Good morning.

The Fast Five → Biden’s defiant State of the Union, Powell tells Senate "not far" from confidence needed to cut rates, US layoffs reach the highest in a year, Congress plows forward with TikTok bill, and Rivian surprises with smaller, cheaper electric SUVs…

Calendar:

Today: US nonfarm payrolls, unemployment rate, 8:30a ET

Your 5-minute briefing for Friday, March 8:

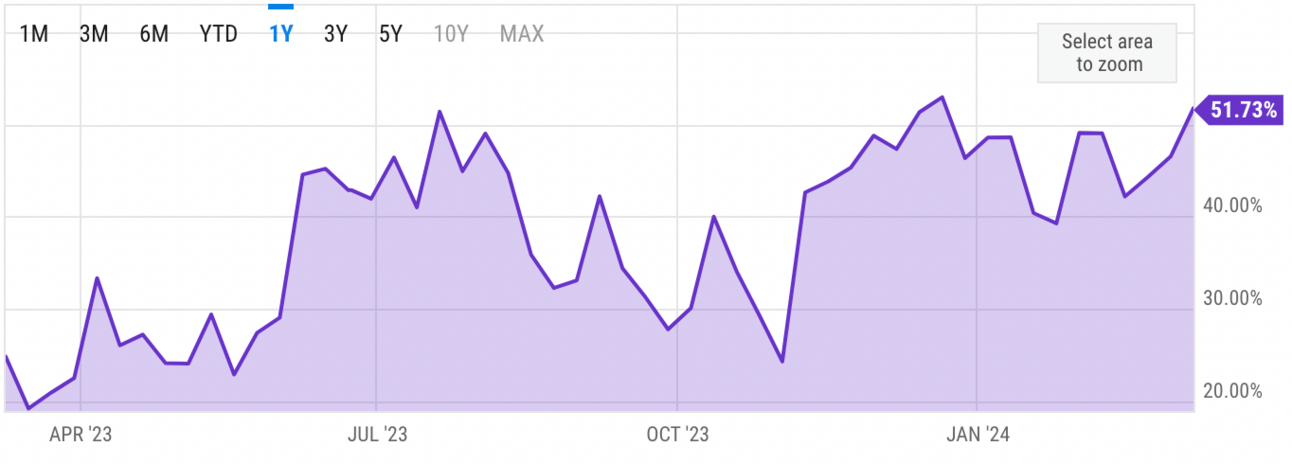

US Investor % Bullish Sentiment:

51.73% for Wk of Mar 07 2024 (Last week: 46.50%)

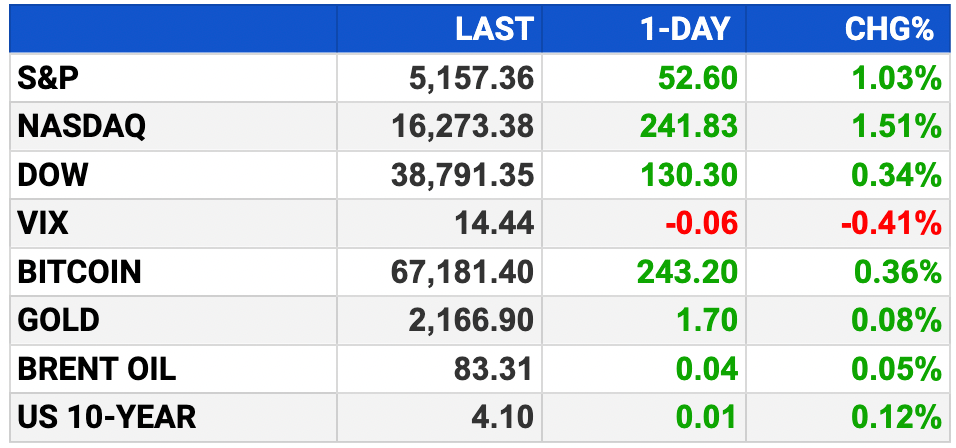

Market Recap:

S&P 500 futures near flatline as traders await February jobs report.

Dow futures slip 0.08%; Nasdaq 100 futures down 0.3%.

Broadcom dips 3%, Costco falls 4% after-hours.

Tech drives S&P 500, Nasdaq to new highs Thursday.

Investors await Friday's nonfarm payrolls data for labor market insight.

S&P 500 up 0.4% this week; Dow down 0.8%; Nasdaq slightly lower.

