Good morning.

The Fast Five → Apple debuts AI tools, including ChatGPT partnership, Musk threatens iPhone ban over Apple-OpenAI deal, Nvidia stock rises after stock split, FOMC meeting starts today, and the UAW president is under investigation. Full briefing ahead after this message from Netpicks…

🔔 NEW Alerts Service: Be one of the first to try NetPicks NEWEST yet PROVEN (1000+ wins) alerts service. Learn more »

Calendar: (all times ET)

WED, 6/12: | Consumer Price Index (CPI), 8:30a |

THU, 6:13: | Initial jobless claims, 8:30a |

FRI, 6:14: | Consumer sentiment, 10:00a |

Your 5-minute briefing for Tuesday, June 11:

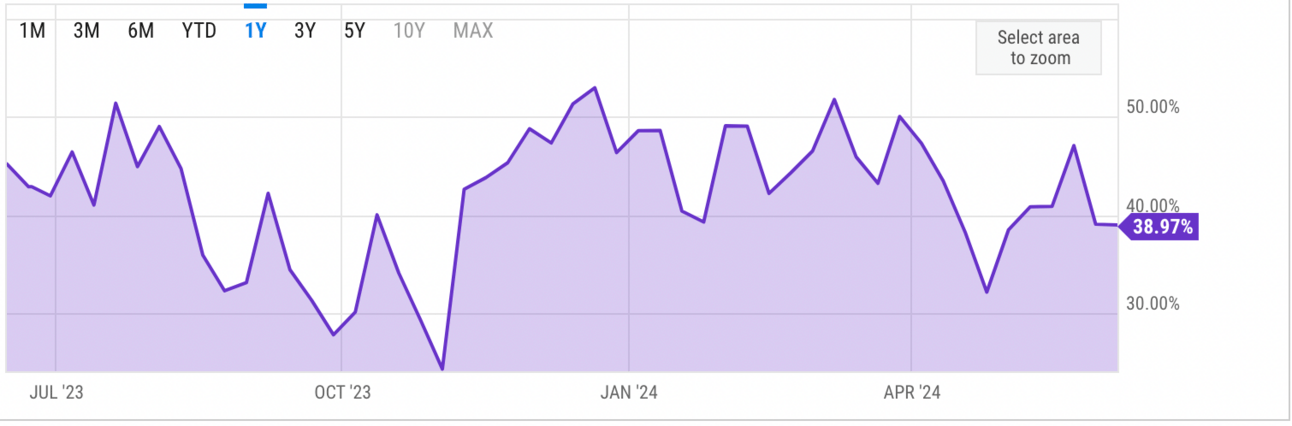

US Investor % Bullish Sentiment:

↓ 38.97% for Wk of June 06 2024 (Last week: 39.04%).

Market Recap:

Stock futures dip ahead of Fed's June meeting.

S&P 500 and Nasdaq hit new records; Dow up 0.2%.

Fed meeting starts today; decision and press conference Wed.

No rate change expected; CME’s FedWatch Tool shows no cut.

Oracle and Rubrik earnings after close.

EARNINGS

What we’re watching this week:

Today:

Oracle (ORCL) - earnings of $1.65 per share (-1.2% YoY) on $14.6B revenue (+5.4% YoY)

Broadcom (AVGO) - earnings of $10.80 per share for (+4.7% YoY) on $12.0B revenue (+37.9% YoY)

Thursday:

Adobe (ADBE) - earnings of $4.39 per share (+12.5% YoY) on $5.3B revenue (+10.4% YoY)

Full earnings calendar here.

