Good morning.

The Fast Five → Musk warns: ‘rough quarters’ ahead for Tesla, Trump to visit the Fed, Trump considered breaking up Nvidia, silver's hot streak gathers pace, Krispy Kreme, GoPro and Beyond Meat surge as the latest in meme stock revival…

📌 Jeff Clark's "Crossfire" trades trigger fast and can pay big. In the past they've delivered gains of 388%, 1,263%, and 1,285%... sometimes in as little as two days. But he warns the current Crossfire window won't last forever. He explains the whole thing from beginning to end right here, and it won't cost you a penny. (ad)

Calendar: (all times ET) - Full Calendar

Today:

Initial jobless claims, 8:30A New home sales, 10:00A

Tomorrow:

Durable-goods orders, 8:30A

Your 5-minute briefing for Thursday, July 24:

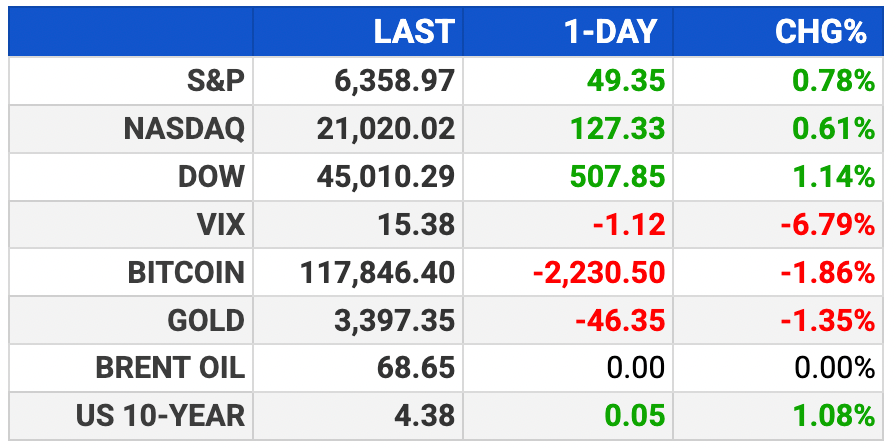

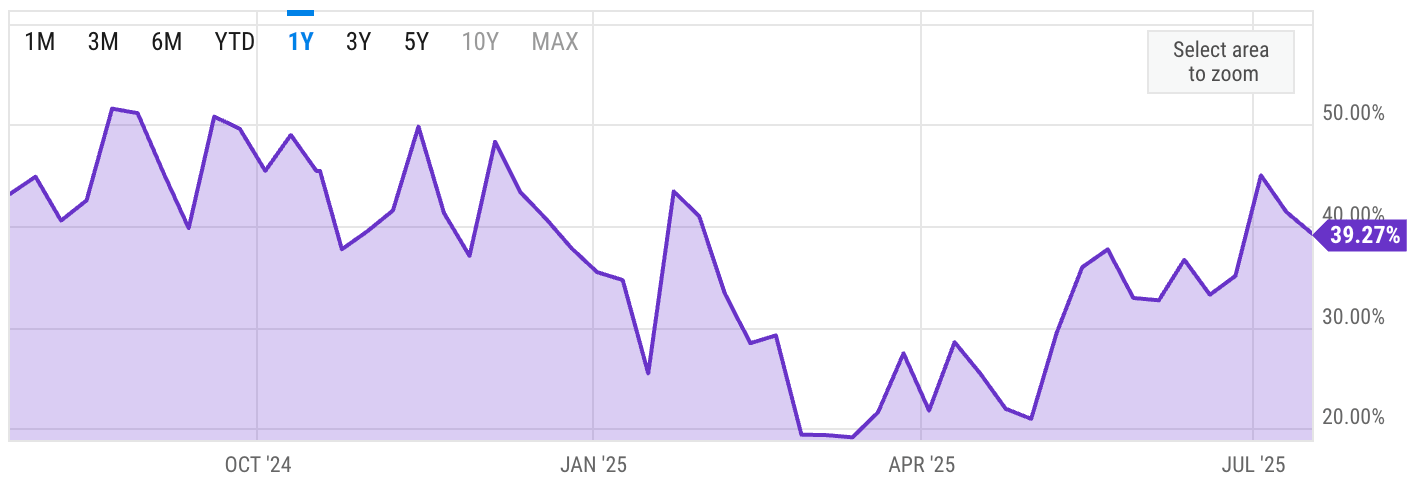

US Investor % Bullish Sentiment:

