Good morning.

The Fast Five → S&P tops 5,300 in record-breaking stock rally, consumer inflation resumes downward trend fueling rate-cut bets, Biden and Trump agree to debate, Xi welcomes Putin, and GameStop, AMC tumble as meme stock rally fizzles…

Calendar: (all times ET)

Today: | Initial jobless claims, 8:30a |

Your 5-minute briefing for Thursday, May 16:

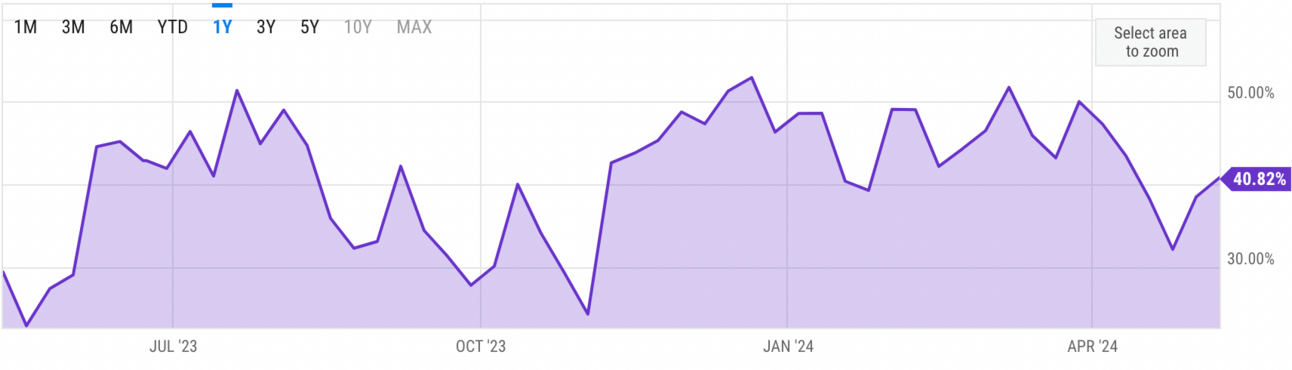

US Investor % Bullish Sentiment:

40.82% for Wk of May 09 2024 (Last week: 38.49%)

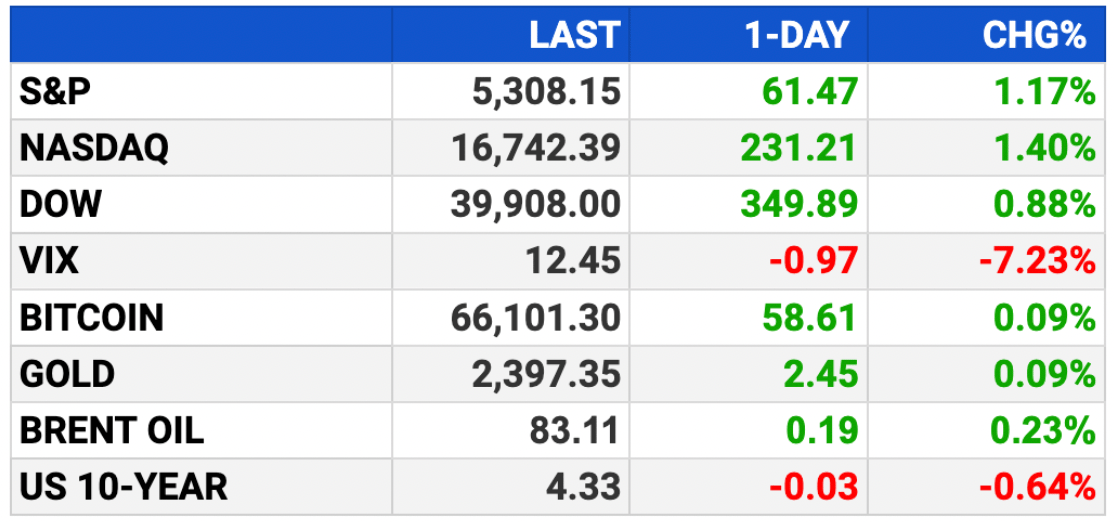

Market Recap:

Stock futures flat after record highs on lighter inflation.

Dow futures +32 points (+0.08%), S&P futures +0.06%, Nasdaq 100 futures +0.1%.

Major averages hit records: Dow +0.88%, S&P +1.17% (above 5,300), Nasdaq +1.40%.

April CPI +0.3% monthly (vs. 0.4% expected), +3.4% annually.

Today: weekly jobless claims, Philly Fed manufacturing index.

Earnings: Walmart, Under Armour, Baidu before the bell.

