Good morning.

The Fast Five → Nvidia doubles profit as A.I. chip sales soar, Bitcoin crosses $97,000 in new record-high, Walmart attracting high income shoppers, Target sounds the alarm on holiday shopping, and MicroStrategy becomes second-most traded stock after Nvidia…

📈 AI's Massive Surge: Don't Miss the Second Wave »

From Behind The Markets

Calendar: (all times ET) - Full calendar

Today:

Initial jobless claims, 8:30 am

Existing home sales 10:00 am

Tomorrow:

Consumer sentiment, 10:00 am

Your 5-minute briefing for Thursday, November 21:

US Investor % Bullish Sentiment:

↑ 49.84% for Week of November 14 2024

Last week: 41.54%. Updates every Friday.

Market Wrap:

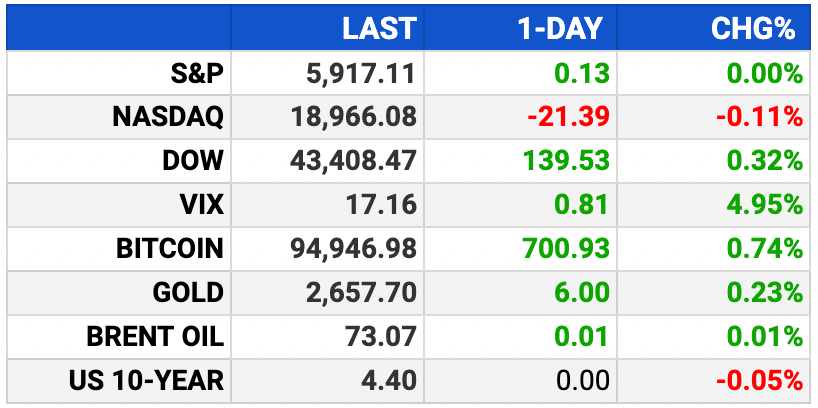

Nasdaq futures fell 0.5%; S&P down 0.4%; Dow slipped 49 points (-0.1%).

Nvidia dropped 2% post-earnings despite beating estimates, strong guidance.

Snowflake soared 19% after surpassing Q3 expectations.

Dow rose 140 points; S&P flat; Nasdaq dipped 0.1% Wednesday.

Today: Jobless claims, home sales, Fed speeches.

EARNINGS

Here’s what we’re watching this week. Full calendar »

Deere (DE) - earnings of $3.93 per share (-52% YoY) on $9.3B revenue (-32.7% YoY)

HEADLINES

Markets think the odds of a Fed pause in December are rising (more)

Oil prices edge up on geopolitical tensions (more)

Dollar pulls ahead as markets focus on Trump policies, Fed outlook (more)

Asian stocks dip as Nvidia results fail to impress (more)

Target sounds the alarm bell on holiday shopping (more)

Walmart is seeing growth in higher income shoppers (more)

MicroStrategy becomes second-most traded stock after Nvidia (more)

Williams-Sonoma CEO explains pricing strategy after earnings beat (more)

Nvidia partner Hon Hai gets $1.1 Billion bank loan amid AI boom (more)

Bill Hwang sentenced to 18 years in prison in Archegos case (more)

Billionaire Gautam Adani of India's Adani Group charged in US with bribery (more)

IN PARTNERSHIP WITH MASTERWORKS

Over the last seven elections, this asset class has outpaced the S&P 500

Instead of trying to predict which party will win, and where to invest afterwards, why not invest in an ‘election-proof’ alternative asset? The sector is currently in a softer cycle, but over the last seven elections (1995-2023) blue-chip contemporary art has outpaced the S&P 500 by 64% even despite the recent dip, regardless of the victors, and we have conviction it will rebound to these levels long-term.

Now, thanks to Masterworks’ art investing platform, you can easily diversify into this asset class without needing millions or art expertise, alongside 65,000+ other art investors. From their 23 exits so far, Masterworks investors have realized representative annualized net returns like +17.6%, +17.8%, and +21.5% (among assets held longer than one year), even despite a recent dip in the art market.*

Past performance not indicative of future returns. Investing Involves Risk. See Important Disclosures at masterworks.com/cd.

DEALFLOW

M+A | Investments

Funding for Seven & i founding family buyout will be finalised by end Dec (more)

Vista Equity sells LogicMonitor stake in $2.4 billion deal (more)

South Africa's Tiger Brands to sell Baby Wellbeing business, excluding Purity (more)

Certinia, a provider of Professional Services Automation and Customer Success solutions, received an investment from TA Associates (more)

VC

Taito.ai, an AI-powered performance enablement platform, raised $2.7M in Seed funding (more)

Cyera, a data security company, raised $300M in Series D funding, at $3 bln valuation (more)

Tokamak Energy, a commercial fusion energy company, raised $125M in funding (more)

Aquaria, a company building communities and cities supplied with water from the sky, raised $112M in funding (more)

Magma Math, a K-12 instructional math platform for teacher efficiency and classroom management, raised $40M in Series A funding (more)

Prism Worldwide, a company specializing in material solutions, raised $40M in Series A and A1 funding (more)

Zarminali Health, an outpatient pediatric destination providing coordinated primary and specialty care nationwide, raised $40M in Seed funding (more)

Federato, an AI-native underwriting platform for insurance, raised $40M in Series C funding (more)

Lightyear, enterprise telecom management software, raised $31M in Series B funding (more)

Valora Therapeutics, a biotech company providing a novel approach to immunotherapy, raised $30M in Seed funding (more)

Monkey Tilt, a platform providing entertainment and online gaming experiences, raised $30M in Series A funding (more)

Synapticure, a virtual care company improving access and outcomes for patients living with Alzheimer’s, raised $25M in Series A funding (more)

Revv, a B2B SaaS business improving the auto repair industry with AI, raised $20M in funding (more)

Prompt Security, a company specializing in Generative AI (GenAI) security, raised $18M in Series A funding (more)

BrightAI, a company specializing in AI-driven solutions for critical infrastructure, raised $15M in Seed funding (more)

Keychain, a manufacturing platform for the packaged goods industry, raised $15M in funding (more)

Four Growers, a startup building harvesting robots to reduce the production costs of greenhouse growers, raised $9M in Series A Funding (more)

Zitadel, a provider of cloud-native identity infrastructure solutions, raised $9M in Series A funding (more)

Apideck, a provider of real-time Unified APIs, raised $7.5M in Series A funding (more)

Flywheel Dynamix, a buyer-centric cloud marketplace to simplify software acquisition for buyers, raised $7M in Seed funding (more)

Hopae, a digital identity solution company, raised $6.5M in funding (more)

Distru, a cannabis industry ERP platform provider, raised $6M in Series A funding (more)

Anaflash, an edge AI processor developer, raised an undisclosed amount in funding (more)

CRYPTO

BULLISH BITES

🚀 AI’s Surge: This “AI convergence” could send NVIDIA even higher… *

📺 New Frontier: Comcast’s cable network spinoff may be a signal to the media industry for change.

🤪 Too Far? Radical Jaguar rebrand and new logo sparks ire online.

🚫 Cheaters: American Airlines to shame boarding line cutters with new technology.

🍌 Crazy: Crypto chief buys a banana taped to wall at auction for $6.24 million.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.