Good morning.

The Fast Five → S&P 500’s record rally shows cracks, Trump rings bell at NYSE, Congress introduces bills to break up health conglomerates, Broadcom shares soar 13%, and YouTube TV’s monthly cost soars to $82.99…

Jeff Bezos, Mark Zuckerberg, Bill Gates, Jensen Huang, and Elon Musk are all quietly investing millions in a secret revolutionary technology.

You’ve never heard anything like this before…

In this new exposé, Porter Stansberry shares everything you need to know.

- sponsored

Calendar: (all times ET) - Full calendar

Today:

Export/Import prices, 8:30 am

Monday:

Empire State manufacturing survey, 8:30 am

Your 5-minute briefing for Friday, December 13:

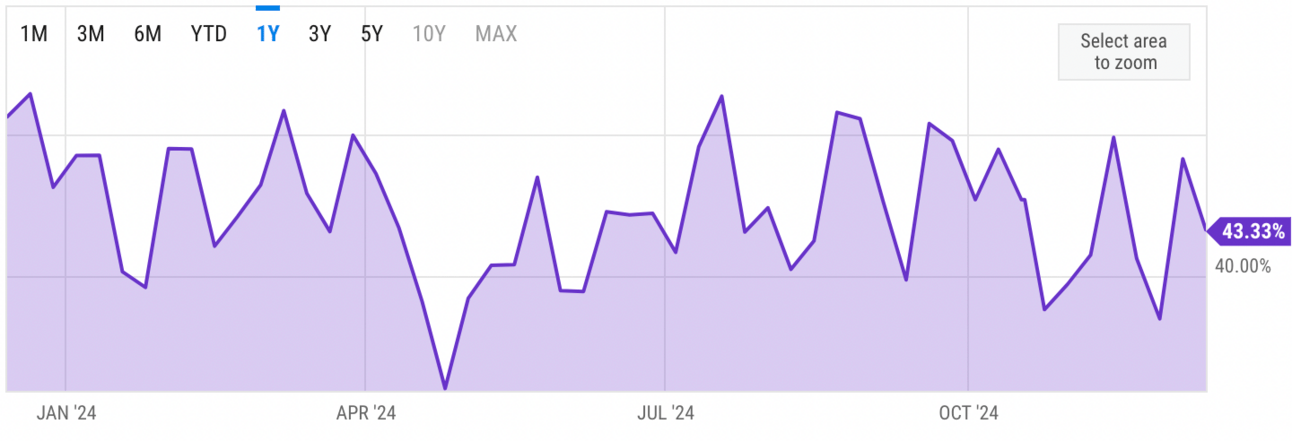

US Investor % Bullish Sentiment:

↓ 43.33% for Week of December 12 2024

Previous week: 48.33%. Updates every Friday.

Market Wrap:

Dow futures flat; S&P up 0.2%, Nasdaq up 0.5%.

Broadcom +14% on AI revenue surge; RH +18% on strong guidance.

Dow heads for 1.6% weekly loss; Nasdaq gains 0.2%.

November PPI rises 0.4%, beating 0.2% estimate.

Analysts cautious on valuations, see sector-specific plays.

EARNINGS

None watched today. See full Calendar »

HEADLINES

Congress introduces bills to break up UnitedHealth Group (more)

Wall Street closes lower as investors assess data after recent gains (more)

Wholesale prices rose 0.4% in November, more than expected (more)

Mortgage rates dropped for a third straight week (more)

Oil set for weekly gain as sanctions outlook offsets glut woes (more)

Asian stocks fall on China policy readout, dollar (more)

European Central Bank cuts interest rates as the economy weakens (more)

Trump advisers consider raising SALT write-off limit to $20,000 (more)

Apple nears switch away from Broadcom for key wireless chip (more)

Broadcom shares rise 13% on profit beat, 'massive' opportunity in AI (more)

Warner Bros. Discovery surges as it restructures its business (more)

YouTube TV’s monthly cost soars to $82.99 (more)

Stanley recalls more than 2 million travel mugs (more)

TOGETHER WITH MASTERWORKS

BofA says +80% of young, wealthy investors want this asset—now it can be yours.

A 2024 Bank of America survey revealed something incredible: 83% of HNW respondents 43 and younger say they currently own art, or would like to.

Why? After weathering multiple recessions, newer generations say they want to diversify beyond just stocks and bonds. Luckily, Masterworks’ art investing platform is already catering to 60,000+ investors of every generation, making it easy to diversify with an asset that’s overall outpaced the S&P 500 in price appreciation (1995-2023), even despite a recent dip.

To date, each of Masterworks’ 23 sales has individually returned a profit to investors, and with 3 illustrative sales, Masterworks investors have realized net annualized returns of +17.6%, +17.8%, and +21.5%

Past performance not indicative of future returns. Investing Involves Risk. See Important Disclosures at masterworks.com/cd.

DEALFLOW

M+A | Investments

Contact lens maker Bausch + Lomb says it is exploring sale (more)

Orbus Software, a global provider of enterprise transformation software, acquired Capsifi, a provider of business architecture solutions (more)

Chroma Medicine and Nvelop Therapeutics announced their merger and subsequent launch of nChroma Bio to expand the R&D of the genetic medicines sector (more)

The Asia Group, a business advisory group to orgs with business interests in the trans-Pacific region, received a majority investment from RLH Equity Partners (more)

The Computer Works, a provider of fiber and fixed wireless internet services, received growth capital from Stephens Group and Circumference Group (more)

VC

Crusoe, a vertically integrated AI infrastructure provider, raised $600M in Series D funding, at $2.8 Billion valuation (more)

Capstan Medical, a developer of robotic-enabled minimally invasive solutions for heart valve disease, raised $110M in Series C funding (more)

Sublime Security, an adaptive, AI-powered email security platform, raised $60M in Series B funding (more)

Terradot, a climate company, raised $58.2M in funding (more)

Evinced, a software company powering accessible web and mobile development, raised $55M in Series C funding (more)

Nanoramic, an advanced battery technology company, raised $44M in funding (more)

Twelve Labs, a video understanding company, raised $30M in funding (more)

Atlas Card, a members-only concierge service and charge card delivering access to coveted experiences, raised $27M in Series B funding (more)

Pleno, a clinical and multi-omics diagnostics company, raised $25M in Series B funding (more)

Vapi, a developer platform for deploying Voice AI agents, raised $20M in Series A funding (more)

Electrified Thermal, an electrified ehermal solutions company, raised $19M in funding (more)

Cofactr, a supply chain and logistics management platform, raised $17M in Series A funding (more)

Azimuth AI, a startup producing customized silicon products for computing markets, raised $11.5M in funding (more)

Reveal Technology, a defense tech platform delivering decision tools for defense and security professionals, raised $11.2M in Series A funding (more)

1m, a data and analytics technology company, raised $10M in Series A funding (more)

Prezent.AI, a company improving enterprise business communication through AI-powered storytelling solutions, received $7.3M in funding (more)

SkySQL, a database management company with AI and serverless capabilities, raised $6.6M in funding (more)

Tuva Health, an open-source healthcare data transformation platform, raised $5M in Seed funding (more)

Pin, an AI-powered recruitment tool, raised $3M in funding (more)

CRYPTO

BULLISH BITES

💰 Influence: Now Amazon gives $1M to 2025 inaugural fund in latest Big Tech gift for Trump.

☠️ No Traction: RIP, Cruise robotaxi.

💰 On Top: The 25 Richest Families in the World 2024 (the Waltons are back on top).

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.