Good morning.

The Fast Five → Nvidia, AMD agree to pay US 15% of China chip sales, Apple has its best week in years, Intel CEO visits White House today, traders flee stocks under threat from AI, while SoftBank founder bets big staking the firm’s future on AI…

📌 This "AI Metal" could be key to Elon Musk's AI revolution… and there's currently only one company here in the US that can produce these metals. That's why this virtual monopoly could be the most important firm in the world when it comes to the development of AI. You can get all the details here → (ad)

Calendar: (all times ET) - Full Calendar

Today:

none scheduled

Tomorrow:

Consumer Price Index, 8:30A

Monthly Federal Budget, 2:00P

Your 5-minute briefing for Monday, Aug 11:

US Investor % Bullish Sentiment:

↓ 34.87% for Week of AUG 07 2025

Previous week: 40.33%

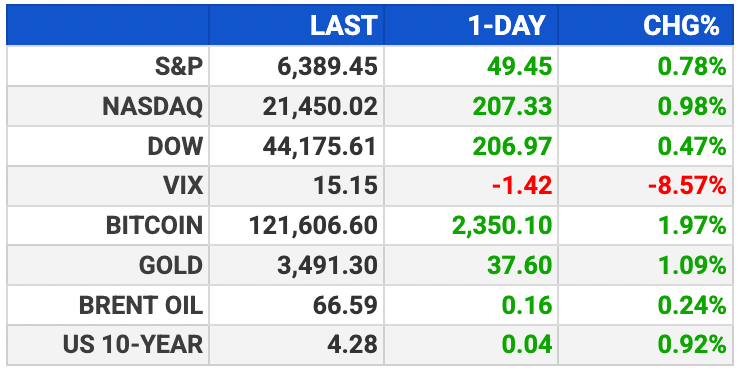

Market Wrap:

• Futures edge higher: Dow +56 (0.1%), S&P/Nasdaq +0.1%

• Nasdaq closed week at fresh highs; S&P just shy of another record

• Apple rally helped lift indexes Friday

• Valuation, tariffs, weak season weigh on outlook

• Key CPI tomorrow, PPI Thursday could sway Fed

• Jackson Hole meeting set for Aug. 21–23

EARNINGS

Here’s what we’re watching this week. (*) indicates before the bell

MON:

AMC Entertainment $AMC ( ▼ 1.64% ): a loss of $.08 eps (an improvement from a year-ago loss of $.43), on $1.44B revenue (+30.1% YoY)

WED:

Cisco Systems $CSCO ( ▲ 0.82% ) - earnings of $.98 eps (+12.6% YoY), on $14.6B revenue (+7.4% YoY)

THU: *Deere $DE ( ▲ 0.07% ) , *Tapestry $TPR ( ▲ 3.15% )

Forget Nvidia, This "Ghost Town" Company Holds the Key to the AI Boom

Nvidia, AMD, Intel, Taiwan Semiconductor Manufacturing, Google, Microsoft, Apple, Tesla, Oracle, Palantir, IBM…

They all need this little-known company's product.

And this company has a virtual monopoly in the U.S.

That means this company that's located in an American ghost town — with only 30 people — could be the key to the $100 trillion AI boom.

- sponsored by Brownstone Research -

HEADLINES

Wall Street sees AI, rate-cut optimism fueling rally (more)

Traders are fleeing stocks feared to be under threat from AI (more)

Hedge funds flip on green energy and start betting against oil (more)

Intel CEO to visit White House today (more)

Gold Futures Slip as Traders Await Clarification on Tariffs (more)

Oil prices fall as market eyes US-Russia talks on Ukraine (more)

Chinese state media says Nvidia H20 chips not safe for China (more)

Trump suggests "MAGA" stock listing for Fannie, Freddie (more)

Bill Ackman proposes combining Fannie Mae and Freddie Mac (more)

Palantir's 2,500% run has bulls scrambling to justify valuation (more)

SoftBank founder bets big by staking the firm’s future on AI (more)

David Sacks' "Goldilocks" scenario (more)

IN PARTNERSHIP WITH PlayersTV

Invest Alongside Kyrie Irving and Travis Kelce

A new media network is giving pro athletes ownership of their content…and they’re inviting fans, too.

That network is PlayersTV.

It’s the first sports media company backed by over 50 legendary athletes including:

Kyrie Irving

Chris Paul

Dwyane Wade

Travis Kelce

Ken Griffey Jr.

And more

PlayersTV is a platform where athletes can tell their own stories, show fans more of who they really are, and connect in a whole new way.

And here’s the kicker: It’s not just athlete-owned—it’s fan-owned, too.

PlayersTV has the potential to reach 300M+ homes and devices through platforms like Amazon, Samsung, and Sling.

And for a limited time, you can invest and become an owner alongside the athletes.

2,200+ fan-investors are already backing PlayersTV. Want in?

This is a paid advertisement for PlayersTV Regulation CF offering. Please read the offering circular at https://invest.playerstv.com/

DEALFLOW

M+A | Investments

Ripple to buy Rail, for $200M

Lyten agreed to acquire most of Northvolt's assets

10x Genomics to acquire Scale Biosciences

Rolls‑Royce sells UK pension fund to PIC in £4.3 billion deal

DOCSI receives investment from iGan Partners

Dfinitiv receives investment from United Airlines Ventures

PreFix receives debt financing from Decathlon Capital Partners

VC

August Health, a provider of an EHR platform for care tracking and analytics, raised $29M in Series B funding

OneSkin, a skin longevity brand, received a $20M investment from Prelude Growth Partners

Celera Semiconductor, an analog design automation company, raised $20M in Series A equity funding

Perle raised $9M in Seed funding, bringing its total raise to $17.5M

Translucent AI, an AI-powered financial platform for healthcare operators, raised $7M in Seed funding

Lava Payments, a digital wallet company, raised $5.8M in Seed funding

WiseBee, an AI-powered cybersecurity platform, raised $2.5M in Pre-Seed funding

Ostra Security, a provider of managed security solutions, raised an undisclosed amount in Series A extension funding

Alkymi, an AI-powered data workflow platform for financial services, raised a strategic financing round of undisclosed amount

CRYPTO

BULLISH BITES

📊 Trump 401k changes: What to know.

📉 How once-iconic Intel fell into a 20-year decline.

🎲 Sin City’s economic slump signals wider slowdown.

👜 Quiet luxury is over, loud luxury is back.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.