Good morning.

The Fast Five → Gold tops $5,000 for the first time, investors get set for busiest week of Q1, energy stocks to watch as winter storm rips through the US, hedge funds are back on top, and US set to make its largest investment in rare earths…

Calendar: Full Calendar »

Today:

Durable Goods Orders, 8:30A

Monday:

New Home Sales, 10:00A

Your 5-minute briefing for Monday, Jan 26:

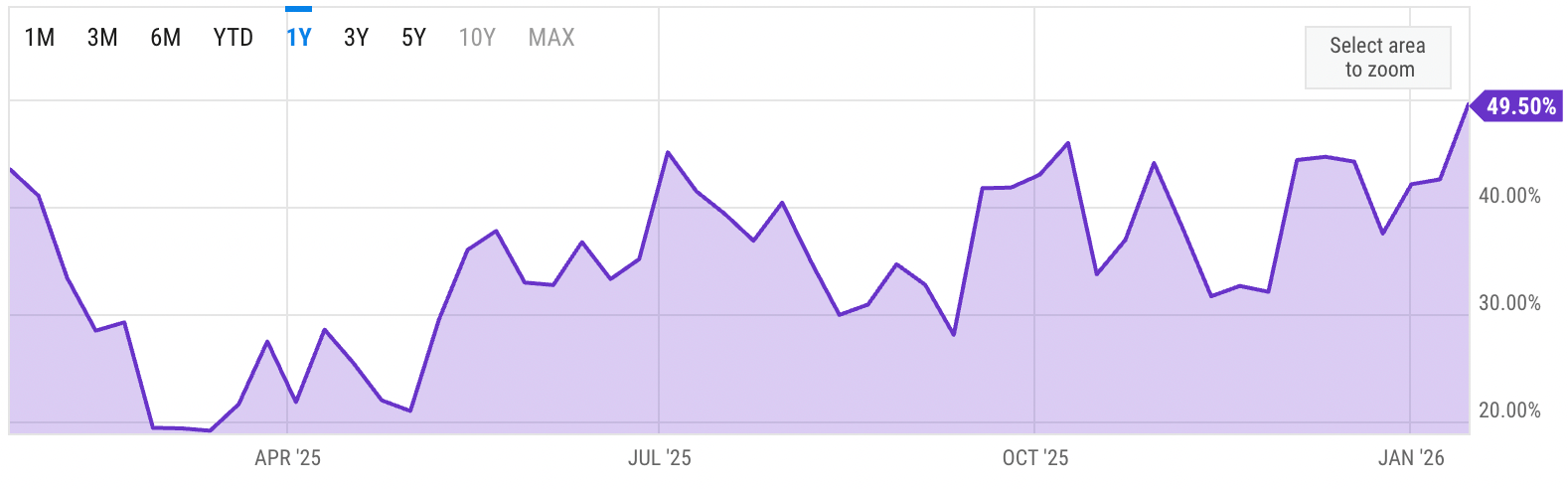

US Investor % Bullish Sentiment:

