Good morning.

The Fast Five → Powell tells Congress economy no longer overheated, key takeaways from testimony, Tesla's US market share drops below 50% for first time, Goldman sees stocks and economy slowing, and Adidas set to benefit as Nike’s turnaround efforts falter…

Calendar: (all times ET)

Today: | Jerome Powell testimony to House, 10 AM |

THU, 7/11: | Initial jobless claims, 8:30 AM |

FRI, 7/12: | Producer price index (PPI), 8:30 AM |

Your 5-minute briefing for Wednesday, July 10:

US Investor % Bullish Sentiment:

↓ 41.74% for Wk of July 04 2024 (Last week: 44.49%)

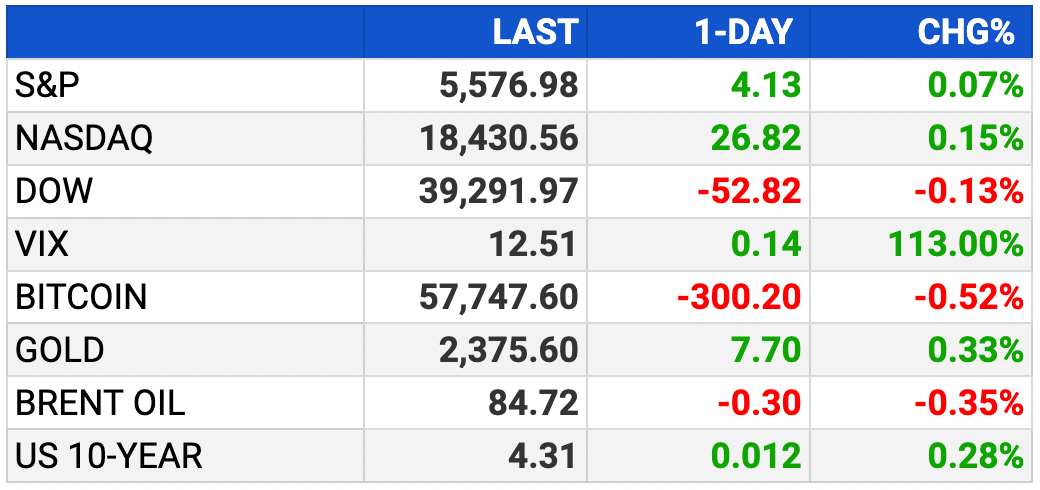

Market Recap:

Stock futures flat after S&P 500 hits record.

Nasdaq, S&P hit new records; Fed Chair Powell warns on high rates.

S&P +0.07%, Nasdaq +0.14%, Dow -0.13%.

Today: Powell testifies to House Committee.

Key data: May wholesale inventories, June CPI Thu, June PPI Fri.

CPI seen as key test for rate cuts.

EARNINGS

It’s a light week. Here’s what we’re watching:

Thursday: PepsiCo (PEP)

Delta Air Lines (DAL) - earnings of $2.37 per share (-11.6% YoY) on $15.5B revenue (+5.8% YoY)

JPMorgan Chase (JPM) - earnings of $4.55 per share (-4.2% YoY) on $44B revenue (+3.9% YoY)

Full earnings calendar here.

HEADLINES

Key takeaways from Fed Chair Powell’s testimony on Capitol Hill (more)

Yellen: inflation will continue to ease over time (more)

Biden announces new NATO aid for Ukraine, as his reelection campaign teeters (more)

Fed may tweak rule saving biggest US banks billions (more)

Oil edges lower as focus turns from hurricane to Fed (more)

China bond traders draw red lines as PBOC gears up to calm rally (more)

China’s ETF market sees ‘explosive’ growth, inflows jump 5-fold in three years (more)

U.N. Aviation Council launches audit of US air safety oversight (more)

Goldman Sachs asset managers see economy, stocks slowing (more)

Growth stalls at Elon Musk’s X (more)

Nike’s new chief runs into trouble as turnaround efforts falter (more)

Adidas set to benefit as Nike struggles (more)

Dyson to cut a quarter of UK workforce (more)

Etsy loses its ‘handmade’ and ‘vintage’ labels as it takes on Temu and Amazon (more)

Intercom for Startups

Join Intercom’s Early Stage Program to receive a 90% discount.

Get a direct line to your customers. Try the only complete AI-first customer service solution.

DEALFLOW

M+A | Investments

Athletic Brewing raises $50M as nonalcoholic wave sweeps beer making (more)

Tyson to sell chicken plant as streamlining push continues (more)

Vista Outdoor rejects MNC's buyout offer, agrees to CSG's sweetened bid for unit (more)

StanChart crypto unit in talks to buy Alan Howard-backed firm (more)

Uberdoc, a healthcare platform, received an investment from CharmHealth and Bioverge (more)

VC

Captions, a generative video creation and editing platform, raised $60M in Series C funding, at $500M valuation (more)

DigniFi, a fintech company specializing in automobile repair financing, raised $175M in funding (more)

ZwitterCo, a company empowering water treatment through membrane technologies, raised $58.4M in Series B funding (more)

Volley, a creator of voice-controlled games played on TVs and smart speakers, raised $55M in Series C funding (more)

Gymdesk, a member management software for fitness and wellness businesses, raised $32M in funding (more)

NOWDiagnostics, a developer of over-the-counter and point-of-care diagnostic tests, raised $22.5M in Series B funding (more)

Command Zero, an autonomous and user-led cyber investigation platform, raised $21M in Seed funding (more)

Courier Health, a tech company specializing in chronic conditions or rare diseases, raised $16.5M in Series A funding (more)

Scaler, a platform for decarbonizing real estate with machine learning and ESG data collection, raised $10M in Series A funding (more)

The Lasso, an online car bidding platform, raised $9.8M in funding (more)

Biostate AI, a biodata foundry startup, raised $4M in funding (more)

NodaFi, a company specializing in facility operations platforms, raised $3.5M in Seed funding (more)

Niva, a global business identity platform, raised more than $3.3M in funding (more)

Accend, a company helping fintechs and banks accelerate business customers’ onboarding process, raised $3.2M in Seed funding (more)

Maximum Fidelity Surgical Simulations (MaxFi), a company providing lifelike cadavers to create highly realistic surgical simulations for medical education, raised $2.25M in Seed funding (more)

| Sponsored |

| What’s Nvidia doing next?? |

| Nvidia ruled the first wave of the AI boom. Its chips are needed by anyone who is serious about artificial intelligence. But Nvidia recently pivoted to a massive new sector. One that is vital to the future of AI. This pivot is already worth at least $1 trillion. And now, three small companies could benefit greatly from Nvidia’s pivot.Click here to learn about Nvidia's next AI move. |

| Privacy Policy/Disclosures |

CRYPTO

BULLISH BITES

🏆 Check it out: The top 250 global fintechs — from banking challengers to crypto heavyweights.

📈 Stock Alert: Prepare for a “cash avalanche” *

🗑 Trash Talk: McKinsey's $4M trash deck for NYC is 95-slides long and titled “The Future of Trash” - see it here.

💼 Huh? Greece defends new six-day work week legislation, says it’s an ‘exceptional measure’.

🚨 July Warning: Why are tech stocks stocks swinging? *

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.