Good morning.

The Fast Five → Nvidia CEO says AI boom is ‘real, not a bubble’, Trump urges Bessent to take Federal Reserve job, Fed minutes: ‘many’ officials lean against December cut, bond market wagers on Fed rate cut crumble, and Alphabet soars on ‘Rave Reviews’ for new Gemini 3 AI model…

📌 Get out of "The World's Most Crowded Trade" now — Megacap tech stocks – like Nvidia and Microsoft – are the most popular trade in the world. Yet, 78% of Wall Street fund managers believe an event is coming soon that could kill this trade and incite total "regime change" in the stock market. Watch Futurist Eric Fry's "Sell This, Buy That" broadcast for 7 alternative plays to help protect yourself from big tech's potential downturn — all the analysis, names, and tickers right here → (ad)

Calendar: (*Shutdown may affect key data. All times ET) - Full Calendar »

Today:

Unemployment Claims (tentative)

Existing Home Sales, 10:00A

Tomorrow:

Flash Manufacturing PMI, 9:45A Flash Services PMI, 9:45A

Your 5-minute briefing for Thursday, Nov 20:

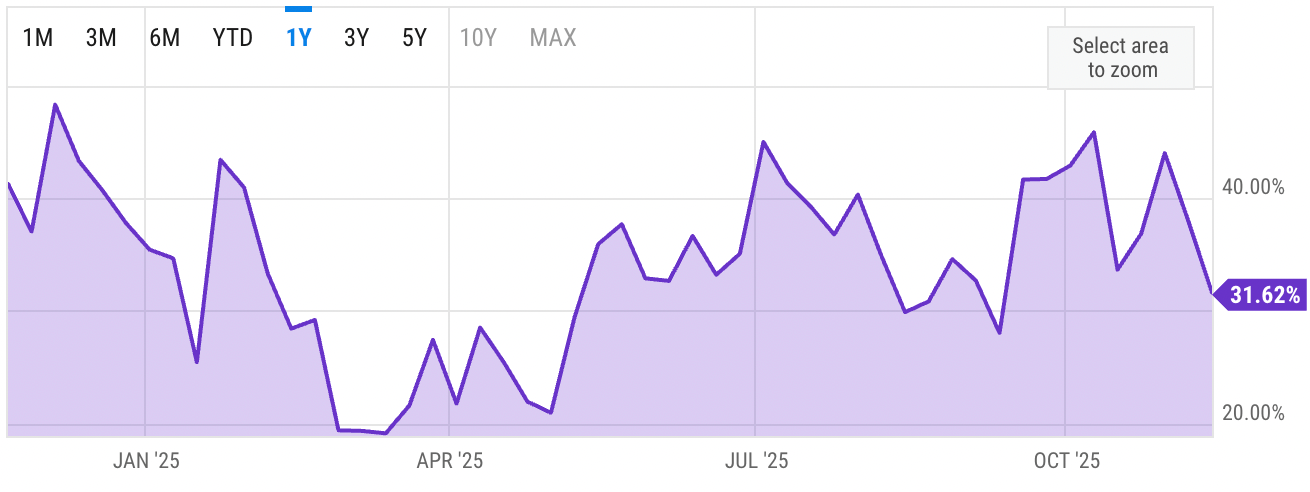

US Investor % Bullish Sentiment:

↓31.62% for Week of NOV 13 2025

Previous week: 37.97%

Market Wrap:

Futures higher: Dow +222 (0.5%), S&P +1.1%, Nasdaq +1.6%.

Nvidia +5% after crushing Q3 and guiding above forecasts.

CEO Huang: demand for Blackwell chips “off the charts.”

AI sentiment rebounds; AMD, Broadcom, Eaton gain after hours.

S&P, Dow snapped 4-day slide Tuesday but still down for week.

Fed minutes show split on cuts; odds of Dec cut now 33%.

September jobs report due today after shutdown delay.