Unlock Profit Opportunities with a Soaring Penny Stock

HEADLINES

Stocks settle higher ahead of FOMC meeting (more)

Dollar firm ahead of key inflation test, Fed update (more)

Oil holds biggest gain since March ahead of OPEC report (more)

Bond traders will follow the new Fed Dots all the way into 2025 (more)

BlackRock cautious on long-term Treasuries ahead of elections (more)

Asia stocks range-bound as EU politics adds new risks (more)

UAW president under investigation by federal monitor (more)

Dockworkers at ports from Boston to Houston halt labor talks (more)

Nvidia stock rises after 10-for-1 stock split (more)

Toyota, Mazda, Honda, Suzuki shares fall after safety scandal (more)

OpenAI hires new CFO and product chief (more)

Elliott disrupts CEOs’ summer plans with $400B in new targets (more)

NYC landlord to sell office building at roughly 67% discount (more)

A MESSAGE FROM BEHIND THE MARKETS

China to Launch Gold-Backed Currency

A mountain of evidence compiled over the past 20 months makes it clear to us that China will make this announcement as soon as July 6, 2024.

How you handle this situation will be one of the most important financial decisions you ever make.

Here are 3 steps to take right now to protect yourself - and a $2 gold mining stock that could soar 1,000% when their announcement comes.

- please support our sponsor -

DEALFLOW

M+A | Investments

Textainer in talks to buy HNA’s Seaco in $5B deal (more)

Bain makes $1.2B bid for Australian car parts shop Bapcor (more)

Daiwa Securities to buy Aozora Bank stake from activist fund (more)

Cognizant to acquire Belcan for $1.3B (more)

JobGet, an app-first hiring platform connecting workers with brands, acquired Wirkn, a frontline recruitment platform provider (more)

Greater Sum Ventures, acquired Kologik, a provider of software for law enforcement (more)

Cvent, a meetings, events, and hospitality technology provider, acquired Reposite, an AI-powered vendor and supplier sourcing platform (more)

Cognizant acquires Belcan, a global supplier of ER&D services, for approx $1.3B in cash and stock (more)

Radiant Logistics, Inc. (RLGT) a tech-enabled global transportation logistics company, acquired the operations of DVA Associates, Inc., a transportation and logistics company (more)

Omega Systems, an MSP and MSSP, acquired Amnet Technology Solutions and Cloudpath (more)

OneRail, a last mile delivery fulfillment solution provider, acquired Orderbot, a distributed order management solution (more)

insightsoftware, solutions for the Office of the CFO, acquired FXLoader, an automated exchange rate loading software for ERP systems and financial applications (more)

Netsurit, an MSP industry leader, acquired Avaunt Technologies, Inc., an MSP company offering technical services to SMB’s (more)

Health Catalyst, Inc. (HCAT), a provider of data and analytics tech to healthcare orgs, acquired Carevive Systems, an oncology-focused health technology company (more)

Apex Infusion, a provider of ambulatory infusion therapy services, received an investment from FFL Partners (more)

VC

Atlantic Street Capital, made an add'l $70M investment in its portfolio company, Zips Car Wash (more)

Relay, a cloud-based communications platform for frontline teams, raised $35M in Series B funding (more)

Nexus, a zero-knowledge cryptography company, raised $25M in Series A funding (more)

Anterior, an AI-powered healthcare administration platform, raised $20M in Series A funding (more)

Whoosh, a provider of a club operations software solution, raised $10.3M in Series A funding (more)

OnStation, a provider of digital stationing solutions for the heavy highway industry, raised $8.5M in Series A funding (more)

FirmPilot, an AI marketing engine for law firms, raised $7M in Series A funding (more)

PPC.io, a pay-per-click marketing startup, raised $5M in Seed funding (more)

Jump, a provider of AI software for financial advisors, raised $4.6M in funding (more)

Tomato.ai, a speech AI company specializing in accent softening software, raised $2.1M+ in extension seed funding (more)

CRYPTO

BULLISH BITES

📊 Learn: How the new ‘T+1’ rule settles US stocks in a day.

🙏 Tough Love: Starbucks' Howard Schultz on the time Steve Jobs screamed at him.

😬 Sketchy: The shortcut that allows risky startups to raise billions from rookie investors.

🌯 Buzz: "Chipotle boys" are taking NYC by storm.

🎓 Inspiring: Roger Federer's speech to recent Dartmouth graduates is going viral (for all the right reasons).

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.