Good morning.

The Fast Five → Amazon, OpenAI strike $38 billion deal, Big Tech's AI bets show bubble has 'good ways to go', Alphabet is selling $25 billion of bonds, Palantir shares fall after record run-up, and BofA CEO to face investors with worst returns on Wall Street…

📌 Not a Single "Mag 7" on His List — A renowned former hedge fund manager – friends to some of the biggest investors in the world – just released a new list of his favorite AI stocks... and not a single Magnificent 7 name made the cut. Instead, an AI stock you've likely never heard of just flagged as "near-perfect" in his new investing scoring system. For the name, ticker and demo, click here. (ad)

Calendar: (*Shutdown may affect key data. All times ET) - Full Calendar »

Today:

JOLTS Job Openings (tentative)

Tomorrow:

Non-Farm Employment, 8:15A

ISM Services PMI, 10:00A

Your 5-minute briefing for Tuesday, Nov 4:

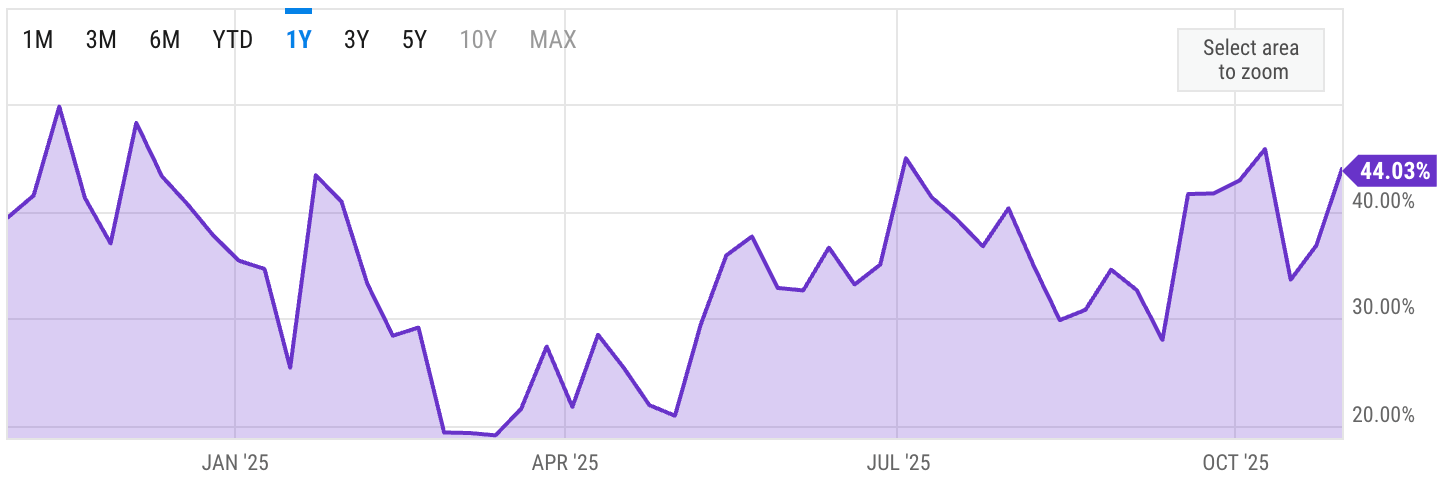

US Investor % Bullish Sentiment:

↑44.03% for Week of OCT 30 2025

Previous week: 36.86%

Market Wrap:

Futures lower: Dow –0.2%, S&P –0.26%, Nasdaq –0.4%.

Palantir swings after earnings and AI guidance.

Amazon–OpenAI deal lifts Nasdaq; S&P +0.2%, Dow –0.5%.

Breadth weak: 300+ S&P stocks declined.

Q3 earnings strong: 80% beat; AI capex stays heavy.

Mag-7 results diverge, but tech still leads.

Goldman: stick with megacap tech; Fed cuts/capex are key drivers.

