Good morning.

The Fast Five → Alphabet’s AI chips are a potential $900B ‘secret sauce’, ‘China’s Nvidia’ Moore Threads surges 469% on trading debut, layoffs this year the most since pandemic, Warner Bros. begins exclusive deal talks with Netflix, and Amazon considering directly competing with USPS…

📌 Wall Street Legend: ”Trump Tariffs Will Accelerate the Greatest Wealth Transfer in History”— A financial insider with decades on Wall St. has released a controversial video from his oceanfront estate. He reveals the unseen connection between Trump's economic vision and a tech revolution silently reshaping America. This hidden synergy is creating both unprecedented wealth and poverty. What can you do about it? Click here to see » (ad)

Calendar: (*Shutdown may affect key data. All times ET) - Full Calendar »

Today:

Consumer Sentiment, 10:00A

Inflation Expectations, 10:00A

Monday:

None watched

Your 5-minute briefing for Friday, Dec 5:

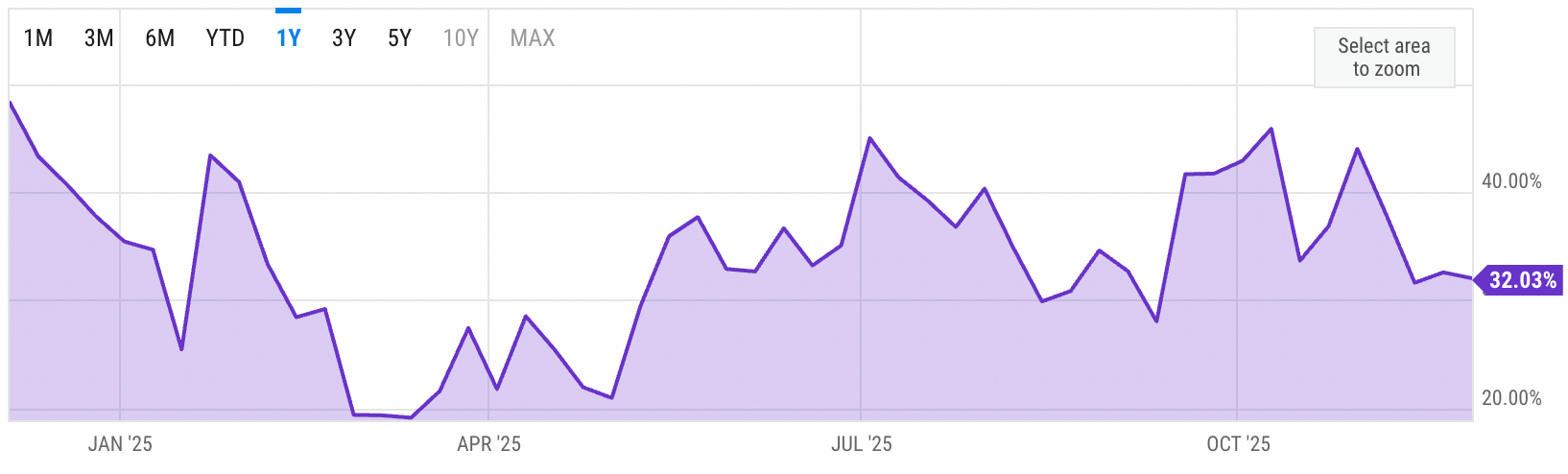

US Investor % Bullish Sentiment:

↓ 32.03% for Week of NOV 27 2025

Previous week: 32.58%

Market Wrap:

Futures flat ahead of key inflation data.

Nasdaq logged its 8th gain in 9 sessions; Meta +3.4%, Nvidia +2.1%.

Job cuts topped 1M YTD; AI/tariffs cited.

Weekly jobless claims hit lowest since Sept. 2022.

Markets still price ~87% odds of a Dec. 10 Fed cut.

Today brings delayed PCE, spending/income data, and UMich sentiment.

Stocks up modestly this week (S&P +0.1%, Nasdaq +0.6%, Dow +0.3%).

EARNINGS

Nothing watched today. See full calendar here »

The window for preparation isn't just closing —

It's slamming shut.

What I've uncovered about the true impact of President Trump's tariffs and DOGE initiative has left me deeply troubled.

As someone who worked inside the Federal Reserve system and managed billions for America's wealthiest families, I recognize the warning signs others miss. I urge you to see my urgent message immediately. The window for preparation isn't just closing — it's slamming shut.

- a message from InvestorPlace Digest -

HEADLINES

Indexes end near flat, supported by Fed hopes but dragged by Amazon (more)

Global shares and dollar higher as markets eye Fed rate cuts (more)

Senators unveil bill to keep Trump from easing curbs on chip sales to China (more)

Layoff announcements hit the highest level since the pandemic (more)

US import prices unexpectedly flat in September (more)

US jobless claims fell to three-year low over Thanksgiving (more)

Layoff announcements top 1.1M this year, the most since the pandemic (more)

CEOs see younger consumers driving growth amid tariffs, AI changes (more)

Jane Street’s trading haul juiced by surging bet on Anthropic (more)

Amazon considering directly competing with USPS (more)

Tesla gains in 2026 Consumer Reports’ auto brand rankings (more)

Google partners with Replit, in vibe-coding push (more)

Meta stock gains on plans for deep cuts for Metaverse efforts (more)

Warner Bros. begins exclusive deal talks with Netflix (more)

Pimco rejected ‘sell America’ talk and won big with US bond bet (more)

Trump's Neighbor Reveals Truth Behind America's New Transformation

A mysterious financial figure — called "one of the most important money managers of our time" by national media — has issued a scathing economic warning. His controversial video exposes how an invisible force is rewriting the rules of wealth creation.

The question everyone's asking: Who dared to break ranks with the financial elite?

- a message from InvestorPlace Digest -

DEALFLOW

M+A | Investments

- check back Monday

VC

7AI, a company building dynamic AI agents for security work, raised $130M in Series A funding

Paradigm Health, a company supporting the clinical research ecosystem, raised $78M in Series B funding

Lemurian Labs, a hardware-agnostic AI development platform, raised $28M in Series A funding

Unlimited Industries, an AI-native construction company, raised $12M in Seed funding

Guide Labs, a developer of interpretable and auditable AI systems, raised $9M in Seed funding

SPhotonix, a company working in optical storage and photonics, raised $4.5M in Pre-Seed funding

Govstream.ai, a startup building AI-powered permitting tools for local governments, raised $3.6M in Seed funding

CRYPTO

BULLISH BITES

💰 Nvidia has a cash problem — too much of it.

👶🏻 ‘Trump account’ or 529? How to pick investment accounts for kids.

👌 The 'OK'-shaped economy?

🎬 Quentin Tarantino’s of the 21st century.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.