☕️ Good Morning.

The Fast Five → Fed holds rates and indicates three cuts coming in 2024, Dow closes above 37,000 for the first time, Tesla recalls nearly all vehicles to boost autopilot safeguards, Etsy lays off 11% of its staff, and OpenAI and Axel Springer strike unprecedented deal to offer news in ChatGPT. Full briefing ahead, but first…

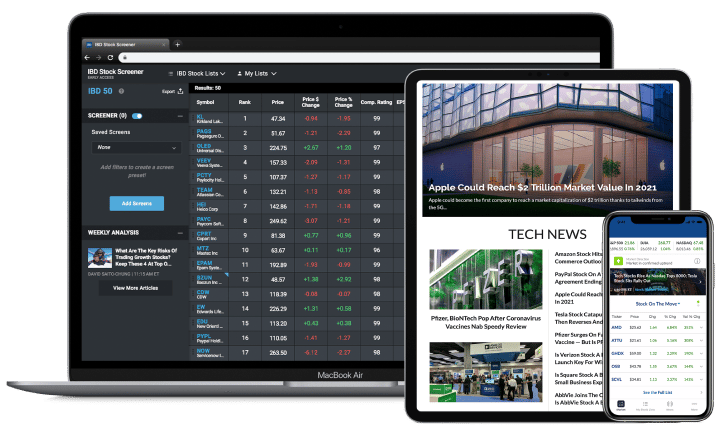

For over 35 years, Investors Business Daily has learned what it takes to outperform the market and help investors like you gain an edge. Don’t miss another day —

Limited-time offer for MB readers: Grab IBD's Premium Annual Subscription today for only $249 - it’s like getting 5 months free!

Here’s your 5-min briefing for Thursday:

BEFORE THE OPEN

As of market close 12/13/2023.

MARKETS:

Dow hits record high, closing above 37,000 for the first time.

S&P 500 crosses 4,700, also reaching levels last seen in January 2022.

Nasdaq climbs with all three major indexes hitting fresh 52-week highs.

Federal Reserve signals plans for three rate cuts in 2024, citing eased inflation.

Inflation forecast lowered to 2.4% for 2024, down from 2.6%.

EARNINGS

What we’re watching this week:

Today: Lennar (LEN)

Costco Wholesale (COST) - expected: $3.41 per share (+11.1% YoY) on $57.7 billion revenue (+8.1% YoY)

Friday:

Darden Restaurants (DRI) - expected: $1.73 per share (+13.8% YoY) on $2.7 billion revenue (+8.0% YoY)

Full earnings calendar here

NEWS BRIEFING

Dow ends at record high as Fed says it sees lower borrowing costs in 2024 (more)

10-year Treasury yield drops to lowest level since August as Fed forecasts easing rates 3 times next year (more)

Wholesale prices held flat in November, providing another encouraging inflation signal (more)

House approves resolution demanding MIT, Harvard presidents resign after antisemitism testimony (more)

Mortgage refinance applications surge as rates drop to 6-month low (more)

FCC votes to ban termination fees for cable and satellite services (more)

China makes plans to revive economy in 2024 (more)

China chip firm powered by US tech and money avoids Biden's crackdown (more)

Etsy stock falls after company lays off 11% of its staff, citing ‘very challenging’ environment (more)

Citi offers partial early bonuses to encourage staff departures (more)

SpaceX valuation climbs to $180 billion (more)

OpenAI, Axel Springer strike unprecedented deal to offer news in ChatGPT (more)

Man Group CEO Robyn Grew Says Asset Managers Ready for M&A Wave (more)

Apple now requires a judge's consent to hand over push notification data (more)

Nestle CEO sees weight-loss drugs lifting vitamin sales (more)

McDonald's concept CosMc's could win the coffee war against Starbucks and Dunkin' (more)

TOGETHER WITH INVESTORS BUSINESS DAILY

Start investing smarter.

For over 35 years, Investor’s Business Daily has armed people like you with the tools and strategies to consistently outperform the market and prosper — no matter the conditions. Now, in a single subscription, you can access all their pro-level tools and strategies designed to boost your profits.

“Investor’s Business Daily delivers information you

can’t get anywhere else.” -Mike G., subscriber

🔥 Exclusive Offer for MarketBriefing readers: Grab IBD's Premium Annual Subscription today for only $249 - it’s like getting 5 months free! Act quickly, this is a limited-time offer you won’t find anywhere else.