EARNINGS

What we’re watching:

Walmart (WMT) - earnings of $.53 on $159.4B (+4.7% YoY)

Full earnings calendar here

HEADLINES

Here’s the inflation breakdown for April 2024 (more)

Biden and Trump agree to debates on June 27 and Sept. 10 (more)

Xi welcomes Putin, says China-Russia ties should last ‘generations’

(more)

Oil rebounds, gains 1% after US crude draw (more)

Boeing has four weeks to stop possible prosecution over crashes (more)

Uber announces shuttle rides, features for caregivers and Costco perks (more)

GameStop, AMC tumble as meme stock rally fizzles after two days (more)

Netflix hits 40 million users for ad-supported plan (more)

Paramount holds talks with Amazon about expanded partnership (more)

Peloton taps JPMorgan for $850M loan sale to tackle debt (more)

Buffett’s Berkshire reveals $6.7B stake in insurer Chubb (more)

Soros Fund dissolves stake in NYCB, buys Goldman Sachs shares (more)

Real estate mogul Frank McCourt readying US TikTok bid (more)

Visa adds new way to share customer data with retailers (more)

| Sponsored |

| The Next Big AI Stock: Invest Before August 5th |

| One secretive company’s new technology is poised to disrupt the AI market – a market that is projected to grow from roughly $500 billion to $200 trillion. That’s a surge of 39,900% over the next six years. Today, you can invest in this one-of-a-kind company for just $25 a share.But you must act by August 5th. |

| Privacy Policy/Disclosures |

DEALFLOW

M+A | Investments

Morgan Stanley to buy property debt from Blackstone Venture (more)

KKR readies EU remedies for €22B Telecom Italia deal (more)

Royal Mail owner IDS agrees to $4.4B Kretinsky takeover bid (more)

Siemens to sell drive division to KPS for $3B (more)

Blackstone, GIC and others sell $2B stake in LSEG (more)

Red Lobster creditors to weigh bid for assets in Chapter 11 (more)

HG Automation, an automation company, acquired Treva Automation, a provider of automated solutions (more)

EasyKnock, a home equity solutions platform, acquired assets of home equity investment firm HomePace (more)

ListEngage, a Salesforce Ventures-backed certified partner, acquires 1to1, a Salesforce personalization consulting agency (more)

Synechron, digital consulting firm for financial services and tech orgs, acquired iGreenData, a data-centric digital solutions company (more)

Mill Point buys majority stake in iQor (more)

Huron-backed Hansons buys Paramount Builders (more)

Avathon purchases Summit Professional Education (more)

LGP-backed Iris acquires Swipeclock (more)

The Watermill Group invests in Musser (more)

Metaplane, a data observability platform, received an investment from Snowflake Ventures (more)

VC

Restaurant365, a provider of a restaurant enterprise management platform, raised $175M in funding (more)

Weka, a data platform company, raised $140M in Series E funding, at a $1.6M valuation (more)

Alkira, an on-demand network infrastructure as-a-service company, raised $100M in Series C funding (more)

Cover Genius, an insurtech company for embedded protection, raised $80M in Series E funding (more)

Polymarket, a prediction market, raised $70M in funding (more)

cylib, a sustainable end-to-end battery recycling firm, raised €55M in Series A funding (more)

Chapter, a medicare navigation platform, raised $50M in Series C funding (more)

Elegen, a DNA synthesis and production company, raised $35M in Series B funding (more)

Nabla Bio, a company developing AI and wet-lab technologies, raised $26M in Series A funding (more)

Elevate K-12, a company prividing synchronous LIVE teaching for K-12 classrooms in the US, raised $25M in Growth financing (more)

Annuity.com, a fintech and financial media company, raised $15.7M in Seed funding (more)

Orange Charger, a provider of EV charging solutions, launched $6.5M in seed funding (more)

Relocalize, a cleantech startup, raised $5.8M in Seed funding (more)

Firmus, a company specializing in preconstruction AI design review and risk analysis, raised an undisclosed amount in funding (more)

CRYPTO

BULLISH BITES

🗽 AI HQ: The Big Apple is making a bid to become a premier hub for generative AI.

📈 "AI Healthcare Genesis" sets the stage for a new era in medicine. Here's the Micro-Cap behind it >>> *

💪 New flex: Baby Boomers are loving the ‘freedom’ of renter life.

🌮 Taco ‘bout it: This is the first Mexican taco stand to get a Michelin star.

🏘 Vision wanted: Historic California town for sale for a stunning $6.6M.

Exclusive Report: Master Uncertain Markets

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.