☕️ Good Morning.

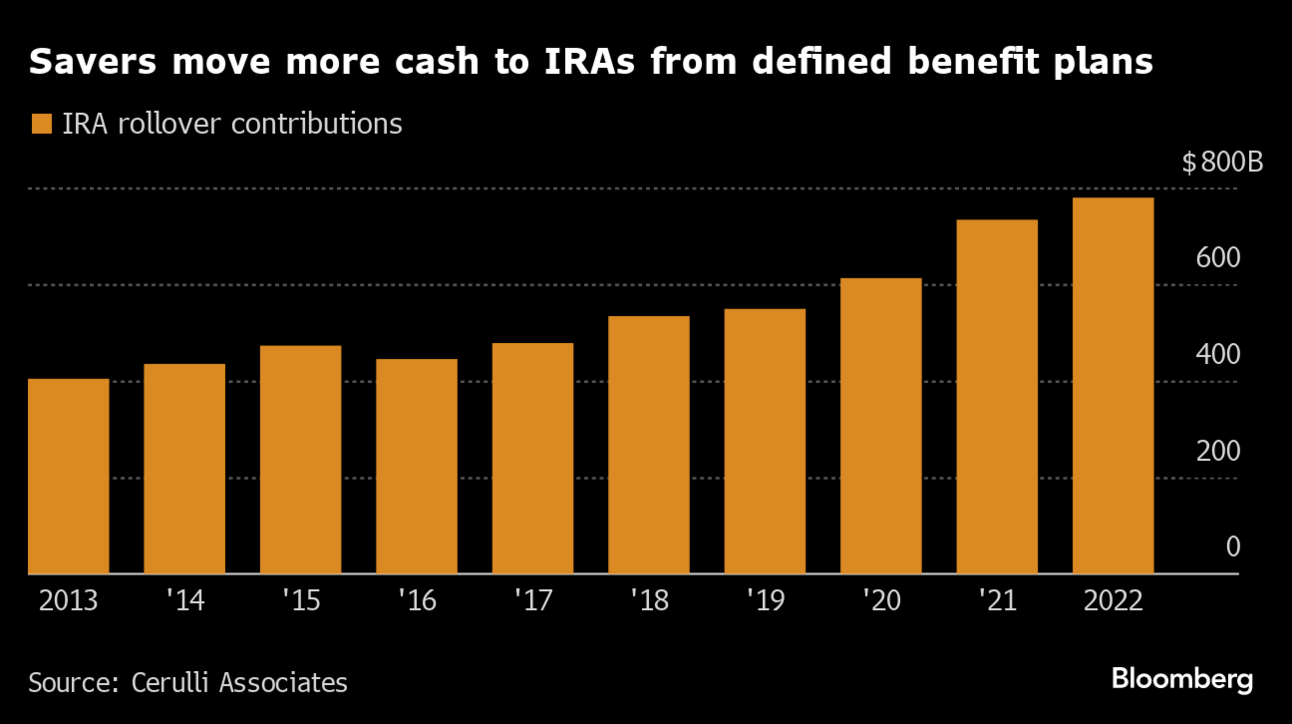

The Fast Five → Israel bombards Gaza preparing for invasion, Mike Johnson elected House speaker, Ford and UAW in tentative deal to end strike, PE wants a piece of your retirement savings, and SBF set to testify at his fraud trial today…

Here’s your 5-minute briefing for Thursday:

BEFORE THE OPEN

As of market close 10/25/2023.

MARKETS:

Nasdaq 100 futures down 0.7% after regular session selloff.

Meta beats Q3 earnings but reports $3.7 billion loss in Reality Labs division, shares down 3%.

Align Technology drops 25% due to weak Q4 revenue guidance and Q3 earnings miss.

Alphabet suffers 9.5% decline, its worst day since March 2020.

S&P 500 falls 1.4%, closing below 4,200, Nasdaq down 2.4%, Dow down 0.3% in regular session.

Today's focus on Q3 GDP estimate, expected at 4.7%, and weekly jobless claims data.

Upcoming major earnings reports from Amazon, Ford, and Chipotle after the close.

