☕️ Good morning.

The Fast Five → Fed sees rates staying high for some time- minutes show, TikTok eyes $17.5B shopping business on Amazon’s turf, Xerox cuts 15% of workforce, bankruptcies surged 18% in 2023, and Starbucks now accepts personal cups in drive-thru, mobile orders…

Here’s your 5-minute briefing for Thursday:

BEFORE THE OPEN

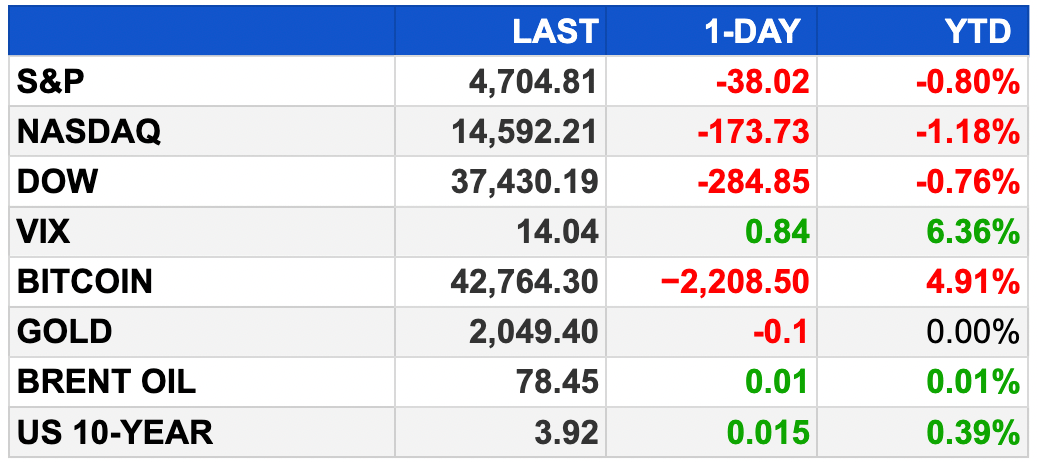

As of market close 1/3/2024.

MARKETS:

Nasdaq falls for second consecutive day.

S&P 500 and Dow also decline.

Tech stocks, including Apple, Nvidia, Tesla, and Meta, under pressure.

10-year Treasury yield briefly rises above 4%.

Uncertainty around Fed rate cuts dampens investor enthusiasm.

Market experiences short-term correction.

Fed meeting minutes reveal no immediate rate cuts, but expectations for three cuts this year.

Major averages rebounded in 2023 after a tough 2022.

EARNINGS

What we’re watching this week:

Today: Conagra (CAG), Lindsay Corp (LNN)

Walgreens Boots Alliance (WBA) - expected: $.63 per share (-45.7% YoY) on $34.9 billion revenue (+4.5% YoY)

Friday:

Constellation Brands (STZ) - expected: $3.00 per share (+6.0% YoY) on $2.5 billion revenue (+4.2% YoY)

Full earnings calendar here

HEADLINES

Key takeaways from minutes of Fed’s December rate meeting (more)

Dollar extends New-Year Rally as Traders Hope for Clues on Fed (more)

Job openings nudged lower in November, down to 1.4 per available worker (more)

Unemployed Americans are being forgotten in a strong job market (more)

US bankruptcies surged 18% in 2023 and seen rising again in 2024 (more)

Manhattan home prices rise in early sign of a market rebound (more)

Oil prices rise more than 3% on mounting Middle East tensions, OPEC pledge to support market (more)

Shell joins BP in ramping up dispute with key US gas exporter (more)

Morgan Stanley’s Gorman says proposed bank rules will change (more)

Xerox to cut 15% of its workforce (more)

Samsung to announce new phones ‘powered by AI’ on Jan. 17 (more)

Disney will work with ValueAct to counter billionaire Nelson Peltz (more)

GM’s 2023 US vehicle sales were its best since 2019 (more)

SpaceX launches first cell service satellites with T-Mobile (more)

Starbucks now accepts personal cups for drive-thru and mobile orders (more)

Evercore sees private equity deals bouncing back as funds seek cash for partners (more)

TOGETHER WITH INVESTOR’S BUSINESS DAILY

Experience IBD for just $1 —

Investor’s Business Daily has been helping people like you invest better for over 35 years. They’ve learned what it takes to outperform the market and prosper in any market condition. IBD Digital gives you an edge with one-of-a-kind investing tools and analysis designed for investors at every level.