↓ 39.27% for Week of JUL 17 2025

Previous week: 41.38%

Market Wrap:

S&P 500 futures +0.1%, Nasdaq +0.3%, Dow -113pts (0.2%)

S&P notches 12th record close of 2025

Alphabet jumps 2% post-earnings; Tesla dips on weak auto rev

IBM falls 5% on soft software sales, weighing on Dow futures

Trade clarity boosts sentiment, Siegel says

Earnings ahead: Dow, AAL, HON, UNP; plus jobless claims & housing data

EARNINGS

Here’s what we’re watching this week:

Today: American Airlines $AAL ( ▲ 1.8% ), Blackstone $BX ( ▼ 3.57% ), Honeywell $HON ( ▲ 1.33% ), Union Pacific $UNP ( ▲ 1.19% )

Jeff Clark: “I’m giving away my top

trading secret.”

Jeff Clark has kept his Crossfire strategy close to the vest for years. But he's no longer working with his Silicon Valley clients…

So, he can reveal the whole thing in a new no-cost strategy session. It's a rare opportunity to learn his three-step process for potentially massive profits—

HEADLINES

S&P 500 and Nasdaq rally to record highs on optimism about trade deals (more)

EU sees progress toward US trade deal with 15% tariffs (more)

US automakers find little to cheer in Japan trade deal (more)

Justice Dept prepares crackdown on Trump tariff violators (more)

June home sales drop as prices hit record high (more)

Oil prices climb on US trade optimism, drop in crude stockpiles (more)

Silver's hot streak gathers pace; market at highest since 2011 (more)

Trump weighed Nvidia breakup but was told it would be ‘hard’ (more)

Google shares fall as spending spree spooks investors (more)

Tesla stock sinks after earnings miss (more)

Chipotle plunges after company reports 2nd straight sales decline (more)

Krispy Kreme, GoPro and Beyond Meat surge as meme stock revival rolls on (more)

Trump admin ramps up its campaign against colleges (more)

Mubadala expands private credit push (more)

TOGETHER WITH PACASO

Big investors are buying this “unlisted” stock

When the founder who sold his last company to Zillow for $120M starts a new venture, people notice. That’s why the same VCs behind Uber and eBay also backed Pacaso. They made $110M+ in gross profit to date. They even reserved the Nasdaq ticker PCSO. Now, you can join, too.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

DEALFLOW

M+A | Investments

SLB’s $8 billion acquisition of ChampionX cleared by UK CMA

Sony explores sale of cellular chipsets business

AES exploring sale amid takeover interest

VC

Vanta, an AI trust management platform, raised $150M in Series D funding

Swift Navigation, a company specializing in centimeter-accurate positioning for vehicle, robotics, and precision logistics, raised $50M in Series E funding

april, an AI tax platform, raised $38M in Series B funding

Scrunch AI, a company helping brands optimize AI search visibility, raised $15M in Series A funding

Dash Bio, a preclinical and clinical bioanalysis company, raised $11M in funding

Estes Energy, a materials and manufacturing company, raised $11M in Seed funding

Hypernatural, an AI video creator, raised $9.2M in funding, across 2 rounds

Volca, an AI-powered marketing platform built specifically for home services businesses, raised $5.5M in Seed funding

Olto, an AI demo engineer supporting how B2B teams demo and sell software, raised $5.1M in Pre-Seed funding

Starseer, an AI exposure management and compliance company, raised $2M in Seed funding

Capitalize.io, an AI-powered platform turning data into deals by connecting brokers and lenders with leads, closed its Seed funding round

CRYPTO

BULLISH BITES

🤖 Trump unveils his plan to put AI in everything.

🐂 Dan Niles explains why he turned bullish on NVIDIA.

🚖 DC overtakes LA for worst traffic in America.

🧠 Why an active mindset matters.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.