Good morning.

The Fast Five → Watching for a 'Santa rally', FOMO vs bubble angst signals more volatility in 2026, gold rises to record high, copper charges toward $12,000 a ton in record-setting run, and Elon Musk becomes first person worth $700 billion…

📌 Gold just blasted past $4,400. It's up almost 50% in the past year. But why settle for 50% like most coin buyers… when past gold cycles have thrown off gains of 2,300%, 7,746%, even 9,850%? Weiss Ratings' gold expert Sean Broderick reveals what he believes is a more profitable way to play this surge. No futures, no options, no vault required. See Sean's top 5 gold plays before you make your next move » (ad)

Calendar: (*Shutdown may affect key data. All times ET) - Full Calendar »

Today:

none watched

Tomorrow:

ADP Employment (tentative)

Prelim GDP, 8:30A

Your 5-minute briefing for Monday, Dec 22:

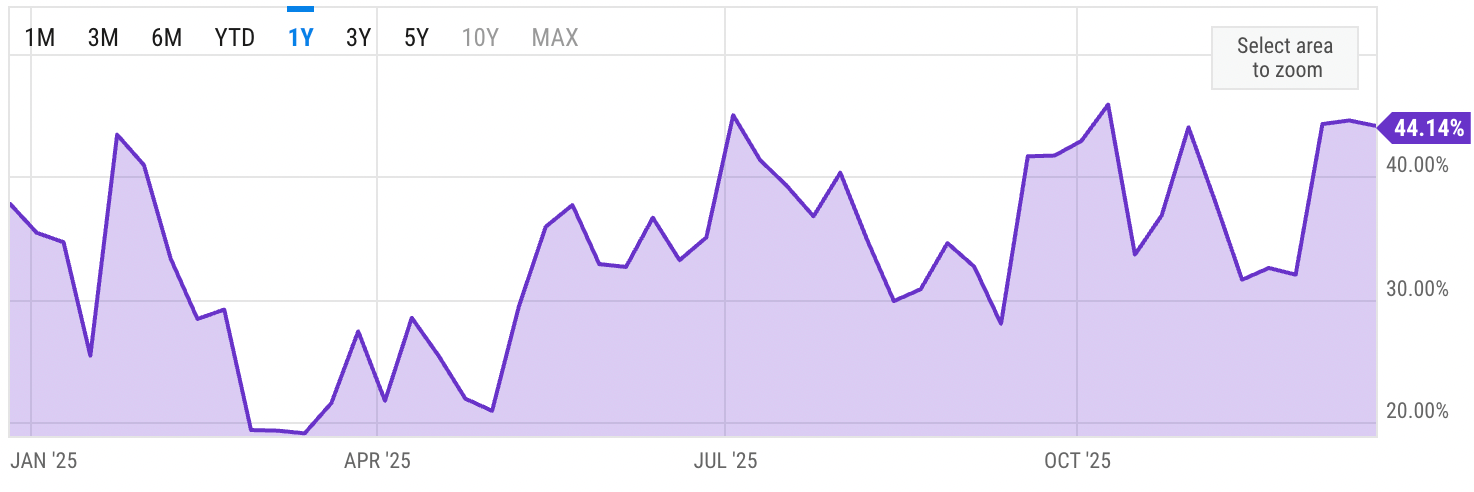

US Investor % Bullish Sentiment:

↓ 44.14% for Week of DEC 18 2025

Previous week: 44.59%

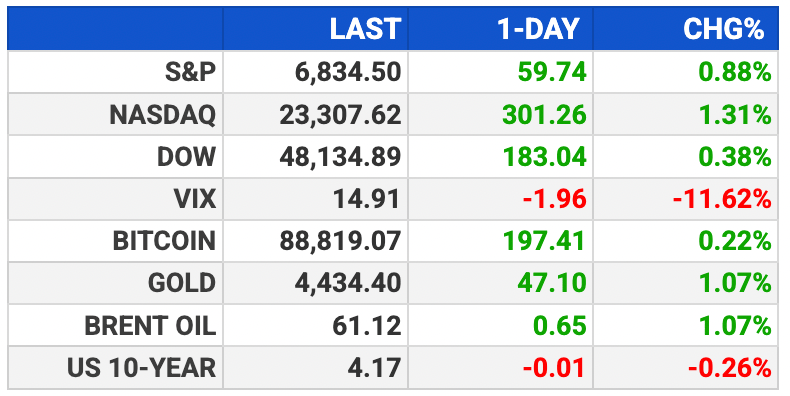

Market Wrap:

