Good morning.

The Fast Five → CPI expected to show 'upside risks', Tesla ready to roll out Cybercab, Nvidia shares up 25% in the last month, VC investors wary of dealmaking despite market momentum, and hedge funds sold record Chinese stocks Tuesday…

📈 Why This $8 Stock Could Be the Best Investment of 2025 »

A message from BTM

Calendar: (all times ET) - Full calendar here

Today:

Initial jobless claims, 8:30 am

Consumer price index (CPI), 8:30 amTomorrow:

Producer price index (PPI), 8:30 am

Consumer sentiment, 10:00 am

Your 5-minute briefing for Thursday, October 10:

US Investor % Bullish Sentiment:

↓ 45.45% for Week of October 03 2024

Last week: 49.62%. Updates every Friday.

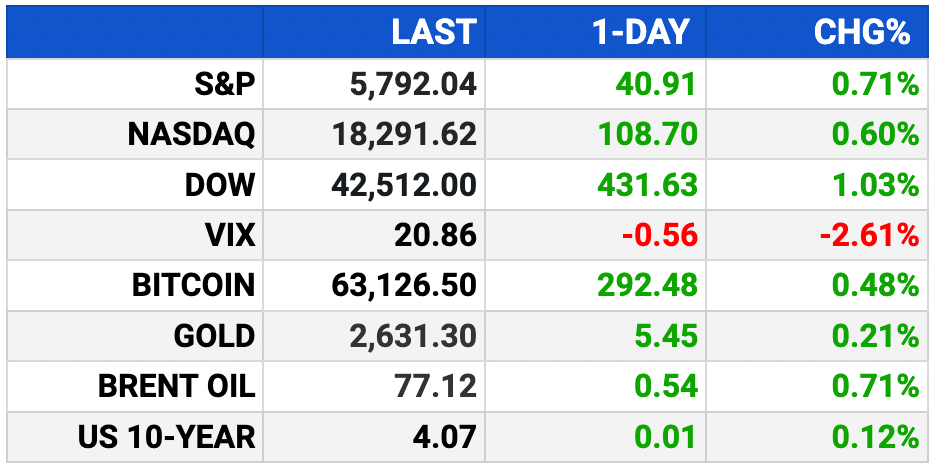

Market Wrap:

Stock futures flat ahead of CPI report.

S&P 500 and Dow hit record closes, Dow up 400+ points.

Tech stocks lift Nasdaq by 0.6%.

CPI expected to rise 0.1% monthly, 2.3% annually.

CPI could shape Fed's next move; 70% chance of a 25-point rate cut.

EARNINGS

Earnings we’re watching this week:

Today:

Delta Air Lines (DAL) - earnings of $1.55 per share (-23.6% YoY) on $14.77B revenue (+1.5% YoY)

JPMorgan Chase (JPM) - earnings of $4.01 per share (-7.4% YoY) on $41.7B revenue (+5.1% YoY)

See full earnings calendar here.

HEADLINES

Powell’s half-point cut is hard to repeat with Fed in no hurry (more)

S&P 500 hits record high in run-up to CPI report (more)

Treasury yields slightly higher as investors await inflation data (more)

China revives stocks rally, traders await US inflation test (more)

Hedge funds sold record Chinese stocks on Tuesday, Goldman says (more)

Oil gains as traders monitor Middle East while stockpiles climb (more)

Gold price edge lower as traders eye US CPI data (more)

Nvidia up 25% in last month, rallying near record ahead of tech earnings (more)

Berkshire Hathaway raises $1.9B in Samurai bonds, term sheet shows (more)

Tesla sells $783M of prime auto lease-backed debt (more)

BlackRock among suitors exploring purchase of credit firm HPS (more)

VC investors wary of dealmaking despite stock market momentum (more)

A MESSAGE FROM BTM

The $8 Stock That Could Slash Healthcare Costs by $1.7 Trillion

Science Magazine called it the "breakthrough of the year"...

A brand-new superdrug that is so lucrative...

Some expect it to become the best-selling drug EVER...

With projections of 8,966% growth in the next four years.

It could slash healthcare costs by $1.7 trillion in the US alone...

And ONE tiny firm (trading for only $8) holds a key patent on it.

- sponsored message -

DEALFLOW

M+A | Investments

Couche-Tard hikes bid for 7-Eleven owner to $47B (more)

Arnault poised to buy Paris FC Football Club with Red Bull (more)

Tritax EuroBox agrees $1.44B deal with Brookfield, snubs Segro (more)

Rio Tinto goes all in on lithium with $6.7B Arcadium buy (more)

Stellantis set to secure Italian approval for Comau stake sale (more)

Green Cabbage, a company offering a subscription-based model with a savings guarantee, received an investment from Sorenson Capital (more)

Babson Diagnostics, a science-first healthcare tech company, received a strategic investment from Becton Dickinson and Company (more)

Polaris Laboratories, a fluid analysis company, received a strategic investment from Riverspan Partners (more)

VC

Zap Energy, a liquid-metal-cooled fusion test platform, raised $130M in Series D funding (more)

ShiraTronics, a clinical-stage medical device company, raised $66M in Series B funding (more)

Arda Therapeutics, a company specializing in therapies for chronic diseases, raised $43M in Series A funding (more)

Logik.io, a company empowering CPQ and enterprise selling experiences, raised $25M in Series B funding (more)

Unify, a go-to-market tech platform enabling companies and teams to drive customer interactions, raised $19M in Series A and Seed financing (more)

Airloom, a renewable energy company specializing in wind power, raised $13.75M in Seed funding (more)

Claim, a viral social app, raised $12M in Series A funding (more)

OpenGradient, an AI infrastructure company, raised $8.5M in Seed funding (more)

Cyrisma, a risk management platform, raised $7M in Series A financing (more)

Prime Security, a company ensuring orgs have the tools to implement security at the design phase, raised $6M in Seed funding (more)

Cove, a hyper-visual AI collaboration space, raised $6M in seed funding (more)

MeWe, a privacy-first social media network, raised initial $6M in Series B funding (more)

TreQ Global, a quantum computing company, raised $5+M in Seed funding (more)

Molg, a robotic microfactory company, raised $5.5M in Seed funding (more)

Truthset, a data validation-as-a-service offering company, raised $5M in Series A funding (more)

Drawer AI, an AI-powered estimating system, closed a $5M Seed funding round (more)

Vultron, an AI-powered proposal development solution for the public sector, raised $4.85M in seed funding (more)

Holobiome, biotech products that improve health through multiple marketplaces, raised an undisclosed amount in Seed funding (more)

CRYPTO

BULLISH BITES

🚨 Investor Alert: Ex-Wall Street CEO reveals “Millionaire-Maker” Superdrug *

🚖 Tesla Robotaxi Reveal: What to expect.

➗ The Buzz: The math that explains how multi-strat hedge funds make money.

🤖 Inside Look: Wired explores the talent exodus at OpenAI and its implications for the company's future.

✈️ Get Air: He flies business and first class many times a year — all on credit card points.

What did you think about today's briefing?

hitHave a comment or suggestion?

💌 Send us a message

*from our sponsor

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.