DEALFLOW

M & A | INVESTMENTS:

AbbVie pays $10.1B for drugmaker ImmunoGen (more)

Carlyle weighs $4.6 billion exit for Switzerland’s Acrotec (more)

CD&R acquires snack foods manufacturer Shearer’s Foods (more)

Integra buys Ethicon for up to $280M (more)

Windjammer Capital acquires Bio X Cell (more)

Bain Capital buys controlling stake in Swedish infrastructure firm Eleda (more)

Cognizant has entered into an agreement to acquire Thirdera, an Elite ServiceNow Partner specializing in advisory, implementation and optimization solutions related to the ServiceNow platform (more)

Help at Home PE owners reportedly weigh sale of $3B Healthcare Firm (more)

Accel-KKR invests in Ntracts (more)

WTWH Media, a Cleveland, OH-based digital-first B2B media and marketing company, acquired Engineering.com, a leading digital B2B media company (more)

Morrow Sodali, a company specializing in stakeholder engagement advisory services, acquired Domestique, a corporate communication and reputation management company (more)

Perion Network, a multi-channel advertising technology company, acquired Hivestack Inc., a programmatic digital out of home (DOOH) company (more)

VC

Tome Biosciences, Inc., a programmable genomic integration company, raised $213M in Series A and B funding (more)

Bicara Therapeutics, a clinical-stage biotechnology company developing dual-action biologics to elicit a potent and durable immune response, closed a $165M Series C financing (more)

Twin Health, a creator of the Whole Body Digital Twin™ service for reversing, improving, and preventing chronic metabolic diseases, raised $50M in funding (more)

Zuper, a provider of solutions to scale and modernize fast-growing businesses with field operations, closed a $32M Series B funding (more)

Dimensional Energy, a provider of carbon utilization technology, Sustainable Aviation Fuel production and advanced carbon emissions-derived fuels and materials, raised $20M in Series A funding (more)

Verve Motion, a wearable robotics technology company, raised $20M in Series B funding (more)

Chalk, a provider of a data platform for machine learning, raised $10M in Seed funding (more)

Encellin, a biotechnology company developing a cell encapsulation platform with an initial focus on Type 1 Diabetes, closed a $9.9M financing round (more)

Delphina, an LLM-powered copilot for data science, closed a $7.5M seed funding round (more)

AllSpice.io, a provider of a hardware development platform for empowers engineers to modernize their collaboration and workflows, raised Additional $6M in Venture funding (more)

Featureform, an MLOps feature store for building AI and ML systems, raised $5.5M in Seed funding (more)

Inductive Bio, a technology company developing a machine learning (ML) platform designed to accelerate the compound optimization process, raised $4.3M in Seed funding (more)

Stem Cell Implants, a provider of biotechnology dental implant, raised an undisclosed amount in Seed funding (more)

Provision IAM, a technology company specializing in Identity Security for financial institutions, raised an undisclosed amount in funding (more)

Powerside, a provider of power monitoring solutions, received a growth funding of undisclosed amount from Energy Growth Momentum (more)

SellersFi (formerly SellersFunding), a FinTech offering innovative financial products to online sellers, raised a funding round of undisclosed amount (more)

Zafrens, a multi-modality drug discovery company, raised $23M in funding (more)

FUNDRAISING

Falfurrias Management Partners, a lower middle-market private equity firm, closed Falfurrias Growth Partners I (FGP), at $400M (more)

Was this briefing forwarded to you? Sign Up Here

CRYPTO

BULLISH BITES

✨ Magic: With AI Studio, Google launches an easy-to-use tool for developing apps and chatbots based on its Gemini model.

🍫 Shortlist: The 13 best chocolates in 2023, tested and reviewed by a professional chocolatier.

🛍 OutShein’d: How Shein outgrew Zara and H&M and pioneered fast-fashion 2.0.

🤑 Pay to play: Welcome to the ad-free internet.

🐝 2024: Want to start your own newsletter? The new year is a perfect time and Beehiiv has everything you need in a single platform (and it’s so easy!)… start your free trial now

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

Disclaimer: MarketBriefing is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the MarketBriefing team.