☕️ Good morning.

The Fast Five → Reddit plans to launch IPO in March, Red Sea attacks already bigger supply chain issue than pandemic, jobless claims plunge to lowest level since Sept ‘22, Lenovo betting its Motorola brand will be 3rd largest globally, and Macy’s to cut 3.5% of workforce and 5 stores…

Your 5-minute briefing for Friday, January 19:

BEFORE THE OPEN

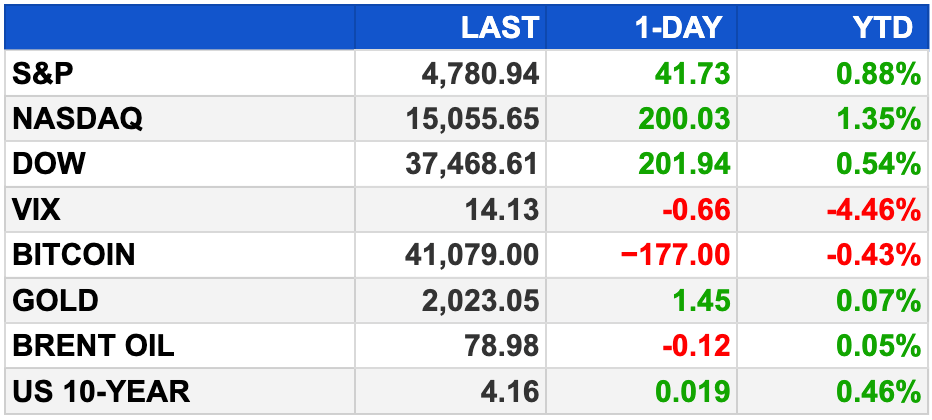

As of market close 1/18/2024.

PRE-MARKET:

MARKETS:

S&P 500 futures near flat line.

Dow futures down 0.07%, Nasdaq 100 futures up 0.33%.

iRobot drops 40% as EU likely to reject Amazon's bid.

Congress passes bill averting government shutdown.

Thursday gains end 3-day Dow losing streak.

Nasdaq up 0.55% weekly, Dow down 0.33%.

Tech sector surges on Bank of America's Apple upgrade.

Upcoming earnings and economic data in focus.

EARNINGS

What we’re watching:

Today:

Travelers (TRV) - expected: $5.00 per share (+47% YoY) on $10 billion revenue (+13.1% YoY)

Full earnings calendar here

HEADLINES

Jobless claims plunge to 187,000, lowest since September 2022 (more)

Congress approves funding to avert US Government shutdown (more)

US prepares rule forcing banks to tap Fed discount window (more)

IPO market rebound hinges on post-debut trading, retail’s return (more)

Tech giants drive stock gains as chipmakers rally (more)

AG suit alleges Meta estimated 100K kids per day sexually harassed on Facebook, Instagram (more)

Investors split over China risks as Beijing seeks to woo Davos (more)

China is buying up US farmland, but just how much isn’t clear (more)

Amazon’s AWS to invest $15 billion to expand cloud computing in Japan (more)

Zuckerberg indicates Meta is spending billions on Nvidia AI chips (more)

Macy’s to cut more than 2,300 jobs, about 3.5% of its workforce, and close five stores (more)

Los Angeles Times plans 'significant' layoffs (more)

YouTube and Spotify won’t launch Apple Vision Pro apps, joining Netflix (more)

Activist investor Peltz seeks 'meaningful change' on Disney board (more)

Lenovo bets its Motorola smartphone brand will be the third-biggest globally in 3 years (more)

JPMorgan lifts CEO Jamie Dimon’s pay to $36M for 2023 (more)

TOGETHER WITH INCOGNI

Data brokers play a shady game — harvesting your personal data online, and selling it to the highest bidder. No informed consent required.

In fact, every time you accept cookies or download an app from a bad actor, your data could be at risk. Opting out is possible of course — but made difficult by design.

It’d take the average person 304 hours to manually complete all the data removal requests needed to secure their privacy. That’s why the VPN specialists at Surfshark created Incogni: The data removal service that takes care of wiping your personal info from hundreds of databases, reducing the threat of robocalls, scams, and fraud.

Safeguarding your data shouldn’t take up your spare time. Leave it to Incogni — Our readers get 60% off the Incogni annual plan at this link with code PRIVACY.

