Good morning.

The Fast Five → Microsoft sinks, chipmakers climb as AI rally faces divide, Kamala Harris vows to combat price gouging, Tesla recalls 1.85 million US vehicles, Starbucks sales fall as diners retreat, and Fed likely to hold rates steady today- one last time …

📈 From Behind The Markets: Is NVIDIA signaling a market crash?

Calendar: (all times ET)

Today: | FOMC interest-rate decision, 2:00 PM |

THU, 8/1: | Initial jobless claims, 8:30 AM |

FRI, 8/2: | Employment report, 8:30 AM |

Your 5-minute briefing for Wednesday, July 31:

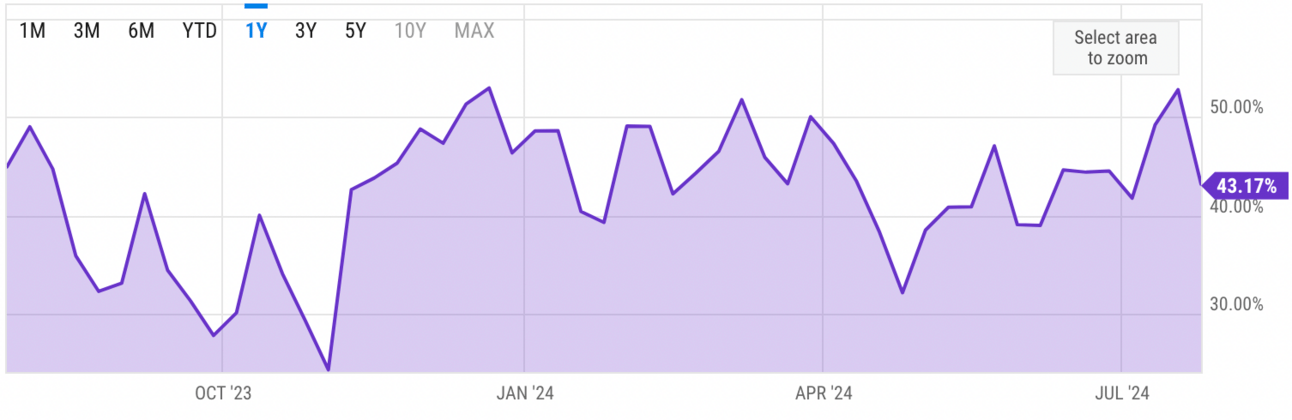

US Investor % Bullish Sentiment:

↓ 43.17% for Wk of July 25 2024 (Last week: 52.75%)

Chart updates every Friday.

Market Recap:

S&P futures flat, Dow -0.4%, Nasdaq up +0.2%.

Nasdaq -1.3%, S&P -0.5%, Dow +0.5%, Russell 2000 +0.4%.

Microsoft drops 4%, AMD up 7%, Nvidia up 4%.

Today: Fed decision on rates expected.

Key data: private payrolls, employment costs, pending home sales.

Earnings: Boeing, Albemarle, Qualcomm, Etsy, Carvana.

July: S&P -0.4%, Nasdaq -3.3%, Dow +4%, Russell 2000 +9%.

EARNINGS

HEADLINES

S&P, Nasdaq stumble on caution ahead of tech earnings (more)

US job openings fall marginally, consumers less upbeat on the labor market (more)

Fed likely to hold rates steady one last time as inflation fight finale unfolds (more)

US regulators seek to limit asset managers’ sway over big banks (more)

Geithner sees ‘Dark Shadows’ for next president, warns on dollar (more)

Japan stocks set to drop ahead of BOJ decision (more)

Yen holds onto biggest monthly gain since 2022 before BOJ, Fed (more)

UK confirms record £1.5 Billion budget to support green power (more)

Intel to cut thousands of jobs to reduce costs, fund rebound (more)

Microsoft stock drops after disappointing cloud growth (more)

Starbucks sales fall as diner retreat extends in US, China (more)

Tesla recalls 1.85M US vehicles over unlatched hood issue (more)

AMD says data center sales more than doubled in a year (more)

"The most predictable crisis in history"

When the largest bank in the U.S. says a crisis is coming - you NEED to listen.

The Wall Street Journal warns, "America's bonds are getting harder to sell."

Bloomberg says, "Homebuyers are starting to revolt."

JP Morgan calls it, "The most predictable crisis in history."

Simmy Adelman, Publisher

Behind the Markets

- sponsored message -

DEALFLOW

M+A | Investments

Blackstone in bid to acquire shopping center owner Retail Opportunity (more)

Cybersecurity firm Tenable is exploring a potential sale (more)

Grifols cuts Chinese stake value by €457M after audit (more)

Reason Automation, an enterprise e-commerce data technology startup, received a seed investment from Verify Ventures (more)

VC

Medicom, a health tech startup leading enterprise imaging interoperability, closed its strategic financing round (more)

Gradient AI, an enterprise software provider of AI solutions in the insurance industry, raised $56.1M in Series C funding (more)

Faye, a travel tech startup, raised $31M in Series B funding (more)

Axiad, an identity-first enabler of the zero-trust enterprise, raised $25M in funding (more)

Perchwell, a modern data and workflow platform for residential real estate, raised $25M in Series B financing (more)

Credo AI, a global leader in AI governance software, raised $21M in funding (more)

Haus, a provider of decision science and marketing measurement solutions, raised $20M in additional financing (more)

Lineaje, a leader in continuous software supply chain security management, raised $20M in Series A funding (more)

LTZ Therapeutics, an immunotherapy-focused biotech company, closed its Series A financing of over $20M (more)

Pinetree Therapeutics, Inc., a biotech company advancing next-generation targeted protein degraders to combat drug resistance in oncology and beyond, raised $17M in Series A funding round (more)

Montara Therapeutics, Inc., a therapeutics company aiming to advance brain-targeting drugs, closed an $8m seed financing (more)

Batbox, a baseball entertainment concept, closed its $7.3m Series A funding round (more)

AeroShield Materials, an MIT spin out developing tech for energy efficiency applications in the built environment, raised $5M in additional funding (more)

Powder, a fintech startup providing AI agents for precise document analysis, raised $5M in seed funding (more)

Raad Labs, a blockchain climate tech company emerging from the Montauk Climate incubator, raised $2.25M in funding (more)

DecoverAI, a legal tech company, raised $2M in seed funding (more)

CRYPTO

BULLISH BITES

📉 July’s Market Dip: Start of a larger financial crisis? *

😳 Smart Move? It took some serious nerve for Wiz to walk away from Google’s $23B offer.

🤖 Roll Out: OpenAI starts rolling out its Her-like voice mode for ChatGPT.

🚨 Coming soon? Prepare for the 2024 Wall Street reckoning *

📈 New Toys: A karaoke mic for your Tesla.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.