✅ Unlimited access to IBD Digital across platforms and devices

✅ Access 14 exclusive IBD stock lists

✅.Proprietary investing tools & IBD ratings for 5,000+ stocks

✅ Best-in-class training webinars, podcasts, videos and more

Don’t miss out on this limited-time offer you won’t find anywhere else.

~ please support our sponsors ~

DEALFLOW

M & A | INVESTMENTS

SoftwareOne acquires Novis Euforia, a SAP and cloud services provider (more)

Dakota Wealth Management, an independent investment management firm, acquired C2C Wealth Management, LLC, an SEC registered investment advisory firm managing approximately $350M (more)

Renovus Capital invests in Behavioral Framework (more)

Myers Industries (NYSE: MYE), a manufacturer and distributor of industrial products, acquired Signature Systems, a company specializing in composite ground protection solutions, for approximately $350M (more)

Traliant, a provider of online compliance training solutions, acquired Kantola Training Solutions, an eLearning company serving over 15,000 organizations (more)

SonicWall, a cybersecurity company, acquired Banyan Security, a provider of security service edge (SSE) solutions for the modern workforce (more)

Systm Foods, a provider of a functional beverage brand platform, acquired HUMM Kombucha, a company working in the field of a low and zero-sugar kombucha and gut health beverage category (more)

Leeds Equity Partners acquired Big Blue Marble Academy (more)

Advent-backed Imperial Dade purchases Insight Distributing (more)

Proof of the Pudding buys Southern Crust Catering (more)

Black Bay acquires Merichem Company’s technology business unit (more)

PE-backed Mercer Advisors purchases $465M RIA Transitions Wealth Management (more)

Arcline-backed DwyerOmega buys Miljoco (more)

VC

Intel Corp. and DigitalBridge Group, Inc., a global investment firm, announced the formation of Articul8 AI, Inc., an independent company offering enterprise customers a full-stack, vertically-optimized and secure GenAI software platform (more)

Remix Therapeutics, a clinical-stage biotechnology company developing small molecule therapies, raised $60M in funding (more)

Aqua Security, a company specializing in cloud native security, raised $60M in funding (more)

Radionetics Oncology, a clinical stage radiopharmaceutical company focused on the discovery and development of novel agents for the treatment of a wide range of oncology indications, raised $52.5M in Series A funding (more)

Vita Inclinata Technologies, a company specializing in intelligent lifting hardware and software for rescue crews and other field safety applications, raised $44M in funding (more)

Apollo Therapeutics, a portfolio biopharmaceutical company focused on translating fundamental medical research into medicines, raised $33.5M in second close of its Series C financing (more)

BioCentriq, a cell-based therapy contract development and manufacturing organization, raised $29.2M in Series A funding (more)

Heranova Lifesciences, a biotech company for women’s health, raised $13.5M in Seed+ funding (more)

Intrinsic, a startup building AI systems for Trust & Safety teams to keep up with abuse, raised $3.1M in seed funding (more)

Vasa Therapeutics, a preclinical stage biopharmaceutical company developing novel therapies for cardiovascular aging, closed a Seed funding of $6M supplemented by $2.3M non-dilutive grant funding (more)

iFlock Security Consulting, a boutique cybersecurity company, raised an undisclosed amount in funding (more)

Graviton Biosciences, a NYC-based biotechnology company, raised an undisclosed amount in funding (more)

FUNDRAISING

Baird Capital, an investment firm focused on B2B technology & services companies, closed its sixth U.S. venture capital fund with a total of $218M (more)

NewSpring, a family of private equity strategies investing in the lower-middle market, raised over $180M for fourth growth equity healthcare fund, NewSpring Health Capital IV (more)

Banner Ridge raises $2.15B for flagship Secondary Fund (more)

Forward closes debut fund at $425M Hard Cap (more)

Was this briefing forwarded to you? Sign Up Here

CRYPTO

BULLISH BITES

💸 Ouch: Best-selling personal finance author, Robert Kiyosaki, says he’s more than $1 billion in debt.

🛳 Amazing: New AI satellite imagery show the clearest picture yet of human activity at sea.

👩🦳 New norm? AI-created “virtual influencers” are stealing business from humans.

💼 Get hired: How to get a job in the age of AI, according to a top LinkedIn exec.

🔥 Exclusive offer for MB readers: Try Investor’s Business Daily Digital now for one full month and get Unlimited Access to IBD Digital across platforms and devices. Don’t miss out on this limited-time offer! (cancel anytime)

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

Disclaimer: MarketBriefing is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the MarketBriefing team.