Good morning.

The Fast Five → Wall Street got the rally signals from Powell it wanted, Nvidia earnings set to test AI trade, Fitch affirms US credit at 'AA+', POTUS goes on an investment spree, and Cracker Barrel loses $100 million in value after new logo release…

📌 The economic shift no one’s talking about— This week is all about the Fed conference. But many don't realize that there is another economic shift happening behind the scenes, one that is unlike anything Louis Navellier has seen in his four decades on Wall Street. He calls it The Economic Singularity. Make sure you know exactly what's coming and how to prepare for it the right way. (ad)

Calendar: (all times ET) - Full Calendar

Today:

New Home Sales, 10:00A

Tomorrow:

Durable Goods Orders, 8:30A Consumer Confidence, 10:00A

Your 5-minute briefing for Monday, Aug 25:

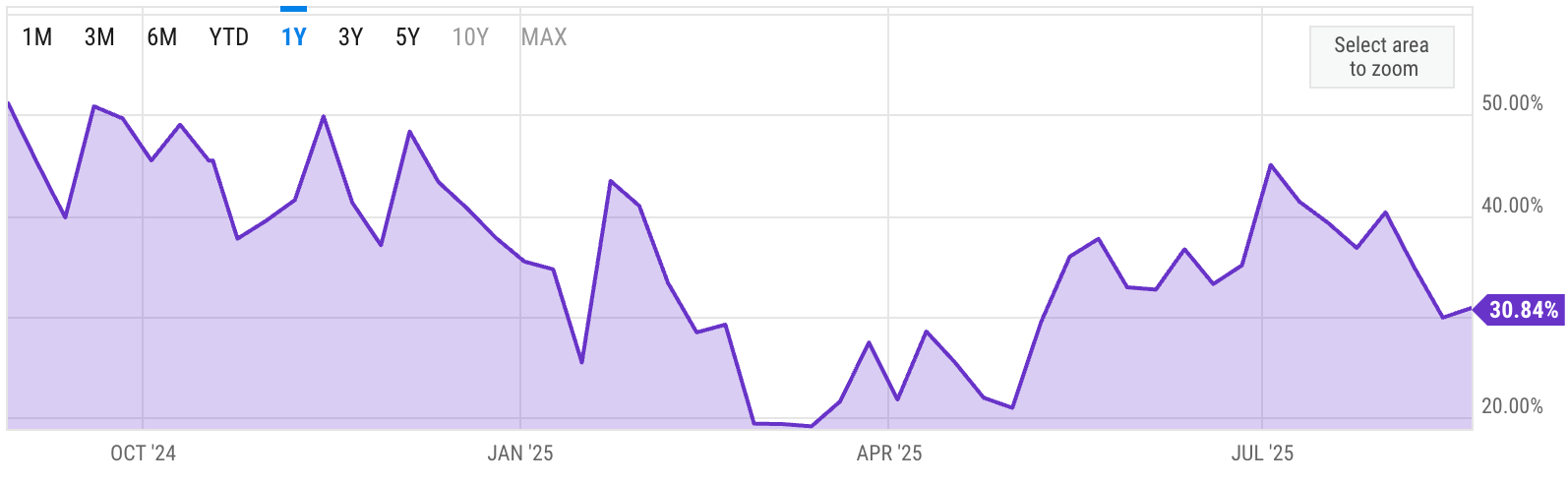

US Investor % Bullish Sentiment:

↑ 30.84% for Week of AUG 21 2025

Previous week: 29.88%

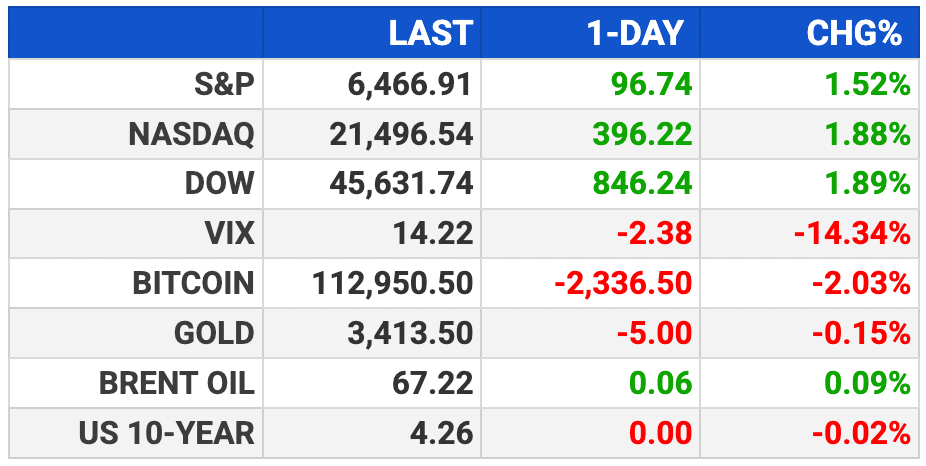

Market Wrap:

Dow futures +5 pts (+0.01%); S&P -0.03%; Nasdaq -0.06%

Dow +846 pts Fri; S&P +1.5% to 6,466.91; Nasdaq +1.9% to 21,496.53

Powell signaled Sept cuts possible; odds jump to 84%

Rotation trade: tech soft, cyclicals/value in favor

Nvidia Wed, Dell & Marvell Thurs — key for tech momentum

Fri: July PCE inflation, Fed’s preferred gauge

EARNINGS

Here’s what we’re watching this week:

WED: Crowdstrike $CRWD ( ▼ 7.95% ), HP $HPQ ( ▲ 1.36% ), *Kohl’s $KSS ( ▼ 2.49% )

*Royal Bank of Canada $RY ( ▲ 1.04% ) - earnings of CA$3.31 per share (+1.5% YoY) on CA$16.03B revenue (+9.6% YoY)

Nvidia $NVDA ( ▲ 1.02% ) - NVDA stock is up more than 30% in 2025 vs a gain of about 10% for the S&P 500

THU: Best Buy $BBY ( ▼ 2.75% ), Dell $DELL ( ▲ 2.7% ), *Dollar General $DG ( ▼ 0.76% ), Gap $GAP ( ▲ 1.95% ), Petco $WOOF ( ▼ 0.39% ), Ulta Beauty $ULTA ( ▼ 1.43% )

FRI: Alibaba $BABA ( ▲ 0.12% )

This Isn’t About Politics. It’s About

Your Financial Future —

The video Louis Navellier just recorded from his Palm Beach estate may be the most important of his entire career.

Because what he's seeing right now isn't just another market correction. It's something far more profound.

And it starts with what President Trump's new tariffs and the DOGE initiative are really setting in motion. What looks like routine policy is actually the catalyst for the most aggressive wealth transfer in modern American history. This isn't about politics. It's about your financial future.

HEADLINES

Investors zero in on Nvidia results as US tech stocks waver (more)

Key takeaways from the Fed’s annual Jackson Hole conference (more)

US inflation to edge up as Powell shifts on job market (more)

Wall Street favors vanilla options rather than VIX to hedge (more)

Trumponomics: POTUS goes on an investment spree (more)

Import slide continues after early peak (more)

Businesses scramble as 'de minimis' tariff exemption set to end (more)

Fitch affirms US credit at 'AA+', rising debt a ratings constraint (more)

Global equity fund inflows cool on caution over tech sector selloff (more)

Bubble risks grow as China’s stock bull run defies economy angst (more)

ECB rate cut talk may resume after September pause (more)

The AI vibe shift is upon us (more)

Credit is fueling the AI boom — and fears of a bubble (more)

Cracker Barrel loses $100M in value after new logo release (more)

TOGETHER WITH THE FLYOVER

This 611% Growth Proves the Mainstream Media Is Dying

As millions tune out of the legacy news, advertisers and investors are looking elsewhere.

The Flyover is bringing back fact-based journalism without corporate agendas or algorithm games. And it’s working: 2.5M+ readers, 611% yearly growth.

You can invest in their national expansion.

Learn more and invest in The Flyover.

This is a paid advertisement for The Flyover’s Regulation CF offering. Please read the offering circular at https://invest.jointheflyover.com/.

DEALFLOW

M+A | Investments

Coca-Cola explores sale of Costa Coffee

Keurig Dr Pepper reportedly nearing an ~$18B deal for JDE Peet’s

Crescent Energy nears deal for Vital Energy

Yageo raises offer for Shibaura Electronics

Applied Value receives growth investment from Trivest Partners

VC

Group14 Technologies raised $463M in Series D to advance silicon battery-anode manufacturing, backed by SK, Porsche, others

FieldAI, a developer of “universal robot brains,” raised $405M in a round co‑led by Bezos Expeditions, Temasek, others

Nuro raised $203M in Series E funding led by Nvidia, Uber, others

restor3d, a leader in personalized orthopedic solutions, secured a $104M strategic investment.

Eight Sleep, an AI-powered sleep‑fitness tech company (NYC), raised $100M in funding

Twin Health, a metabolic health company, raised $53M in Series E funding at a $950M+ valuation

The Better Meat Co., a maker of plant-based meats, raised $31M in Series A funding

Pylon, a B2B support platform for post-sales teams, raised $31M in Series B funding

Agenda Hero, an AI platform focused on improving calendar workflows, raised $6.5M in funding

Oway secured $4M to develop a decentralized freight‑booking platform

CRYPTO

BULLISH BITES

🍎 Scoop: Trump's new "Apple Store".

🛍 Why brands seem to keep getting it so wrong.

⏳. America's young people are delaying adulthood milestones

🏚 What wealthy parents need to know about giving real estate to their kids.

🍽 Dining rooms are disappearing from new floor plans.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.