Good morning.

The Fast Five → Inflation rose much more than expected, Fed gets more reasons to delay cuts, Biden opposes Nippon Steel's US Steel takeover plans, Blackstone says it’s a good time to buy real estate, and Mnuchin wants to buy TikTok…

Calendar:

Today: Consumer sentiment, 10:00am ET

Your 5-minute briefing for Friday, March 15:

US Investor % Bullish Sentiment:

45.90% for Wk of Mar 14 2024 (Last week: 51.73%)

Market Recap:

Stock futures flat: Dow down 10 pts, S&P 500 and Nasdaq stable.

Adobe plunges 11%, Ulta slides 6% post-earnings.

Wall Street dips: Dow -0.4%, S&P 500, Nasdaq -0.3%.

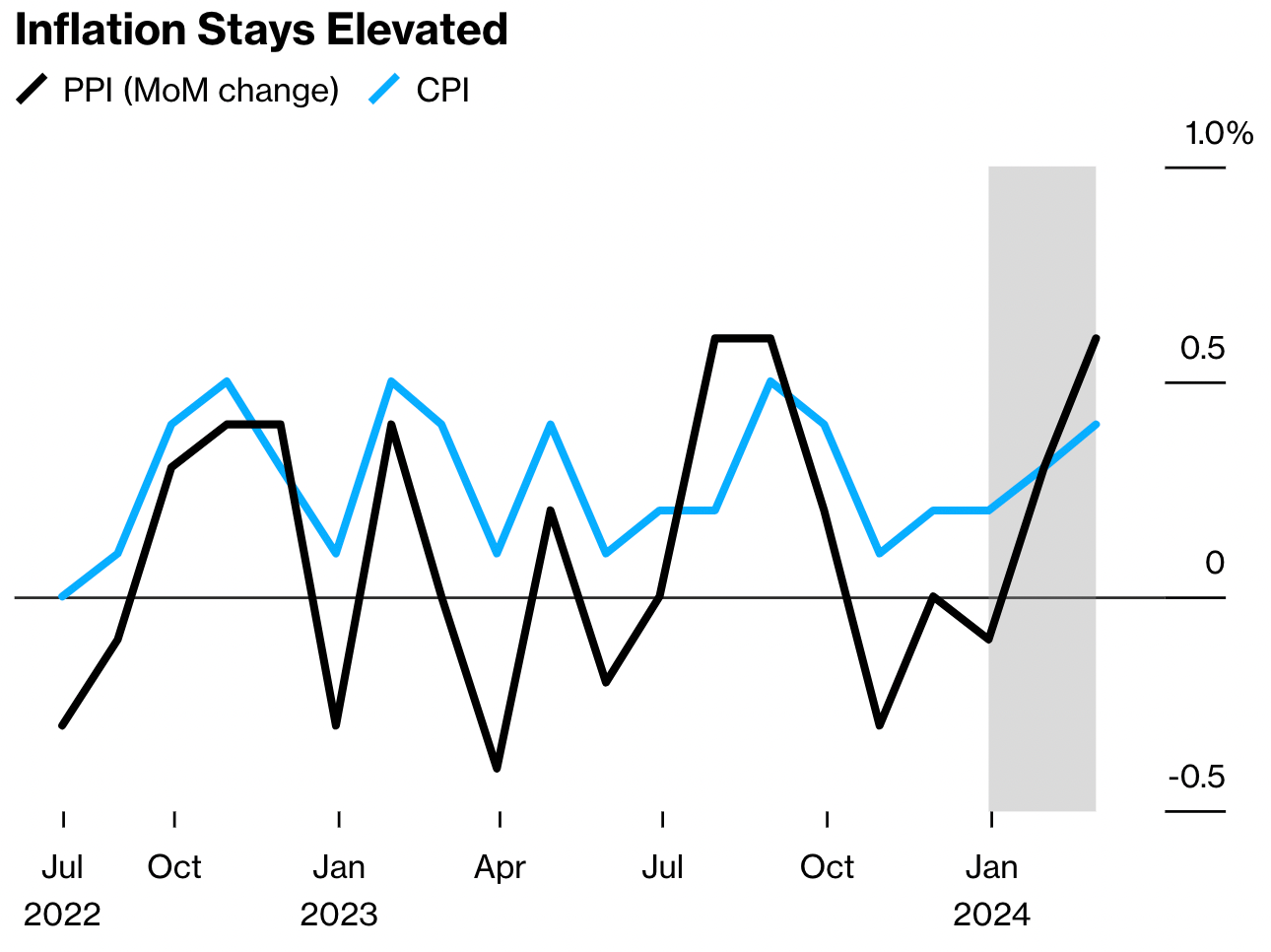

PPI higher-than-expected, bond yields climb.

Fed likely to hold rates steady next week, but strong data raises questions.

Despite losses, Dow, S&P 500 up 0.5%, Nasdaq up 0.3% for week.

Today: consumer sentiment, import prices, industrial production data.

EARNINGS

Watchlist for next week’s earnings will post Monday.

