (more)

HPC-AI Tech, an AI startup specializing in AI Software Infrastructure and Video Generation, raised $50M in Series A funding (more)

Apono, a leader in privileged access for the cloud, raised $15.5M in Series A funding (more)

Neeve, a cloud platform-as-a-service for smart buildings and spaces, raised $15M in funding (more)

Wispr, a company building a natural way to interact with technology, raised $12M in funding (more)

Lucky Energy, an energy drink company, raised $11.75M in Series A funding (more)

Loti AI, a company specializing in likeness protection technology, received an add'l undisclosed amount in Seed funding from Khosla Ventures (more)

Ensemble, an enterprise machine learning startup, raised $3.3M in seed funding (more)

CRYPTO

BULLISH BITES

🚨 Exclusive: The last retirement stock you’ll ever need? *

💼 Next Level: The rise of the "intern CEO."

✋ Back Off: The VC buying up prized real estate in SF says not to ‘listen to agitators’.

🧬 Going, Going… Remember that DNA you gave 23andMe?

🍸 Shaken, Not Stirred: The world’s first official James Bond bar just opened in London—here’s a look inside.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.