Good morning.

The Fast Five → China’s new trade negotiator is ready to play hardball, Google could fall 25% in 'black swan event’, finance leaders fear destructive US debt scenario, Robinhood’s Bitstamp deal takes it beyond retail trading, and Elon Musk returns to his tech empire…

📌 NEW THIS WEEK: Energy Discovery In Utah - The Department of Energy says it could power America for millions of years. Buffett, Bezos, Zuckerberg, and Bill Gates are all directly invested. Here's the name of the company at the heart of it all. (ad)

Calendar: (all times ET) - Full Calendar

Today:

Factory orders, 10:00A

Job openings, 10:00A

Tomorrow:

Fed Beige Book, 2:00P

Your 5-minute briefing for Tuesday, June 3:

US Investor % Bullish Sentiment:

↓ 32.89% for Week of MAY 29 2025

Previous week: 37.70%. Updates every Friday.

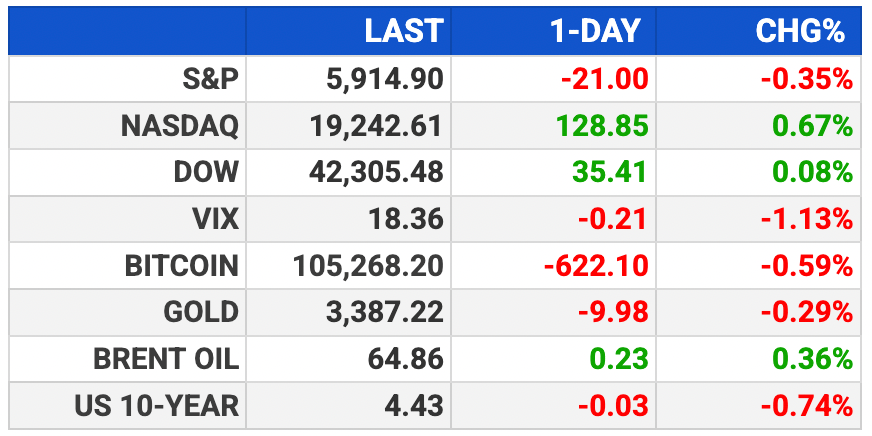

Market Wrap:

Futures edge down: S&P -0.2%, Nasdaq -0.2%, Dow 83 pts (-0.2%)

Monday’s close: S&P +0.41%, Nasdaq +0.67%, Dow 35.41pts (+0.08%)

US-China tensions flare again; trade talks at risk

EU slams Trump’s plan to double steel tariffs to 50%

Volatility remains high, but seasonality favors short-term gains

EARNINGS

Here’s what we’re watching this week:

Today: Hewlett Packard $HPE ( ▼ 0.09% )

CrowdStrike $CRWD ( ▼ 7.95% ) - of $.66 per share (-29% YoY) on $1.1B revenue (+20% YoY)

Wednesday: Five Below $FIVE ( ▲ 1.91% )

Dollar Tree $DLTR ( ▲ 0.7% ) - earnings of $1.20 per share (-16% YoY) on $4.5B revenue (-40.7% YoY)

Thursday: Lululemon $LULU ( ▲ 2.42% )

Broadcom $AVGO ( ▼ 0.4% ) - earnings of $1.57 per share (+42.7% YoY) on $15B revenue (+19.9% YoY)

TOGETHER WITH BOXABL

The Father-Son Duo Revolutionizing Homebuilding

Paolo and Galiano Tiramani founded BOXABL with a disruptive idea: bring factory efficiency to homebuilding. Today, new homes can roll off their assembly lines in ~4 hours – already building 700+. Now, they’re prepping for Phase 2, combining modules into larger townhomes, single-family homes, and apartments. And until 6/24, you can share in their growth.

*This is a paid advertisement for Boxabl’s Regulation A offering. Please read the offering circular at https://invest.boxabl.com/#circular

HEADLINES

Wall St starts June with modest gains, dollar weakens, trade tensions flare (more)

Treasuries extend May slump as tariff concerns cloud outlook (more)

Federal retirement process goes digital, targeting paper pileup (more)

Finance leaders fear destructive US debt scenario (more)

Tariff gloom weighs on US manufacturing; delivery times lengthening (more)

Oil rises on Iran, Russia and Canada supply concerns (more)

Steel stocks surge after Trump doubles steel tariffs (more)

Elon Musk returns to his tech empire (more)

Microsoft cuts hundreds more jobs after firing 6,000 last month (more)

Robinhood’s $200M Bitstamp deal takes it beyond retail trading (more)

Temu's US users fell by 58% after Trump ended 'de minimis' loophole (more)

More office space being removed than added for the first time in 25 years (more)

DEALFLOW

M+A | Investments

Bristol Myers Squibb and BioNTech enter $11.1B cancer immunotherapy deal

Sanofi to buy US biopharma group Blueprint for up to $9.5B

Roark Capital buys restaurant chain Dave's Hot Chicken for $1 billion

Thiel-backed psychedelic drugmaker Atai to acquire rival Beckley

Snowflake to buy database startup Crunchy Data for about $250M

Baker Hughes to sell stake in unit to Cactus

VC

Musk's Neuralink raises $650M in latest funding round

TAE Technologies, a fusion energy company, raised $150M in funding

Infleqtion, a quantum information company, raised $100M in funding

Prepared, an assistive AI platform for emergency response, raised $80M in Series C funding

SpyGlass Pharma, an ophthalmic biotechnology company, raised $75M in Series D funding

Yieldstreet, a private markets investment platform, raised $45M in Series D funding

Rally UXR, a user research CRM platform, raised $11M in Series A funding

AgentSmyth, an autonomous agent platform for trading, raised $8.7M in Seed funding

Limited, a fintech company offering stablecoin-based banking with self-custody, raised $7M in Seed funding

LuminX, an AI inventory automation company, raised $5.5M in Seed funding

Dexari, a decentralized mobile crypto trading app, raised $2.3M in seed funding

Fisent Technologies, focused on applied GenAI process automation, extended its Seed funding, bringing the total to $2M

GC AI, a legal AI platform built for in-house counsel, closed a Series A funding round

CRYPTO

BULLISH BITES

🚀 New drilling breakthrough spawns second shale boom. *

🫣 Behind the Curtain: Trump's America-First AI risk.

🤖 McKinsey leans on AI to make powerPoints, draft proposals.

🍫 Why everyone is selling Dubai chocolate bars.

⛳️ The Robb Report’s 42 best Father’s Day gifts for the dad who has everything.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.