Good morning.

The Fast Five → Nvidia’s best wasn’t enough to prop up market, traders search for clues behind S&P reversal, tariffs will cut deficits by $1 trillion less than expected, Fed fractures deepen amidst inflation concern, and Michael Saylor’s Strategy risks losing billions…

📌 NVIDIA CEO: A.I. E.I. Will be as Common as Cars Today -- E.I. isn't science fiction anymore. It's already here. And one little-known company is quietly supplying the systems behind it. This stock is still under Wall St's radar... but not for long. You'll get the name, the ticker, and the full thesis inside. Click here before the next move hits » (ad)

Calendar: (*Shutdown may affect key data. All times ET) - Full Calendar »

Today:

Flash Manufacturing PMI, 9:45A Flash Services PMI, 9:45A

Monday:

None watched

Your 5-minute briefing for Friday, Nov 21:

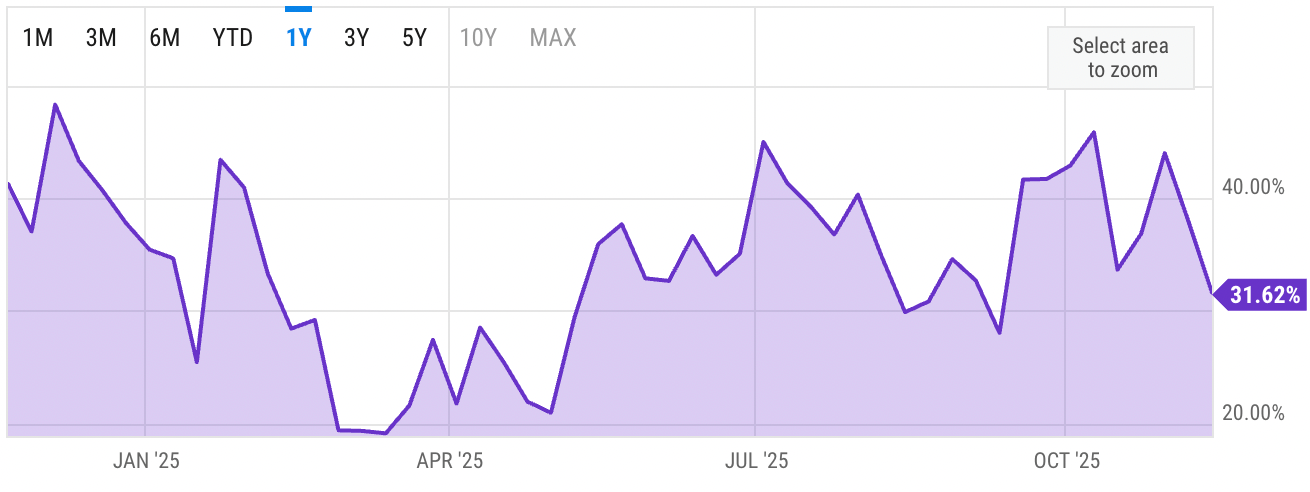

US Investor % Bullish Sentiment:

↓31.62% for Week of NOV 13 2025

Previous week: 37.97%

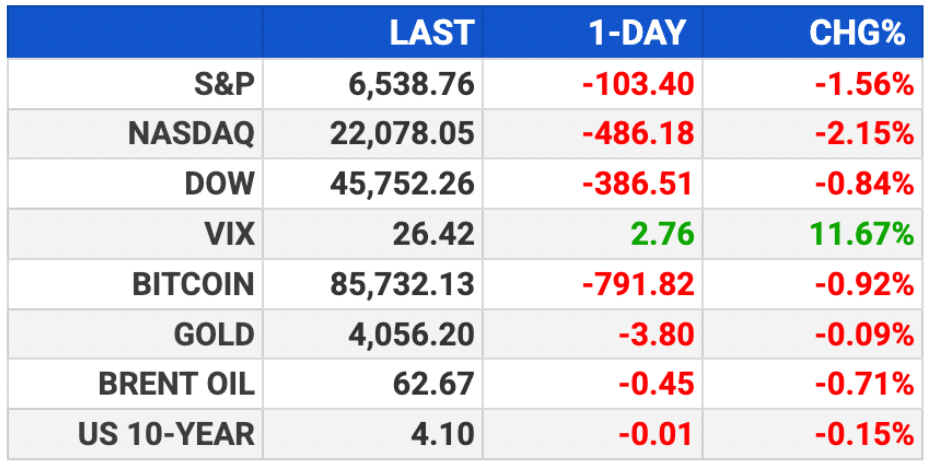

Market Wrap:

Futures edge up: Dow +136 (0.3%), S&P +0.3%, Nasdaq +0.2%.