EARNINGS

Here’s what we’re watching this week:

Today: AMD $AMD ( ▼ 1.58% ), *Pfizer $PFE ( ▼ 0.78% ), Uber $UBER ( ▲ 1.26% ), *Yum! Brands $YUM ( ▲ 0.37% )

WED: DoorDash $DASH ( ▲ 0.06% ), Duolingo $DUOL ( ▲ 1.65% ), Joby Aviation $JOBY ( ▼ 3.71% )

*McDonald's $MCD ( ▲ 0.65% ) - $3.33 EPS (-3.1% YoY), on $6.96B revenue (+1.3% YoY) and same-store sales growth of 2.5%

Robinhood $HOOD ( ▲ 0.61% ) - $.54 EPS, more than triple the $.17 EPS from the year-ago period – on $1.22B revenue (+90.8% YoY)

THU: Airbnb $ABNB ( ▲ 1.65% ), *Tapestry $TPR ( ▲ 3.15% ), *Warner Bros. Discovery $WBD ( ▲ 0.77% )

Best A.I. Move for People 50+

If you're 50 or older... or thinking ahead to retirement... legendary investor Whitney Tilson says this could be your smartest financial move of the entire AI boom.

It's time to look past Nvidia and the "Magnificent 7."

Whitney, a retired hedge fund manager once dubbed "The Prophet" by CNBC, is sharing a new AI story.

His brand-new stock system just gave one company a near-perfect grade... and it's not a name you've heard on the news.

The company just signed a huge new AI deal with a key tech partner, and you'll soon see a massive nationwide rollout.

Whitney's giving away the name, ticker, and full breakdown for no cost.

Matt Weinschenk

Director of Research, Stansberry Research.

HEADLINES

S&P, Nasdaq rise to kick off November (more)

Third-quarter earnings are indicating a divided economy (more)

Loan demand from US mid- and large firms improves, Fed survey shows (more)

Oil steadies as market digests OPEC+ output plans (more)

BofA CEO Brian Moynihan to face investors with the worst returns on Wall St (more)

Alphabet is selling $25 billion of bonds in US, Europe (more)

Microsoft signs $9.7 billion deal with data center firm IREN (more)

Starbucks sells majority stake in China business, valued at $4B (more)

Palantir shares fall after record run-up despite sales surge (more)

Kimberly-Clark agrees to buy Tylenol owner Kenvue in $48.7B deal (more)

Millennium sells $2 billion minority stake in hedge fund firm (more)

DEALFLOW

M+A | Investments

Kimberly‑Clark to acquire Kenvue for ~$48.7 B including debt

UPS acquires Andlauer Healthcare Group for $1.6B

CareScout Completes Acquisition of Seniorly

Millennium Management sells 15% stake to select investors at ~$14B valuation

CoreWeave buys Marimo

DoseMe acquires Firstline

CareScout completes acquisition of Seniorly

RiPSIM Technologies receives investment from Swisscom Ventures

onX receives strategic investment from TCV

Zaelab receives investment from ServiceNow

VC

Infravision, a company focusing on how grids are built and maintained with aerial robotics, raised $91M in Series B

Lettuce Financial, a fintech startup focused on solutions for solopreneurs, raised $28M in funding

Teleskope, a company improving data security, raised $25M in Series A funding

AUI, a company building neuro-symbolic foundation models for conversational AI raises $20M at $750M valuation

Popai Health, a patient conversation intelligence company that turns patient conversations into action, raised $11M in funding

Cob, a snacking brand, raised an undisclosed amount in Seed funding

Buy This AI Stock Tomorrow Morning?

A former hedge fund manager known for spotting early winners is sounding the alarm once again. He called Netflix at $7.78 (up 4,200% since), Apple at $0.35 (up 20,000%), and Amazon at a split-adjust $2.41 (up 3,200%).

Now he's turning his focus to a little-known AI company that just earned a near-perfect score in his new proprietary stock grading system.

In a brand-new presentation, he reveals the name, ticker symbol, and why this could be the smartest AI move of the year... especially if you're over 50. Watch it here before word gets out »

- A message from Stansberry Research -

CRYPTO

BULLISH BITES

🤖 The AI industry is running on FOMO.

🚘 ‘Eyes-off driving’ is coming, and we’re so not ready.

👨🏻🦱 Men’s groups (not ‘boys clubs’) quietly emerge in Big Business.

🧱 They tear down walls and hire architects to make room for their Lego worlds.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.