Futures higher ahead of holiday-shortened week

Dow +0.2%, S&P +0.2%, Nasdaq +0.3%

S&P/Nasdaq notch 3rd win in 4 weeks; Dow slips

AI stocks rebounded; Oracle, Nvidia led bounce

Rotation into cheaper sectors clouds tech leadership

Santa rally in question as S&P struggles technically

EARNINGS

No noteworthy earnings scheduled this week.

The Hidden Winners Behind Gold’s $4400 Surge

Gold pushed past $4,200, but our expert Sean Brodrick says the real opportunity could lie in a handful of stocks that may soar far beyond gold.

He believes the biggest bull market is taking shape and thinks these five companies may have major upside.

With gold hitting record highs and showing no signs of stopping, this opportunity is heating up fast.

Don't delay.

- a message from Weiss Ratings -

HEADLINES

Stock futures rise as traders look ahead to holiday-shortened week (more)

Biggest US banks are ending 2025 on top with markets 'wide open' (more)

Trump, nine pharmaceutical companies strike deal to cut prices (more)

Fed's Hammack signals holding rates steady for months (more)

Big central banks signal rate-cut cycle is ending (more)

Copper charges toward $12,000 a ton in 2025’s record-setting run (more)

Gold rises to record high on rate-cut bets and Venezuela tension (more)

Oil advances as US pursues third tanker in Venezuela blockade (more)

US existing home sales edge up in Nov. as mortgage rates ease (more)

Morgan Stanley seen as front-runner for SpaceX IPO (more)

AI boom drives data-center dealmaking to record high (more)

Taiwan ramps up plans for overseas chipmaking as threat from China looms (more)

Elon Musk becomes first person worth $700B following pay package ruling (more)

Nvidia-Intel deal cleared by US antitrust agencies (more)

DEALFLOW

M+A | Investments

ByteDance agreed to transfer control of TikTok’s US operations to Oracle, Silver Lake, and MGX in a binding transaction slated to close in January 2026

Permira, Warburg to buy Clearwater Analytics for $8.4B

VeriFast acquires Opsansa

Puzzle Healthcare receives investment from HCAP Partners

HBox receives growth investment from Charlesbank Capital Partners

Sports Attack receives investment from Sound Growth Partners

VC

Atavistik Bio, a developer of selective allosteric small molecule therapeutics, raised $120M in Series B financing

Neurable, a company developing neural interface technology, raised $35M in Series A funding

Manifold, an AI platform for life sciences, raised $18M in Series B funding

FINNY, an AI-powered prospecting and marketing platform for financial advisors, raised $17M in Series A funding

Amphix Bio, a peptide therapeutics company for neurological injuries, raised $12.5M in Seed funding

ETHSGas, a startup focused on decentralized blockchain infrastructure, raised $12M in Seed funding

NextFoods, a food and beverage solutions provider, raised $10M in Series 3 funding

Speed1, a company focused on high-performance computing technologies, raised $8M in funding

Ciphero, an AI verification and security platform for enterprise environments, raised $2.5M in Pre-Seed funding

Beycome, a direct-to-consumer real estate platform, raised $2.5M in Seed funding

Givefront, a fintech startup focused on spend management tools for nonprofits, raised $2M in Seed funding

CRYPTO

BULLISH BITES

🤖 The AI trade isn't over. Investors have just become choosier.

🤔 How Oracle became a 'poster child' for AI bubble fears.

💰 Gen X is scrambling to close the retirement savings gap.

🎅🏻 What the Christmas movie ‘Elf’ can teach us about today’s cost of living.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.