NEWS BRIEFING

Israel War Latest:

Mike Johnson elected House speaker, putting Louisiana Republican in the spotlight (more)

Sam Bankman-Fried set to testify at his fraud trial (more)

Deficit doubling as US economy grows shows why yields are at 5% (more)

What can the Fed do about the deficit? Nothing (more)

Surging yields flip from burden to boon in Big Tech earnings (more)

Adjustable-rate mortgage demand hits highest level in a year as interest rates continue to climb (more)

U.S. luxury market Is set for an active fall (more)

America's No. 1 emerging real-estate market is in Kansas. 'Life is easy over here.' (more)

Ford agrees to 25% wage hike in tentative deal to end UAW strike (more)

Only 19% of Americans boosted emergency savings in 2023. It ‘puts households in a bind,’ expert says (more)

US Fed set to revise debit card fee caps pitting banks against retailers (more)

Honda, GM scrap $5 bln plan to co-develop cheaper EVs (more)

Barclays to lay off dozens of US consumer bank employees (more)

Ted Pick gets standing ovation as Morgan Stanley CEO as rivals stay on (more)

Social media platform X rolls out audio, video calling (more)

Amazon brings conversational AI to kids with launch of ‘Explore with Alexa’ (more)

TOGETHER WITH SETAPP

Streamline your workflow.

Imagine every tool you need, in one place. With Setapp, one subscription delivers curated apps for Mac, web, and iOS right to your fingertips. Whether you're diving into task management or coding, Setapp's diverse suite adapts to your workflow. Explore endless apps, all under one roof.

Why juggle multiple subscriptions? With Setapp, harness a world of premium apps designed for your success.

Jump in now and let Setapp redefine your workflow effortlessly!

DEALFLOW

Stellantis nears deal to buy 20% of Chinese EV maker Leapmotor (more)

KKR invests in Precipart (more)

Revelation Partners, a firm providing flexible capital solutions to the healthcare ecosystem, closed its Fund IV at $608M (more)

Aiolos Bio, a clinical-stage biopharmaceutical company, raised $245M in Series A funding (more)

Zenoti, a provider of an enterprise cloud platform for the beauty and wellness industry, raised $50M in Series C funding (more)

Opal Camera Inc., a provider of a professional webcam with DSLR quality, completed its Series A funding round, totalling $17M (more)

LegalMation, Inc., a market leader in Generative AI-driven solutions for high-volume litigation, raised $15M in Series A financing (more)

Sage, a company providing a care coordination platform, raised $15M in funding (more)

Eve, a customizable AI assistant for the legal profession, raised $14M in seed funding (more)

FounderSix, a beauty brand incubator, raised $12M in funding (more)

Flashpoint Therapeutics, a company developing nanotechnology-enabled therapeutics for cancer and other diseases, raised $10M in Seed funding (more)

Rymedi, a healthcare data exchange platform with advanced blockchain security, raised $9M in Series A funding (more)

Ignition, an AI-driven collaboration software for go-to-market teams, raised $8M in Seed funding (more)

Canopy Connect, a provider of a platform for collecting, verifying, and monitoring insurance information, raised $6.5M in Series A funding (more)

RadiantGraph, a provider of a platform using machine learning and artificial intelligence to drive consumer engagement for health plans, raised $5M in Seed funding (more)

CoverForce, an independent insurance platform bringing streamlined comparisons and one-click buying to commercial insurance, raised $5M in seed funding (more)

Castellum.AI, a global risk data platform provider, raised $4M in seed funding (more)

Gozen, a biomaterials startup, raised $3.3M in Seed funding (more)

Harmony Games, a game development studio, raised $3M in Seed funding (more)

Koop Technologies, an insurance technology company focused on the robotics ecosystem, received an investment from Hyundai and Kia (more)

HealthEC, a healthcare technology company, raised additional funding of an undisclosed amount (more)

Upstream Tech, a corporation that builds software for making planetary decisions, received an investment from Hull Street Energy (more)

Sidework, a beverage technology company formerly known as Backbar, raised an undisclosed amount in funding (more)

M & A:

Vector Solutions, a provider of training and software solutions for schools, acquired PATHWAYos, a platform for connecting K-12 schools and students to work-based learning opportunities (more)

TSCP’s Isto Biologics merges with Biologica Technologies (more)

DataCore, a software-defined storage company, acquired Workflow Intelligence Nexus, a workflow services and software firm (more)

Was this briefing forwarded to you? (Sign up here.)

CRYPTO

BULLISH BITES

⛽️ Why Exxon and Chevron are doubling down on fossil fuel energy with big acquisitions.

🍿 Confessions of a venture capital-backed startup founder.

🍌 CEO morning routines are bananas. So I tried a few.

👭 The Pew Research Center surveyed Americans to find out how many friends they have.

💡. Get key insights from bestselling non-fiction books, distilled by experts into bitesize text and audio.

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Subscribe Now

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion for MarketBriefing? We’d love to hear it!

Send us a message -mb