↓ 43.17% for Week of JAN 22 2026

Previous week: 49.50%

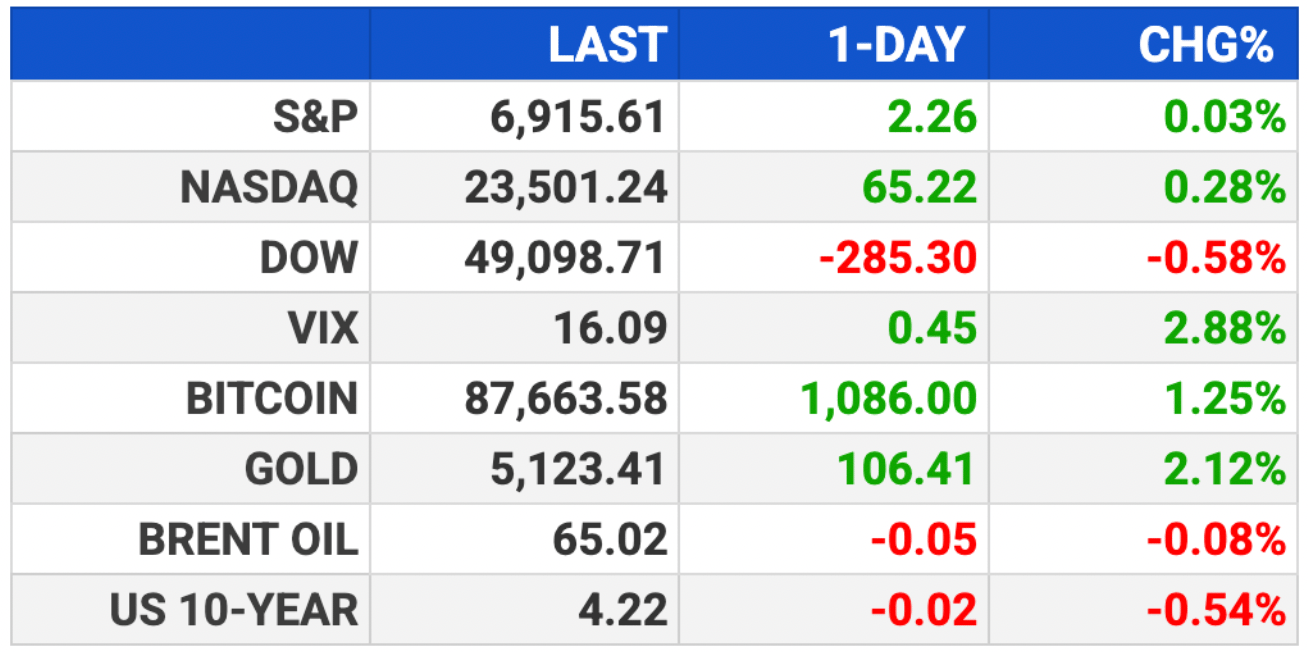

Market Wrap:

Futures fell with Dow -317, S&P -0.8%, Nasdaq -1.1%

This week has 90+ S&P earnings including Apple, Meta, Microsoft

Season has been solid with 76% beating estimates so far

Some beat-and-drop names include Intel and Netflix

The Fed decides Wed with a hold expected and cuts timing in focus

Stocks just had a -0.4% week for a second straight wkly decline

EARNINGS

Here’s what we’re watching this week:

TUE: American Airlines $AAL ( ▼ 4.86% ), Boeing $BA ( ▼ 0.69% ), JetBlue $JBLU ( ▼ 2.43% ), UnitedHealth $UNH ( ▼ 2.64% ) , UPS $UPS ( ▼ 1.47% )

WED: AT&T, $T ( ▲ 1.93% ), Progressive $PGR ( ▼ 0.19% ), Starbucks $SBUX ( ▼ 2.78% ), Meta Platforms $META ( ▼ 2.81% ), Microsoft $MSFT ( ▼ 3.21% ), Tesla $TSLA ( ▼ 2.91% )

GE Vernova $GEV ( ▲ 0.16% ) - eps of $3.12 (+80.3% YoY) on $10.22B (-3.2% YoY)

THU: Blackstone $BX ( ▼ 6.23% ), Mastercard $MA ( ▼ 5.77% )

Apple $AAPL ( ▲ 0.61% ) - EPS of $2.67 (+11.3% YoY) on $138.45B revenue (+11.8% YoY)

FRI: Chevron $CVX ( ▲ 0.53% ), Exxon Mobile $XOM ( ▲ 2.36% ), Verizon $VZ ( ▲ 0.87% )

A MESSAGE FROM STANSBERRY RESEARCH

Ex-Wall Street Insider:

”A Historic Pattern is Repeating and Gold Could Soar Past $27,000”

A seismic event that has played out four times in history is likely unfolding again.

And signs point to gold soaring past a shocking $27,000 an ounce... yet most Americans had no clue it was even happening.

Today, a CEO of a publicly traded company and former Goldman Sachs VP is pulling back the curtain on this strange story playing out in the upper echelons of world finance.

And even if you've never owned an ounce of gold, this could impact everything from your investments to your mortgage.

- a sponsored message from Stansberry Research -

HEADLINES

Stock futures fall as traders get set for a big week of trading (more)

Davos verdict: AI's power bottleneck will keep build-outs booming (more)

Investors hedge China, tech risks amid Trump TACO trade drama (more)

Wall Street expects profit growth to power markets in 2026 (more)

Energy stocks to watch as major winter storm rips through the US (more)

US set to make its largest investment in rare earths (more)

Treasury ‘rate check’ boosts Yen, weakens dollar (more)

Currency markets on guard for intervention in Japan's yen (more)

Oil little changed as supply concerns temper US winter disruptions (more)

Power prices surge as winter storm spikes demand in data center alley (more)

Samsung starts production of HBM4 chips in Feb. for Nvidia supply (more)

Vanguard tops $1 trillion in assets outside the US (more)

Musk’s $1 trillion pay package renews focus on CEO compensation (more)

Hedge funds are back on top after a long ‘alpha winter’ (more)

DEALFLOW

M+A | Investments

Check back tomorrow

VC

Mia Labs, an AI-powered conversational platform for automotive dealerships, raised a $20M Series A funding

Mendra, a biopharma company developing therapies for rare disease medicines, raised $82M in Series A funding

Cork, a company building tokenized risk infrastructure for onchain finance, raised $5.5M in Seed funding

GIGR, an AI creative platform, raised $5.4M in pre-Seed funding

CRYPTO

BULLISH BITES

💔 Wall Street has fallen out of love with software stocks.

💰 The man who almost replaced Warren Buffett.

🏠 The 10 best markets for first-time homebuyers in 2026.

👴🏻 Five longevity lessons from the oldest person in the world.

DAILY SHARES

Have feedback or a suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.