Good morning.

The Fast Five → Trump pushes back on criticism of economy in prime-time speech, Oracle-Blue Owl split over data center rattles markets, AI-themed stocks take more hits, Warner Bros board rejects rival bid from Paramount, and Elliott takes over $1 billion stake in Lululemon…

📌 Same Stocks, 36x Bigger Gains — A small group of folks had the chance to make 36x more from the incredible bull market we’ve seen in recent months. How? They’re using Larry Benedict’s "Skim Codes," which have an 84%-win rate. For full details, go here to watch Larry’s new video bulletin. (ad)

Calendar: (*Shutdown may affect key data. All times ET) - Full Calendar »

Today:

Consumer Price Index, 8:30A Unemployment Claims, 8:30A

Tomorrow:

Existing Home Sales, 10:00A

Your 5-minute briefing for Thursday, Dec 18:

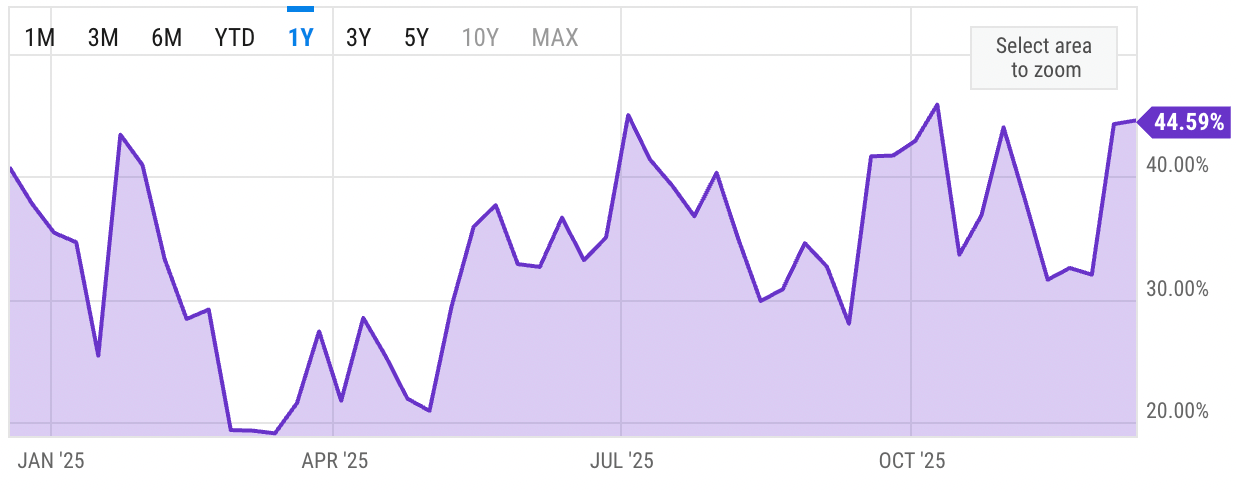

US Investor % Bullish Sentiment:

↑ 44.59% for Week of DEC 11 2025

Previous week: 44.29%

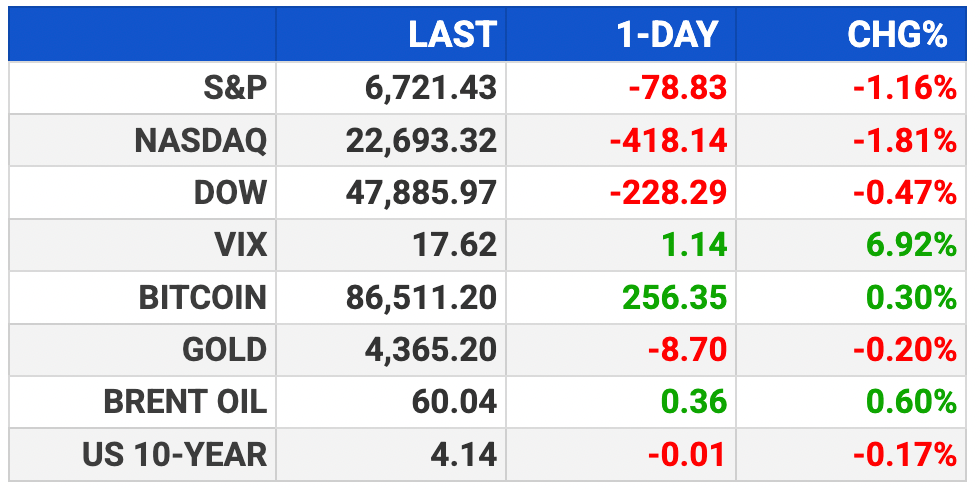

Market Wrap:

Futures flat ahead of key CPI print

S&P +0.1%, Nasdaq +0.2%, Dow flat

Micron +7% after earnings beat, strong guide

Markets coming off fourth straight down day

Semis slide on data-center capex concerns

Today: November CPI due

EARNINGS

Here’s what we’re watching this week:

Today: Darden Restaurants $DRI ( ▲ 2.01% )

FedEx $FDX ( ▲ 1.39% ) - earnings of $4.08 per share on $22.8B revenue

Nike $NKE ( ▼ 0.32% ) - $.37 EPS (-52.6% YoY) on $12.2B revenue (-1.2% YoY)

His Secret, an 18-Digit Code?

This former hedge fund manager made $274 million in profits…

Barron's ranked his fund in the top 1% globally…

And he was featured among billionaires in the book Hedge Fund Market Wizards.

Now he's finally revealed the secret to his success. And no one can believe how straightforward it is…

It's just an 18-digit code you can punch into any brokerage account.

- a message from The Opportunistic Trader -

HEADLINES

Wall Street closes lower as AI funding jitters drag tech stocks (more)

CPI inflation comes back in the spotlight (more)

Trump says next Fed chair will believe in lower interest rates 'by a lot' (more)

Dalio, BlackRock join donor list in backing ‘Trump Account’ program (more)

Dollar broadly firm as markets brace for central bank decisions (more)

Gold forecast to glitter again next year despite biggest gain since 1979 (more)

Wall Street gets a taste of blockbuster stock-market debuts ahead (more)

Tesla's car business is only worth $30 a share, analyst warns (more)

Coinbase announces entry into prediction markets, stocks (more)

Warner Bros board rejects rival bid from Paramount (more)

BP makes O’Neill first female Big Oil CEO in bid for revival (more)

Nvidia director sells $44M in shares held for over 3 decades (more)

Micron forecasts blowout earnings on booming AI market, shares rise 7% (more)

Instacart drops on report that FTC is probing company over AI pricing tool (more)

DEALFLOW

M+A | Investments

Broadwing Capital acquires CloudScale365

a360inc acquires Notary Hub

Leap receives investment from ONE Bow River National Defense Fund

VC

Cyera, an AI cloud data security platform, raised $400M in Series E funding

Radiant Nuclear, a portable nuclear microreactor startup, raised $300M in Series D funding

Tebra, an EHR+ platform provider, received $250M in new financing

MoEngage, a customer engagement platform for consumer brands, received additional $180M in Series F funding

Mythic Inc., an AI chip startup developing analog AI processors, raised $125M in Series D funding

Addition Therapeutics, a genomic medicine company, raised $100M in funding

Last Energy, a nuclear technology company, raised $100M in Series C funding

Codoxo, a generative AI-powered healthcare payment integrity solutions, raised $35M in Series C funding

Ben, a workforce benefits platform company, raised $27.5M in Series B funding

DataLane, an identity graph service for local businesses, raised $22.5M in Series A funding

Ankar, an AI SaaS company for patent automation, raised $20M in Series A funding

Hen Technologies, an intelligent fire suppression company, closed a $20M Series A financing round

Sequence, a fintech revenue automation platform, raised $20M in Series A funding

Nanit, a baby's sleep technology company, raised $50M in growth funding

Trigger.dev, a developer platform for AI automation workflows, raised $16M in Series A funding

Drive Health, a healthcare tech company behind Avery, a Google-powered agentic AI platform, raised $15M in funding

Roamless, a travel connectivity app and mobile operator, raised $12M in Series A funding

Dux Security, a cybersecurity startup, raised $9M in Seed funding

DNA Nanobots, a self-assembling nanoscale therapeutics company, raised $3.5M in funding

Scylos, a stateless endpoint infrastructure company, raised $3M in Seed funding

CRYPTO

BULLISH BITES

📉 The squishy number behind the rise and fall of Oracle’s stock.

💰 Study shows Instacart is charging some shoppers 20% more for the same product.

💼 Office workers hang on for dear life.

✍️ The ultimate desk for fidgeters.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.