Full earnings calendar here

HEADLINES

Wholesale inflation rose 0.6% in February, much more than expected (more)

Biden opposes Nippon Steel's US Steel takeover plans (more)

US steel rival is ready to pick up the pieces if Nippon Steel deal collapses (more)

Dollar advances as US inflation data weighs on rates outlook (more)

Oil holds four-month high after IEA flips forecast to deficit (more)

Tech pulls down Asia stocks, dollar gains on inflation data (more)

S&P would need to rise 20% to look like 90s bubble (more)

Citadel, KKR, Blackstone mobilize to Ttmper SEC’s WhatsApp probe (more)

Good time to buy real estate as prices bottom, Blackstone says (more)

Morgan Stanley names a head of AI as Wall Street leans in (more)

NYCB reaps gain from the sale of more than $1 Billion of loans (more)

Dave Calhoun was hired to fix Boeing. Instead, ‘it’s become an embarrassment’ (more)

United Airlines close to leasing Airbus jets (more)

Bank of America revamps its capital markets division (more)

Fisker breaks silence about potential bankruptcy (more)

A MESSAGE FROM GOLDENCREST METALS

Brace for Impact: Don't Be Fooled By The Mainstream Media

We're raising the alarm – Jamie Dimon of JPMorgan has just forecast a colossal economic disaster for 2024-2025. We're facing a potential collapse, with chaos from Ukraine to the Middle East, and the Federal Reserve gambling with our financial future.

Make no mistake – this is a battle for your survival. The U.S. debt is skyrocketing, posing an unprecedented threat. Even Wall Street giants are scared. The "booming" stock market? It's a bubble on the brink of bursting, and the media is painting a rosy picture – don't buy it!

Take control now. Our No-Cost Wealth Management Guide isn't just advice – it's your survival kit in this economic battlefield.

Don't be a spectator in this economic showdown. Get your no-cost guide NOW.

To your unshakeable prosperity,

- GoldenCrest Metals

- please support our sponsors -

DEALFLOW

M+A | Investments

China Inc. plans sales worth billions of dollars (more)

Advent, H&F are among firms eyeing $3 Billion Synopsys Unit (more)

Platinum Equity explores $2+ Billion Club Car sale (more)

India's Manipal Health set to buy majority stake in Medica Synergie for $151M (more)

AstraZeneca acquired Amolyt Pharma, a clinical-stage biopharmaceutical company, for up to $1.05B (more)

MCS buys Five Brothers Asset Management Solutions (more)

My Salon Suite acquires Mera Salon and Spa Suites (more)

Stonepeak completes purchase of Textainer (more)

PublicSquare purchases Credova (more)

ArmorWorks Enterprises buys Fox Valley Metal-Tech (more)

DirectMed Imaging acquires Titanium Medical Imaging (more)

NewSpring invests in Shake Smart (more)

Nordic Capital invests in One Inc (more)

VC

inDrive, a provider of a mobility and urban services platform, raised an additional $150M investment from General Catalyst (more)

Nozomi Networks, a company specializing in OT and IoT security, raised $100M in Series E funding (more)

CarbonCapture, a direct air capture company, raised $80M in Series A funding (more)

Unstructured, a provider of tools to ingest and preprocess large language models, raised $40M in Series B funding (more)

HiLabs, a provider of AI-powered solutions to manage dirty data, raised $39M in Series B funding (more)

Pi Health, an oncology-focused health technology and clinical research company, raised over $30M in Series A funding (more)

SquareDash, a provider of a payment platform for the insurance restoration industry, raised over $20M in total funding (more)

WarpStream Labs, a cloud native data streaming infrastructure company, raised $20M in funding (more)

Interlune, a natural resources company, raised $18M in Seed funding (more)

Goodshuffle, a software company for the event rental and production industry, raised $5M in Series A funding (more)

Quintessent, a heterogeneous silicon photonics and quantum dot laser tech company, closed $11.5M in Seed funding round (more)

mmERCH, a blockchain-enabled Web3 fashion startup, raised $6.4M in seed funding round at $25.7M post-money valuation (more)

Redcoat AI, a cybersecurity company at the forefront of combating AI-powered threats, backed by $4.24M in funding (more)

Fluent Metal, a company developing production-grade liquid metal printing technology, raised $3.2M in funding (more)

Global Telecom Engineering, a hardware and software engineering company for the wireless industry, received an investment from Stormbreaker Ventures (more)

Voxeleron, an ophthalmic image analysis platform provider, raised an undisclosed amount in funding (more)

PowerGEM, a provider of simulation modeling software and technical services for the electric power indust (more)

CQL, a digital commerce agency, received a strategic investment from Superstep Capital (more)

CRYPTO

BULLISH BITES

💻 Big Tech: Google I/O developer conference is set for May 14, 15.

🥃 Sleuthing: On the trail with the whisky detectives.

🛑 Takedown: New York Times takes action against hundreds of Wordle clones.

🎓 Rate of return: A college degree offers better returns than the stock market - but it varies dramatically between majors.

💰 Take control: This No-Cost Wealth Management Guide isn't just advice – it's your survival kit in this economic battlefield. Download your no-cost guide NOW »*

*from our sponsor

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.