AI stocks reversed hard Thu.; Nvidia -3.2% after an early surge.

Dow swung +718 intraday before closing -386; Nasdaq -2.2%.

Sept. jobs data strong but uneven; Dec. cut odds ~40%.

Fed tone cautious as markets look oversold.

S&P -2.9% WTD, Dow -3%, Nasdaq -3.6%.

Strategists see a normal pullback, not a trend break.

EARNINGS

None watched today. See full calendar here »

Elon Musk just made a bold claim: Robots, not cars, have the potential to be Tesla's biggest business.

That's because we're entering the E.I. Era - Embodied Intelligence - where A.I. jumps out of the screen and into the real world.

Machines that move. Robots that think. Systems that act on their own.

It's already happening in factories, warehouses, and defense labs around the world.

The infrastructure to power it - advanced chips, data centers, and clean energy - is being built right now.

And we've identified the three companies that could capture the lion's share of that spending.

-Simmy Adelman, Publisher

Behind the Markets

- a message from Behind The Markets -

HEADLINES

Traders Search for Clues Behind Biggest S&P Reversal Since April

The slide wiped out an early feeling of optimism that US equities would continue a rebound from an earlier selloff.

Stocks tumble as early rally gives way to tech anxiety (more)

CBO: Tariffs will cut deficits by $1 trillion less than expected (more)

Fed fractures deepen as Barr signals inflation concern (more)

Hassett: Now would be a 'very bad time' for Fed to pause cuts (more)

White House crafting executive order to thwart state AI laws (more)

Trump reveals plan to drill oil off Florida, California (more)

Dollar set for weekly gain as Fed cut bets recede (more)

Asian stocks sink as US jobs fail to clear rate outlook, tech hammered (more)

One area where Nvidia 'disappointed' in earnings (more)

Walmart CFO warns the affordability crisis is getting worse (more)

Verizon cutting more than 13,000 jobs as it restructures (more)

A hedge against AI crash emerges as Oracle CDS market explodes (more)

Michael Saylor’s Strategy risks losing billions in index flows (more)

Netflix, Comcast and Paramount make bids for Warner Bros. (more)

Kalshi’s valuation jumps to $11B after raising massive $1B round (more)

DEALFLOW

M+A | Investments

CoreTrust, a group purchasing organization, acquired BuyQ

VC

Luma AI, an AI company building multimodal AGI, raised $900M in Series C funding

Peek, an operating system provider for experiences, raised $70M in funding and acquired ACME Ticketing and Connect&GO

Norm Ai, a legal and compliance AI company, raised $50M in funding

Lumafield, a company specializing in advanced manufacturing technology, raised $50M in funding

Okami Medical, a medical technology company advancing novel vascular embolization solutions, closed a $45M financing

Automat, an enterprise workflow automation platform, raised $15.5M in Series A funding

Revenium, a financial intelligence platform for managing and optimizing AI spend, raised $13.5M in Seed funding

Poly, an intelligent cloud file browser company, raised $8M in Seed funding

Lakefusion, an AI-native master data management platform built for the Databricks Lakehouse, raised Seed funding

Missed OpenAI? The Clock Is Ticking on RAD Intel’s Round

Ground floor opportunity on predictive AI for ROI-based content.

RAD Intel is already trusted by a who’s-who of Fortune 1000 brands and leading global agencies with recurring seven-figure partnerships in place.

$50M+ raised. 10,000+ investors. Valuation up 4,900% in four years*.

Backed by Adobe and insiders from Google. Invest now.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

CRYPTO

BULLISH BITES

📊 Nvidia’s strong results show AI fears are premature.

💰 Auction for last pennies could draw big money.

✌️ The ‘Golden Handcuffs’ are off: PE employees leave for smaller firms.

🧖🏻♂️ The private wellness clubs that charge members up to thousands a month.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.