EARNINGS

Full earnings calendar here

HEADLINES

Report today expected to show a slowing but still healthy labor market (more)

US layoffs reach highest since last March (more)

Furious Congress plows forward with TikTok bill after user revolt (more)

Keystone oil pipeline segment shuts, sending futures higher (more)

Weak recovery could trigger China rating cut, S&P Global says (more)

S&P Index flub prompted mystery swings in Morgan Stanley, PNC (more)

Mnuchin scores an instant profit rescuing NYCB (more)

Rivian surprises with R3 and R3X electric SUVs (more)

Broadcom sees $10B in AI chip sales in 2024, but shares dip (more)

MindMed’s stock soars 58% after FDA grants breakthrough designation to LSD therapy (more)

Novo weight loss pill more potent than Ozempic (more)

Salesforce announces new AI tools for doctors (more)

High-yield savings accounts slam Americans with larger tax bills (more)

A MESSAGE FROM OUR PARTNER

AI won’t take your job, but a person using AI might. That’s why 500,000+ professionals read The Rundown – the free newsletter that keeps you updated on the latest AI news and teaches you how to apply it in just 5 minutes a day.

DEALFLOW

M+A | Investments

British packaging firm Mondi offers to buy smaller rival DS Smith for $6.57B (more)

SingTel sells 0.8% stake in India's Bharti Airtel to GQG Partners for $711M (more)

Carlyle launches sale of Japanese cosmetics supplier Tokiwa in $800M deal, sources say (more)

Ardian agrees to acquire CampusParc for more than $850M (more)

TruArc Partners acquires Meyer Laboratory (more)

VSS-backed Centroid Systems purchases Intelletive (more)

MiddleGround buys IT8 (more)

Goldman-backed GridStor purchases Galveston County battery energy storage project (more)

Yingling Aviation buys Mid-Continent Aviation Services (more)

Court Square invests in Velosio (more)

Equistone-backed BUKO buys RTS (more)

VC

Alumis, a clinical-stage biopharmaceutical company, raised an upsized $259M Series C funding (more)

Sionna Therapeutics, a clinical-stage life sciences company, raised $182M in Series C funding (more)

Rakuten Medical, a biotech company developing and commercializing precision, cell targeting therapies based on its proprietary Alluminox™ platform, raised $119M in Series E funding (more)

FitLab, an asset management firm specializing in investing and partnering with SMB’s, raised $65M in funding from Atlas Credit Partners (more)

Todyl, a security and networking company, raised $50M in Series B funding (more)

Defense Unicorns, a startup providing open source software and AI for National Security systems, raised $35M in Series A funding (more)

Maybell Quantum, a quantum infrastructure company, raised $25M in Series A funding (more)

Efficient Computer, a computer architecture and software stack company, raised $16M in Seed funding (more)

BrainCheck, a digital health provider, raised $15M in funding (more)

C₂N Diagnostics, a brain health diagnostics company, received up to $15M in investment from Eisai (more)

Hari Mari, a sandal brand, raised $10M in Equity funding (more)

TollBit, a company offering AI bots and data scrapers a compliant way to compensate websites for content, raised $7M in funding (more)

Altro, a provider of a credit-building app, raised $4M in funding (more)

Glimpse, a provider of battery quality monitoring for producers and electric mobility companies, raised $4M in Seed funding (more)

Cogna, a provider of an AI-driven SaaS platform to create customised software applications, raised £3.76M in funding (more)

Firewall, a blockchain infrastructure startup, announced its $3.7M pre-seed round, co-led by North Island Ventures, Breyer Capital, and Hack VC (more)

Enzzo, a company focused on accelerating new hardware product development, raised $3M in Seed funding (more)

Good Trouble, a games studio, raised $1.8M in funding (more)

Handle.com, a provider of construction payment and credit solutions, received investments from Amex Ventures, along with Suffolk Technologies (more)

Moxy.io, a provider of a blockchain empowered tournament platform and infrastructure in the competitive gaming and web3 space, received an investment from GDA Capital (more)

Capstack Technologies, a bank-to-bank marketplace designed to mitigate asset risk, received an investment from Citi Venture (more)

Hook, a music platform, extended its Seed funding with an additional undisclosed amount (more)

CRYPTO

BULLISH BITES

🤨 Not over: How Klarna’s IPO prep got tangled up in a boardroom drama.

💐 Sweet smell of… Eau de Binance?

🛌 Next level: Sleep tourism.

🍾 Full bodied: 7 stellar white wines to drink as winter turns to spring.

➡️ Did you try it yet? For a limited time MB readers can try 6-Weeks of IBD’s brand new MarketSurge for only $49.95 — an offer you won’t find anywhere else. Don’t wait—give it a test-drive!*

*from our sponsor

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Get tomorrow’s briefing here

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion? We’d love to hear it!

💌 Send us a message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.