EARNINGS

Here’s what we’re watching this week:

Today: Gap $GAP ( ▲ 1.95% ), Ross Stores $ROST ( ▲ 0.53% ), Webull $BULL ( ▼ 0.84% )

*Walmart $WMT ( ▼ 1.51% ) - EPS of $.60 (+3.4% YoY) on $175.14B revenue (+4.3% YoY)

Sell Nvidia and replace it with WHAT?! The truth behind Eric Fry's off-the-wall trade idea…

Eric Fry is breaking ranks with Wall Street by saying "Sell Nvidia." Because history, he says, is repeating itself. In 2000, Eric Fry told Barron's that folks should sell one of the dot-com boom's most beloved stocks right before it fell more than 90%.

Now, he says investors need to replace Nvidia stock with a much better alternative – before their money is wiped out.

- a message from Eric Fry, InvestorPlace Digest -

HEADLINES

Tech rebound helps S&P 500 snap four-day slump (more)

Fed minutes show ‘many’ officials lean against December cut (more)

US trade deficit drops 24% as Trump's tariffs reduce imports (more)

BLS cancels October jobs report, couldn’t collect some data (more)

US, Saudi tout new business deals at investment forum (more)

US approves sale of 35k AI chips to UAE’s G42, Saudis’ Humain (more)

Bond market wagers on Fed rate cut crumble on jobs data void (more)

Companies to hash out future of AI exports program with Trump official (more)

It's OK, Nvidia says there's no AI bubble (more)

Alphabet soars on ‘rave reviews’ for Gemini 3 AI model (more)

Target plans another $1 bln investment to jumpstart sagging sales (more)

Musk's xAI to build 500 megawatt data center in Saudi Arabia (more)

Kraken confidentially files for IPO following $800M raise (more)

Meta chief AI scientist is leaving to create his own startup (more)

Blue Owl scraps merger of private credit funds after selloff (more)

DEALFLOW

M+A | Investments

Palo Alto Networks to buy Chronosphere for $3.35B

Schneider Electric seals $2.3B in US data centre deals to power AI boom

Adobe will acquire Semrush for $1.9B

Elliott inks deal to buy up to $6.5B of Klarna’s US loans

VC

Lambda, a superintelligence cloud, raised over $1.5B in Series E funding

Suno, a music tech company built to amplify imagination, raised $250M in Series C funding

Profluent, a leader in frontier AI for protein design, raised $106M in financing

Arbiter, a care orchestration platform, raised $52M in funding

Method Security, a cybersecurity company, raised $26M in combined Seed and Series A funding

Bedrock Data, a DSPM platform for data-centric security, governance and management, raised $25M in Series A funding

Modern Life, an AI-powered life insurance company, raised $20M in Series A funding

Tulu, a platform to enhance the living experience for residents, raised an additional $17M in Series A funding

Jiga, an AI-driven sourcing platform, raised $12M in Series A funding

Manta Cares, a digital health company focused on improving the cancer experience, raised $5.4M in Seed funding

Synthio Labs, a clinical-grade voice AI company, raised $5M in Seed funding

Athian, a platform that helps farmers adopt science-based practices and called protocols, raised $4M in Series A funding

Kaaj, an agentic AI credit intelligence platform that simplifies small business lending, raised $3.8M in Seed funding

Orion, an AI-driven risk intelligence company, raised $3.5M in funding

KERV.ai, a company specializing in AI-powered video analysis, performance, and monetization, raised Series B funding

The Vault Just Opened on a $2T Market Opportunity

Elf Labs owns 100+ priceless trademarks for icons like Cinderella & Snow White. They’ve already earned $15M+ in royalties, and are now using AI to turn these legends into living, interactive worlds for the next generation. With patented tech & a $2T market opportunity ahead, the next chapter of entertainment is being written in real time.

This is a paid advertisement for Elf Lab’s Regulation CF offering. Please read the offering circular at https://www.elflabs.com/

CRYPTO

BULLISH BITES

💥 What to expect if this economic cycle mirrors 2001.

🤪 Even Sundar Pichai thinks the AI investment boom has “elements of irrationality.”

📚 OpenAI launches bespoke ChatGPT for teachers.

⌛️ 10 subtle signs that you are ready to retire.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.