~ please support our sponsors ~

DEALFLOW

M & A | INVESTMENTS

Hyundai Motor's India arm to invest $722M in Maharashtra (more)

GIP eyeing up to 49% stake in Malaysian port operator, could value MMC Port at $6B (more)

India's Haldiram's seeks to buy rival Prataap Snacks (more)

Nextiva, a provider of customer experience solutions, acquired Thrio, a contact center software company with expertise in AI-driven customer experience (more)

Aspen Power, a provider of a distributed generation platform, has completed three financings totaling $241M with J.P. Morgan, Lombard Odier, and Mitsubishi UFJ Financial Group, Inc. (more)

Alphathena, an AI-powered direct indexing platform for Registered Investment Advisors (RIAs), secured a $4M investment (more)

LiveRamp (RAMP), a provider of a data collaboration platform, acquired Habu, a data clean room software provider, valued at $200M (more)

United Payment Systems, LLC (DBA Payzli), an end-to-end payment tech company, received a $6M investment from Esquire Financial Holdings (ESQ) (more)

Accenture acquired Impendi, a sourcing and procurement services provider with a focus on private equity clients (more)

AccessParks, a provider of broadband connectivity to RV Parks, National and State Parks, and MHC nationwide, raised an undisclosed amount in private equity funding (more)

WCAS buys EquiLend (more)

Charlesbank invests in Searchlight Cyber (more)

Littlejohn Capital-backed Maysteel purchases Star Precision (more)

Stellex-backed Fenix Parts purchases Stafford’s Auto Parts (more)

Reservoir Neuroscience, a developer of new therapies for age-related neurodegeneration, closed a $4M financing round (more)

VC

Focus, a new SocialFi app from DeSo that aims to disrupt the trillion-dollar social media/creator economy by rivaling X, Onlyfans, and Patreon, raised $200M from Coinbase, Sequoia, a16z, Social Capital, and others (more)

Quantinuum, an integrated quantum computing company, closed a $300M equity funding at a pre-money valuation of $5B (more)

DailyPay, an on-demand pay company, secured over $175M in debt and equity funding (more)

Cleveland Diagnostics, a clinical-stage biotech company developing diagnostic tests for the early detection of cancers, raised $75M in funding (more)

Digital Onboarding, a SaaS customer relationship company, raised $58M in Growth funding (more)

Forta, an AI healthcare company improving access to dependable quality care, raised $55M in Series A funding (more)

SmartLabs, a provider of flexible laboratory infrastructure and resourcing solutions, raised $48M in Series C funding (more)

International Battery Company, a product and tech company specializing in the creation of eco-friendly, rechargeable batteries, raised $35M in funding (more)

Lightship, an all-electric RV company, closed a $34M Series B financing (more)

Oleria, a company providing adaptive and autonomous identity security solutions, raised $33.1M in Series A funding (more)

Vicarius, a developer of vRx, an autonomous end-to-end vulnerability remediation platform, raised $30M in Series B funding (more)

Kashable, a fintech platform that provides socially responsible credit and financial wellness solutions, raised $25.6M in Series B funding (more)

Prismatic, a provider of an embedded integration platform (iPaaS) for B2B SaaS companies, raised $22M in Series B funding (more)

Unbox, a provider of infrastructure for programmable exchange of value, raised $12M in Series A funding (more)

Cetris Oncology Solutions, a precision oncology and translational science company, raised $10M in Series C funding (more)

PredictAP, an ML enabled invoice ingestion & coding solution for real estate accounts payable, closed its $8M Series A financing round (more)

Kusari, a software supply chain security startup, raised $8M in Pre-Seed and Seed Round funding (more)

RocketStar, a company which specialized in space exploration and satellite services, raised $2M in Seed funding (more)

BankingON, a provider of digital banking solutions, raised an undisclosed amount in Series A funding (more)

Epicore Biosystems, a digital health solutions company, raised an undisclosed amount in funding (more)

FUNDRAISING

Windjammer Capital Investors, closed its sixth fund, Windjammer Capital Fund VI, at $1.3B (more)

KSL Capital Partners, an investor in travel and leisure businesses, raised $1.26B in its latest private credit fund, KSL Capital Partners Credit Opportunities Fund IV (more)

Act One Ventures, an early stage venture capital firm, closed its third fund, at $73M (more)

Starwood Capital Group, a firm focused on real estate, announced the launch of Starwood Digital Ventures (more)

Was this briefing forwarded to you? Sign Up Here

CRYPTO

BULLISH BITES

🛟. Help wanted: Benioff, Bezos and Soon-Shiong want to save the news industry. They’re Losing a Fortune.

🏎 Robo race: AI-controlled race cars are here, and they’re about to compete on an F1 track for millions.

🤫 Underground: Crypto traders in China are meeting in laundromats and snack kiosks to get around government regulations banning the practice.

💰 Stealth wealth: A mystery buyer is paying more than $100M for this NYC penthouse on Billionaires’ Row.

🍪 Cookie cutter: The tyranny of the algorithm and why every coffee shop looks the same.

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

Disclaimer: MarketBriefing is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the MarketBriefing team.